Key Takeaways

-

Discover active Kentucky venture capital firms and angel groups investing now, including Keyhorse Capital, Chrysalis Ventures, Poplar Ventures, Render Capital, Connetic Ventures, and Bluegrass Angels. Learn where they focus and how to approach them.

-

Get a city-by-city roadmap to Kentucky startup hubs in Louisville, Lexington, Northern Kentucky and Cincinnati, Bowling Green, and Owensboro with specific programs, events, and coworking options to accelerate traction.

-

Learn how to raise capital in Kentucky’s relationship-driven ecosystem by aligning with sector theses in healthcare, logistics, B2B SaaS, fintech, agtech and biotech, and advanced manufacturing, and by leveraging SBIR and STTR pathways.

-

Use practical playbooks to secure warm introductions through Launch Blue, XLerateHealth, Awesome Inc, Aviatra Accelerators, and KHIC-Start, plus pitch events such as the Vogt Awards and accelerator demo days.

-

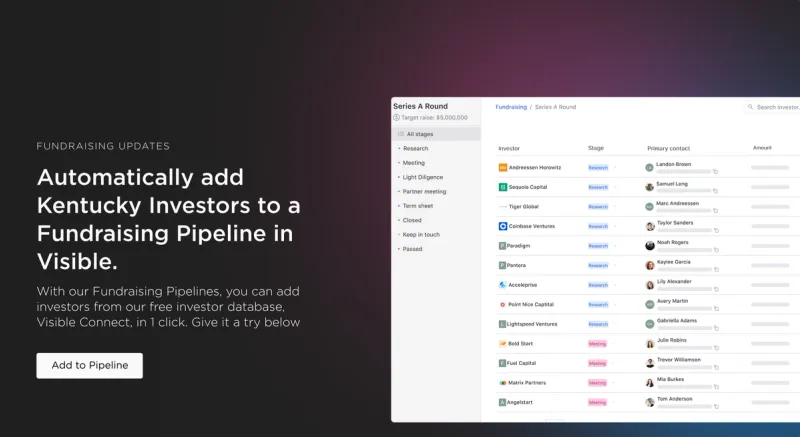

Operationalize fundraising with Visible by sourcing investors through Visible Connect, managing a pipeline, sharing your pitch deck and data room, and sending updates that build trust with Kentucky investors.

Kentucky’s startup scene is gaining traction, with more sector-focused funds, university-linked programs, and corporate partnerships supporting founders. Capital is available, but it is more relationship-driven and industry-specific than in larger markets. Founders who understand local investor preferences and timelines can raise with more confidence.

In this guide, we’ll cover where to find active investors in Kentucky and what they fund. You will also find practical tips and a curated list of resources and events, along with guidance on leveraging regional programs to extend your runway.

Top Kentucky Venture Capital Firms Actively Investing

Keyhorse Capital

About: Keyhorse Capital invests seed and early-stage venture capital to support entrepreneurs building and scaling innovative companies and bringing value to Kentucky. One of the most active seed funds in the region, Keyhorse is supported by the Kentucky Cabinet for Economic Development.

We're the investment arm of the Kentucky Science & Technology Corporation (KSTC), a private, statewide organization committed to advancing science, technology, and innovation founded on Kentucky know-how.

Chrysalis Ventures

About: Chrysalis Ventures is a leading source of equity capital for growth companies in the Southeast and Midwest. They have more than $200 million under management and have made investments in over 40 companies. Chrysalis identifies and nurtures promising early-stage companies poised for growth. To these investments, they contribute not just capital but hands-on experience and assistance.

Poplar Ventures

About: Poplar Ventures is a venture capital firm investing in early growth stage companies delivering recurring revenue cloud-based software services. Poplar supports its portfolio companies by leveraging the proven operating experience of its team and advisors.

Render Capital

About: Render Capital envisions a robust and thriving regional economy where entrepreneurs see the Midwest and South as a place they can find appropriate risk capital necessary for them to start and grow.

Connetic Ventures

About: Connetic is reinventing the VC industry by turning tables on intuition and biases to a more data-driven approach

Access Ventures

About: Access Ventures, a Louisville, KY based private operating foundation, is working to initiate systemic change in communities that results in a more inclusive and creative economy: an economy that functions for all people, and in which everyone is valued.

