Raising capital is one of the most challenging yet essential aspects of building a startup. Managing investor relationships, tracking outreach efforts, and maintaining a well-organized pipeline can make or break a fundraising round. That’s where a CRM for venture capital and investor relations comes into play. The right investor relations CRM software can streamline communication, automate follow-ups, and ensure no potential investor falls through the cracks.

But with so many options available, how can founders choose the best CRM for capital raising? This guide breaks down the key features, free and paid solutions, and top fundraising CRM solutions for startups to help founders make an informed decision.

Why Startups Need a CRM for Capital Raising

The fundraising process is not just about securing investment—it’s about building relationships. A strong investor relations CRM ensures that every interaction with potential investors is logged, follow-ups are automated, and critical data is easily accessible.

Without a CRM, startups often rely on spreadsheets and email threads, which can quickly become unmanageable. By implementing investor relations management software, founders can:

- Track investor interactions and commitments

- Automate personalized outreach and follow-ups

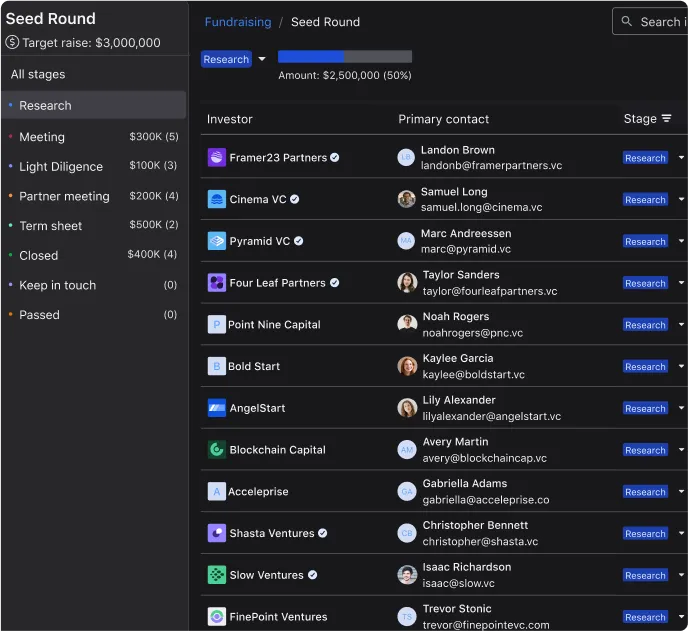

- Segment investors based on interest level and stage of engagement

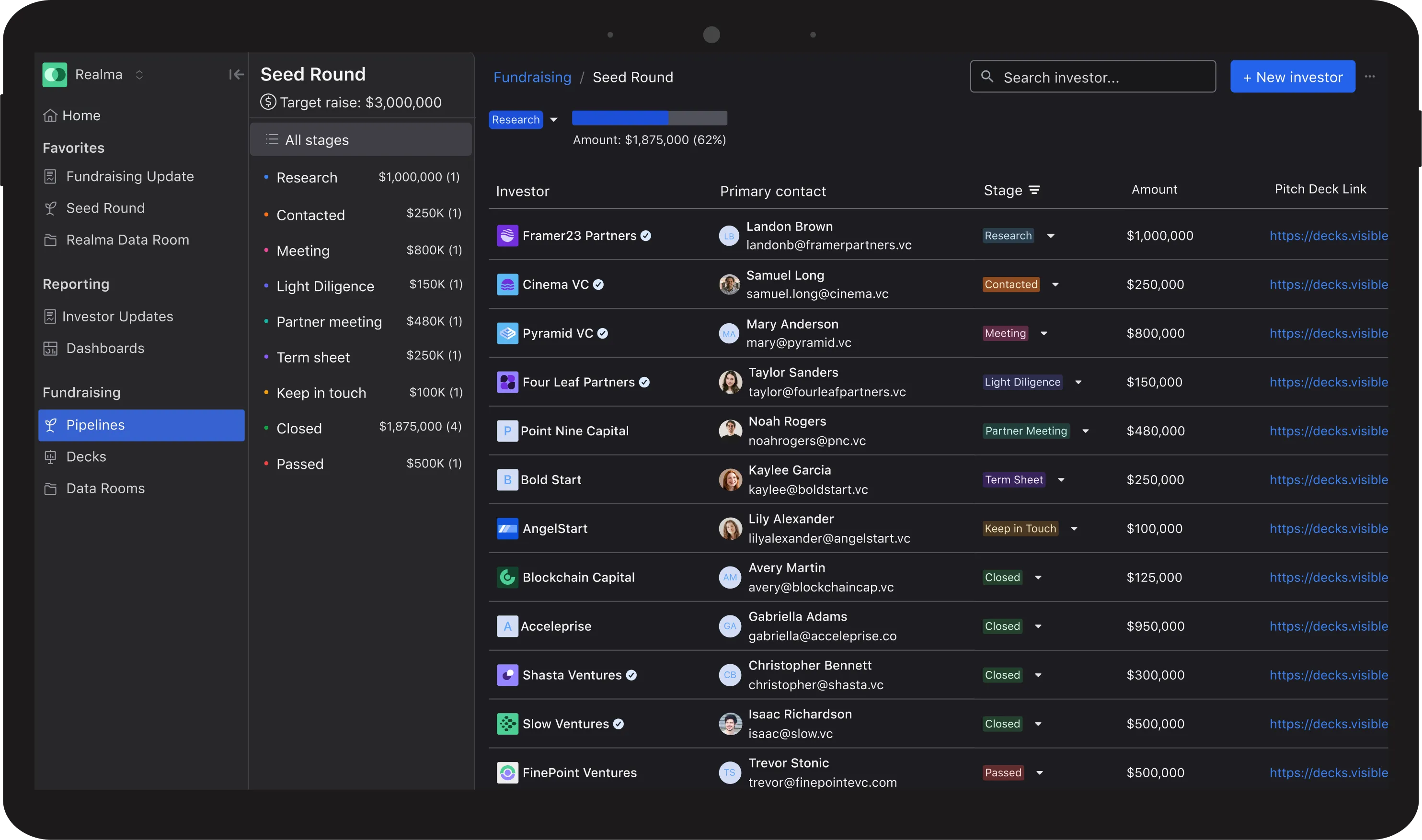

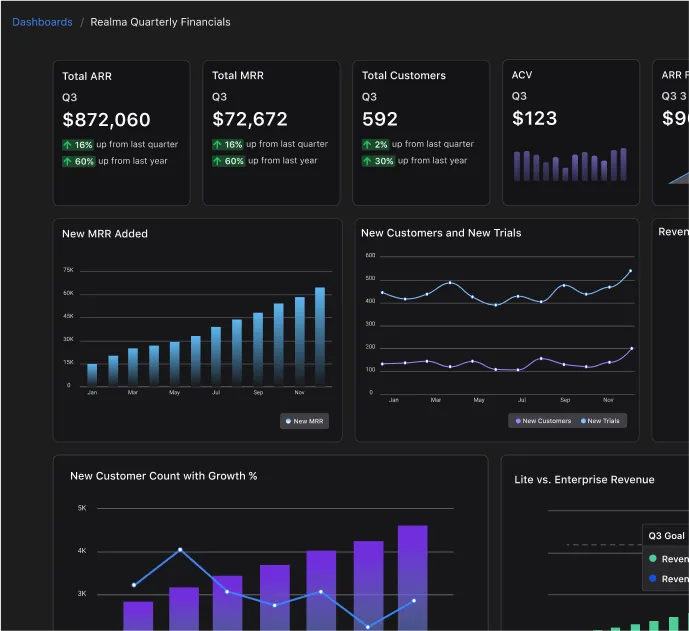

- Maintain a real-time pipeline of fundraising progress

A well-implemented startup fundraising CRM helps founders stay organized and professional, increasing their chances of closing deals efficiently.

