Raise capital, update investors and engage your team from a single platform. Try Visible free for 14 days.

Whether a venture-backed startup looking to attack a massive market or a bootstrapped business, startups are generally in pursuit of growth. One of the main competitive advantages of a startup is the ability to test new growth strategies and move quickly compared to its predecessors.

Related Resource: The Understandable Guide to Startup Funding Stages

Finding a growth strategy or channel can make or break a company. In order to best help you find and develop the growth channels that work best for your business, we’ve laid out a few key strategies below:

1. Develop a strong value proposition

First things first, you need to develop a strong value proposition. As put by the team at Investopedia, “A value proposition refers to the value a company promises to deliver to customers should they choose to buy their product. A value proposition is part of a company’s overall marketing strategy. The value proposition provides a declaration of intent or a statement that introduces a company’s brand to consumers by telling them what the company stands for, how it operates, and why it deserves their business.”

This should be used at the backbone of your growth strategies and can be used to define your channels, messaging, and overall growth strategy. It is important to be thoughtful when laying out your value proposition — talk to customers, potential customers, and other stakeholders to help construct your value proposition.

Related Resource: How to Easily Achieve Product-Market Fit

2. Understand and embrace your target audience

After you’ve laid out your value proposition, you need to define the market and audience you would like to target. This is similar to creating your ideal customer profile.

As put by the team at Gartner, “The ideal customer profile (ICP) defines the firmographic, environmental and behavioral attributes of accounts that are expected to become a company’s most valuable customers. It is developed through both qualitative and quantitative analyses, and may optionally be informed by predictive analytics software.”

Related Resource: How to Write a Business Plan For Your Startup

Identify why a customer wants your product or service

If you’ve properly laid out your value proposition, this should be fairly easy. If you understand the value you are offering your customer, it should be straightforward why they would want to purchase your product or service.

Segment your overall market

For modeling purposes, you will likely start with your market as a whole. From here, it is important to narrow down your target and hone in on your specific segment in a market.

For example, if you are selling snowboards your total addressable market might be every outdoors person but you’d likely want to hone in your market to just anyone that has snowboarded in the last X years.

Related Resource: Total Addressable Market vs Serviceable Addressable Market

Research the market

Once you’ve honed in on your market, you need to make sure you are an expert in all things related to the market. When reaching out to potential customers, chances are they will turn to you for best practices on the market and space. To go above and beyond, come equipped with the right knowledge.

Choose the segmented market

After researching and analyzing the different markets, make the choice. Pick your segmented market and make sure you have the messaging and product in place to win the market.

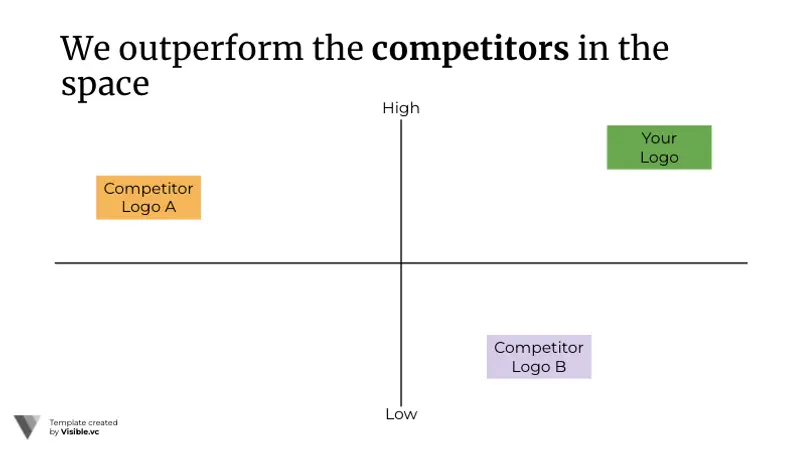

3. Research and analyze your top competitors

Inevitably, when speaking and targeting potential customers you will be compared to your competitors. In order to best combat any pushback, you need to come prepared. In order to best grow you need to understand how your product or service compares to competitors.

If you can understand your strong points (and weak points) in comparison to competitors you’ll be able to better tailor your messaging and campaigns.

4. Establish smart key performance indicators

As the old adage goes, “you can’t improve what you don’t measure.” When testing and finding growth strategies, it is important to have the right KPIs in place to track your performance.

Related Resource: Startup Metrics You Need to Monitor

Depending on the growth strategy or campaign will dictate what metric you should track. Check out a few examples below:

Return on investment (ROI)

One of the most common KPIs to track in relation to a growth strategy is return on investment. In order to continue investing in a growth strategy, you need to make sure it is generating returns.

As put by the team at Investopedia, “Return on investment (ROI) is a performance measure used to evaluate the efficiency or profitability of an investment or compare the efficiency of a number of different investments. ROI tries to directly measure the amount of return on a particular investment, relative to the investment’s cost.”

Churn rate

On the flip side, growth can be fueled by improving your churn rate. If you’d like to grow your current customer base, focusing on churn rate is a surefire way. Learn more about tracking and improving your churn rate below:

Related Resource: Our Ultimate Guide to SaaS Metrics

Customer acquisition cost

As we wrote in our post, “Customer Acquisition Cost: A Critical Metrics for Founders,” customer acquisition cost is “The sum of the amount that it takes your business to acquire a customer, including time from your sales representatives and marketing and advertising expenses.”

By monitoring your customer acquisition costs, you’ll be able to determine what channels make the most sense for your business. A surefire way to fuel growth is by improving your CAC. For example, if you are running ads at a high cost that do not convert to customers, chances are you’d be better suited to reallocate those costs to a better converting channel with lower acquisition costs.

Customer lifetime value

As put by the team at NetSuite, “Customer lifetime value (CLV) is a measure of the total income a business can expect to bring in from a typical customer for as long as that person or account remains a client.”

By monitoring your customer lifetime value, you’ll be able to boost margins and warrant spending more on acquisition costs. Learn more about customer lifetime value below:

Related Resource: Defining Customer Lifetime Value for Startups: A Critical Metric

5. Scale wisely and effectively

In the early days of building a business, the old adage goes, “do things that don’t scale.” However, as you find your rhythm and have a valuable product with growth strategies that work, it is time to scale. During uncertain times, it is especially important to scale efficiently to work towards profitability.

Scaling involves taking your existing channels and growing them at scale (and ideally improving margins). This means making smart hires that will take certain areas of your business to the next level.

Related Resource: Scaling != Growth

6. Continuously review your business model

As you find the growth strategies and channels that work best, it is important to be consistently evaluating your business model. Markets and customer needs change quickly so it is important to make sure you are staying ahead of them.

This means that you are likely evaluating your different acquisition channels, your product, and your hiring plans. If you find your business is most capable of executing in a certain area (for example, product-led growth), you might want to consider hiring and building your product around product-led growth.

Related Resource: How to Write a Business Plan For Your Startup

7. Engage your investors to build relationships

Once you have found the growth strategies that work best for your business, you’ll need to make sure you have the resources in place to grow and scale. This is capital and talent.

One of the most common ways to source capital for a startup growth strategy is by raising venture capital. You’ll want to make sure that you are engaging with current and potential investors along the way to improve your odds of raising venture capital.

Related Resource: How To Write the Perfect Investor Update (Tips and Templates)

Related Resource: Top VCs Investing in the $100 Billion Creator Economy

Grow your startup with Visible

Finding the right growth strategies for your business is only half the battle. Having the resources in place to track your key growth metrics will help you make informed decisions along the way.

Raise capital, update investors and engage your team from a single platform. Try Visible free for 14 days.