Radicle Capital

About: Radicle Capital’s investment philosophy is built on a core focus in sprouting change by helping companies, organizations, and funds who foster the ideals of generating a social and or environmental impact. Because of their impact focus, Radicle Capital is a patient source of capital. Beyond providing funding, they help in areas of board representation, fundraising, scalability, business development, strategic partnerships, and more. Many of their existing portfolio companies have grown from early to growth stage ventures with seed stage to follow on capital from Radicle Capital, as well as advisement in the aforementioned areas.

Aviatra Accelerators

About: Aviatra Accelerators empowers women entrepreneurs to start and grow their businesses faster and with more confidence.

Kentucky Founder Resources, Accelerators, and Networking

Here are specific Kentucky programs, coworking hubs, pitch events, and communities you can use to find pilots, mentors, and investor intros. Listings prioritize official state and operator pages for accuracy.

Incubators and Accelerators

- Awesome Inc (Lexington)

- Awesome Fellowship, co-working (Awesome Space), mentor network, coding education.

- Launch Blue (Lexington, via UK Innovate)

- Pre-Seed Accelerator, UAccel, Incubator, and Labs for scalable tech startups; a pipeline to national seed-stage accelerators.

- XLerateHealth (Louisville)

- Healthcare-focused accelerator with a three-month lean startup “boot camp” and multi-year virtual incubator; named among SBA’s top U.S. accelerators.

- Aviatra Accelerators (Northern Kentucky/Cincinnati)

- Programs empowering women entrepreneurs with curriculum, mentors, and access to capital.

- KHIC-Start (Kentucky Highlands Investment Corporation)

- Accelerator and incubator options, office and workshop space, and targeted support for growth-stage needs.

Coworking Spaces and Hubs

- Awesome Inc Space (Lexington)

- Central co-working and event space tied directly to the Lexington hub programs and mentors.

- BaseHere / Base110 / Base163 / Base249 (Lexington)

- Network of work, meeting, and event spaces downtown used by tech founders and partners in the Lexington hub.

- Sprocket (Paducah; West Kentucky hub lead)

- Regional innovation hub with co-working, programming, and connections to West Kentucky partners.

- Kentucky Innovation Station (Madisonville)

- Co-working and incubation space operated with the local EDC.

Pitch Events and Programs

- Vogt Awards (Louisville)

- Competitive, non-dilutive awards with a 10-week program; strong local visibility with investors and mentors.

- Amplify Louisville events

- Founder education, investor office hours, and pitch-focused programming in Louisville’s hub; use for intros and diligence prep.

- Awesome Inc and Launch Blue demo days

- Regular showcases tied to their accelerator cycles; use to meet angels and seed funds.

Angel Groups and Communities

- Bluegrass Angels (Lexington)

- Active angel network in the Lexington hub; seed focus with mentoring and deal support.

- Endeavor Kentucky–Indiana–Ohio (Louisville office)

- Scaleup-stage mentor and investor network with local presence to help post-seed companies expand.

- Women-focused communities

- Aviatra Accelerators programming connects founders with mentors and lenders in NKY/Cincinnati.

Kentucky Startup Hubs: City by City Guide

Louisville

Louisville is the state’s largest hub for healthcare, logistics, and early capital programs. It combines hospital systems and enterprise logistics with a growing pre-seed and seed investor base.

- Active investors and angels

- Key programs and spaces

- Events

- Render Capital pitch competitions and portfolio events

- XLerateHealth demo days

- Local pitch nights and meetups via Amplify Louisville event listings when available

Lexington

Lexington is university-powered with deep strengths in agtech, biotech, and engineering. It is the best Kentucky hub for SBIR or STTR-backed commercialization and lab access.

- Active investors and angels

- Key programs and spaces

- Launch Blue accelerator and SBIR and STTR support

- University of Kentucky Innovation

- SBIR and STTR coaching resources via Launch Blue and UK

- Coworking: Base110 and Base163

- Events

- Launch Blue demo days

- Bluegrass Angels pitch sessions and office hours

Northern Kentucky and Cincinnati Corridor

Northern Kentucky benefits from immediate access to Cincinnati’s corporates, venture funds, and accelerators. It is strong for B2B SaaS, fintech, and logistics, with efficient business development.