Key Features to Look for in an Investor Relations CRM

Not all CRMs are designed for managing investor relations. While general-purpose CRMs might work for sales and marketing teams, startups raising capital need a solution tailored to investor relations management software. The best CRM systems for managing investor relations should include:

- Pipeline Management: A clear view of where each investor stands in the fundraising process.

- Automated Follow-Ups: Ensuring no conversation goes cold by scheduling timely reminders.

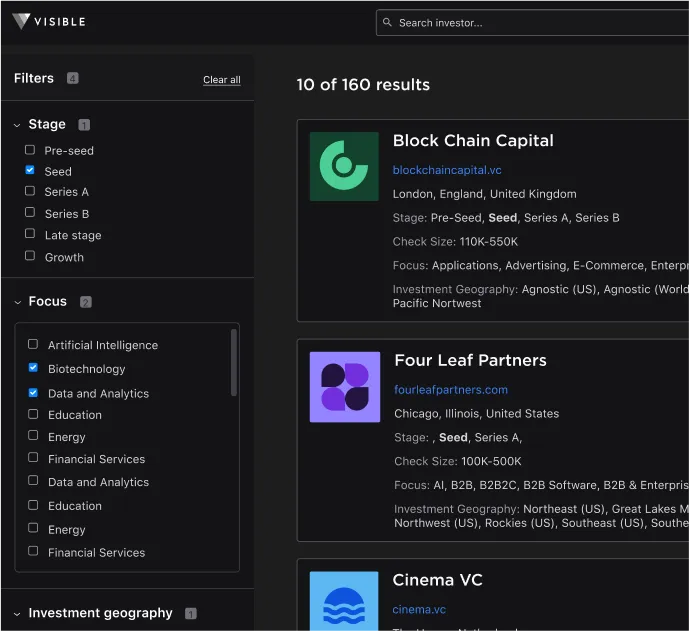

- Investor Segmentation: Grouping investors by interest, industry, or stage of investment.

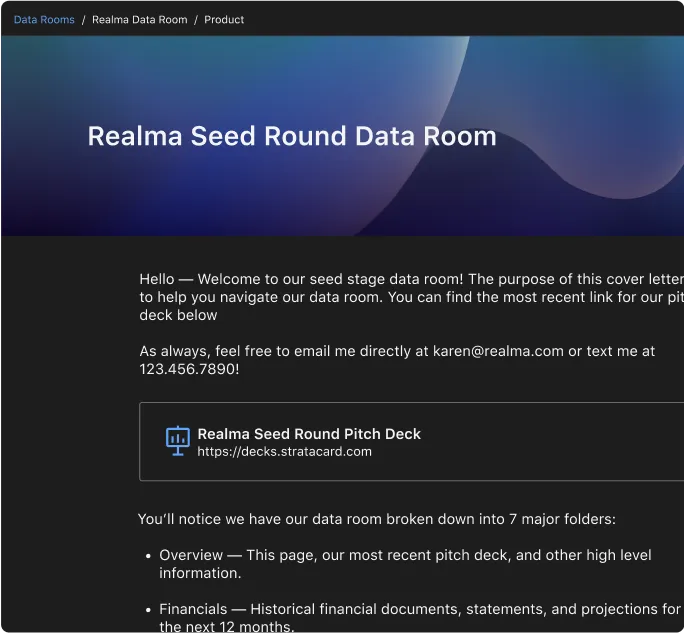

- Data Security & Compliance: Protecting sensitive investment conversations and documents.

- Integration with Email & Calendar: Syncing outreach efforts with existing tools.

By choosing the right investor relations CRM software, startups can maintain transparency, professionalism, and efficiency in their fundraising efforts.

Free vs. Paid CRM Options for Fundraising

For early-stage startups, budget constraints often lead them to explore free CRM tools for capital raising. While these can be a good starting point, they may have limitations in terms of scalability, integrations, and advanced features.

The best CRM for capital raising free solutions typically include essential contact management and pipeline tracking, but they may lack automation and investor segmentation. On the other hand, premium fundraising CRM solutions for startups offer deeper insights, reporting, and workflow automation, making them ideal for high-growth companies.

