Last week, our CEO surveyed founders asking them, “How likely are you to refer your current lead investor(s) to fellow founders?” in his weekly note.

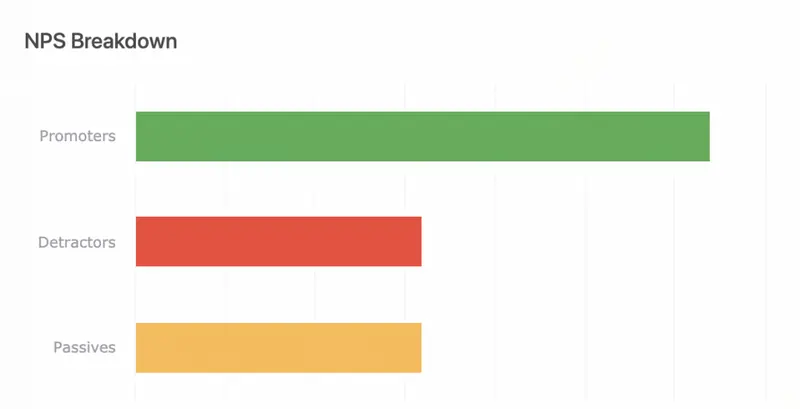

The results from the survey are below:

The Investor NPS

An NPS score of 23 falls below the average for the airline industry. Not a great industry to be compared to in terms of customer satisfaction scores.

Granted, there can be quite a bit of bias when surveying a founder asking their opinion of an investor (e.g. passed on a round). Nonetheless, founders are clearly looking for more out of their investors.

Once a check is cashed, there is no turning back. With the average length of a founder + investor longer than the average marriage in the U.S. (8-10 years) it is important for both founders and investors to strive for a strong relationship. Founders will get out of their investor relations what they put into it. At the end of the day, the investor and founder relationship comes down to communication, starting from the first fundraising meeting to company exit.

Before a fundraise, a founder should have a set of expectations from their investors outside of capital. It is the duty of the founder to communicate and gauge this during conversations and pitches. Easier said than done. Determining what investors to talk to, how to talk to them, and what to expect from them is a difficult process for founders.

Fundraising is an Asymmetric Experience

Fundraising is an asymmetric experience. Investors see hundreds of deals a year where founders may only talk to a handful of investors in a year. Investors are strapped with an abundance of data used during the decision-making process. As Seth Godin writes,

“In these asymmetric situations, it’s unlikely that you’re going to outsmart the experienced folks who have seen it all before. It’s unlikely that you’ll outlast them either.

When you have to walk into one of these events, it pays to hire a local guide.”

Our goal is to uncover more data, advice, and resources to become a “local guide” for founders to lean on during the fundraising process. In order to do so, we’ve started laying the ground work with Visible Connect, our community-sourced investor database. We will be able to uncover things like investor NPS with Visible Connect and create more symmetry in the fundraising process.

Find Investors with Visible Connect

Interested in learning more? Check out the Visible Connect database here.