- Active investors and angels

- Connetic Ventures

- Access to Cincinnati funds and angels through Cintrifuse

- Key programs and spaces

- Northern Kentucky University Center for Innovation and Entrepreneurship navigate to entrepreneurship resources

- Cintrifuse network, mentors, and events

- Coworking options in Covington, Newport, and downtown Cincinnati, including Union Hall via Cintrifuse

- Events

- Cincinnati tech meetups and corporate showcases via Cintrifuse calendar

Bowling Green

Bowling Green is an applied innovation hub tied to advanced manufacturing and the automotive supply chain. It is practical, partner driven, and well supported by local economic development.

- Resources

- Western Kentucky University entrepreneurship and innovation programs

- Bowling Green Area Chamber of Commerce and economic development programs

- Regional maker spaces and coworking are often coordinated through WKU

Owensboro

Owensboro is community-driven with strengths in food and agriculture, healthcare services, and light manufacturing. It is a good base for first customer wins and regional grants.

- Resources

- Greater Owensboro Chamber of Commerce

- Owensboro based incubators and coworking spaces listed through city and Chamber resources

- Regional pitch events promoted by local development organizations

Find investors in Kentucky with Visible

As we previously mentioned, a venture fundraise oftentimes mirrors a traditional B2B sales and marketing funnel. Just as sales and marketing teams have dedicated tools to track their funnel, shouldn’t founders have dedicated tools to manage their most important asset – equity?

With Visible, you can track and manage every part of your fundraising funnel.

- Find investors at the top of your funnel with Visible Connect, our free investor database

- Add them directly to your fundraising pipeline directly in Visible

- Share your pitch deck and data room with investors in your pipeline

- Send updates to current and potential investors to keep them engaged with the progress of your business.

Take your investor relations to the next level with Visible. Give Visible a try for free.

Frequently Asked Questions

What are the best ways to find venture capital investors in Kentucky?

Start with Kentucky-focused funds and angel groups that actively write checks, such as Keyhorse Capital, Chrysalis Ventures, Poplar Ventures, Render Capital, Connetic Ventures, and Bluegrass Angels. Layer in university-linked programs like Launch Blue and UK Innovate, plus events such as Vogt Awards and demo days to build relationships that drive Kentucky startup funding.

How do Kentucky investors differ from coastal venture capital firms?

Kentucky venture capital is more relationship-driven and industry-specific. Funds prioritize sectors like healthcare, logistics, SaaS, agtech, and impact. Timelines can be longer, diligence is hands-on, and warm introductions matter. Founders who engage through accelerators, local hubs, and mentor networks raise faster than those relying solely on cold outreach to Kentucky investors.

Which accelerators and programs help Kentucky startups raise capital?

Launch Blue focused on SBIR and STTR and pre-seed, XLerateHealth for healthcare, Awesome Inc Fellowship, Aviatra Accelerators for women founders, and KHIC-Start provide curriculum, mentors, and investor access. Pair these with coworking hubs such as Base110 and Base163, Story Louisville, and Sprocket and pitch events like Vogt Awards and demo days for introductions.

What sectors get the most attention from Kentucky venture capital?

Kentucky venture capital concentrates on healthcare, logistics, B2B SaaS, fintech, agtech, biotech, and advanced manufacturing. Funds like Poplar Ventures focus on cloud software, XLerateHealth emphasizes healthcare, and regional angels back SBIR and STTR commercialization. Impact-oriented capital, such as Radicle Capital, supports ventures with measurable social or environmental outcomes.

How can founders improve their odds of raising from Kentucky investors?

Align with local theses, secure early pilots with regional corporates, and leverage SBIR or STTR where relevant. Warm introductions via accelerators, mentors, and angel networks outperform cold emails. Share clear milestones, capital efficiency, and traction. Maintain investor updates to build trust and shorten cycles with Kentucky startup investors seeking practical progress.

Where can I build my Kentucky investor pipeline and manage outreach?

Use Visible to operationalize fundraising. Discover Kentucky investors with Visible Connect, add them to your pipeline, share your pitch deck and data room, and send regular updates. Treat fundraising like a B2B funnel by sourcing, qualifying, nurturing, and closing with consistent communication to keep local investors engaged and informed.