Understanding the trade-offs between free CRM for investor relations and paid solutions helps startups choose a tool that aligns with their fundraising goals.

The Best CRM for Capital Raising: Top Picks

With so many CRMs on the market, it’s important to find one that caters specifically to fundraising and investor relations CRM needs. Some of the best CRM for investor relations options include platforms designed for startups seeking venture capital and investor engagement tools.

The ideal CRM for venture capital should offer:

- A user-friendly interface that allows founders to manage relationships effortlessly

- Automation features to track investor interest and follow-ups

- Integration with key platforms like email and data rooms

- Scalability to grow alongside the startup’s fundraising efforts

By comparing various startup fundraising CRM tools, founders can determine which platform offers the best balance of features, usability, and affordability.

How to Choose the Right Startup Fundraising CRM

Selecting the best startup fundraising CRM depends on several factors, including the size of the fundraising team, the volume of investor interactions, and long-term growth plans. Startups should consider:

- Usability: Is the platform easy to navigate and implement?

- Customization: Can it be tailored to specific investor outreach needs?

- Cost vs. Value: Does the CRM justify its price based on features and scalability?

- Support & Integration: Does it integrate with existing tools and offer strong customer support?

Whether opting for a free CRM for investor relations or investing in a premium investor relations management software, founders must ensure the tool aligns with their fundraising workflow and future needs.

Implementing and Optimizing Your CRM for Investor Relations

Once a CRM for venture capital is selected, the next step is ensuring it’s implemented effectively. Simply having a CRM isn’t enough—founders need to optimize its use to maximize results.

- Organize Investor Data: Import existing investor contacts and segment them based on engagement level.

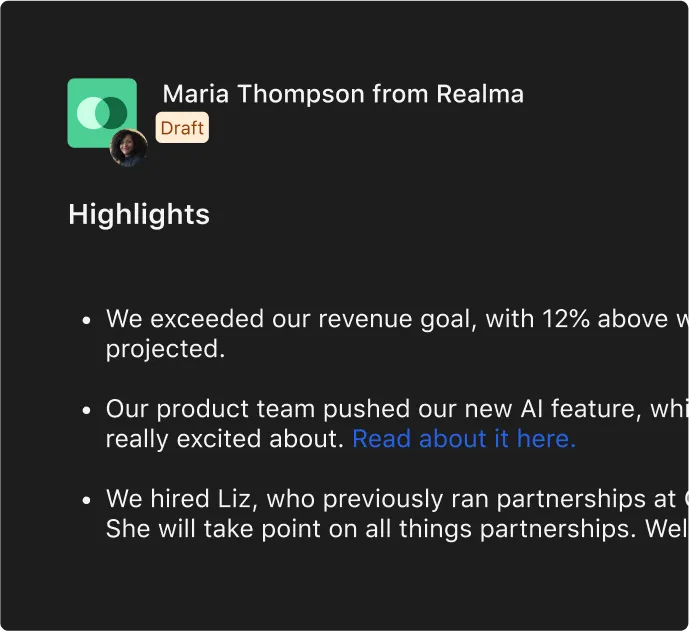

- Automate Follow-Ups: Set reminders for outreach and updates to keep investors engaged.

- Utilize Analytics: Leverage CRM reporting features to track fundraising progress and refine strategies.

- Train the Team: Ensure all team members know how to use the CRM efficiently for investor relations.

By following best practices, founders can ensure that their startup fundraising CRM tools contribute to a successful and streamlined fundraising process.

Streamline Your Fundraising with the Right CRM

Choosing the best CRM for capital raising is essential for maintaining investor relationships and managing a successful fundraising pipeline. The right investor relations CRM software can help startups stay organized, automate critical tasks, and increase their chances of securing funding.

While free CRM tools for capital raising may work for early-stage founders, scaling startups often benefit from feature-rich fundraising CRM solutions for startups. By understanding their needs, evaluating different solutions, and implementing best practices, founders can take control of their fundraising process and build strong investor relationships for long-term success.