Key Takeaways

-

VC fund management software helps venture capital firms streamline operations, track investments, and maintain strong relationships with limited partners.

-

The best platforms offer real-time portfolio analytics, automated reporting, and AI-driven insights to improve decision-making and reduce risk.

-

Free tools provide basic features, but paid solutions deliver scalability, advanced compliance, and seamless integrations that support long-term growth.

-

Choosing the right software requires evaluating fund size, ease of use, security, and integration with your existing tech stack.

-

AI-powered features are transforming venture capital strategy by automating due diligence, forecasting market trends, and optimizing portfolio performance.

-

Investing in modern VC fund management software positions firms for sustainable success and stronger investor confidence.

Why Venture Capital Investors Need VC Fund Management Software

Venture capital (VC) investing requires precision, data-driven decision-making, and strong relationships with limited partners (LPs). Managing multiple portfolio companies, tracking investments, and ensuring compliance can quickly become overwhelming. This is where VC fund management software plays a crucial role.

With the right venture capital software, firms can streamline operations, enhance transparency, and make data-backed decisions that drive better returns. From LP management software to AI tools for venture capital, the right tech stack is critical to managing funds effectively and optimizing venture capital strategy. Effective fund management software not only simplifies complex workflows but also provides investors with deeper insights into the performance of their portfolio companies. This enables them to make informed decisions that drive growth and reduce risks.

Key Features of the Best VC Fund Management Software

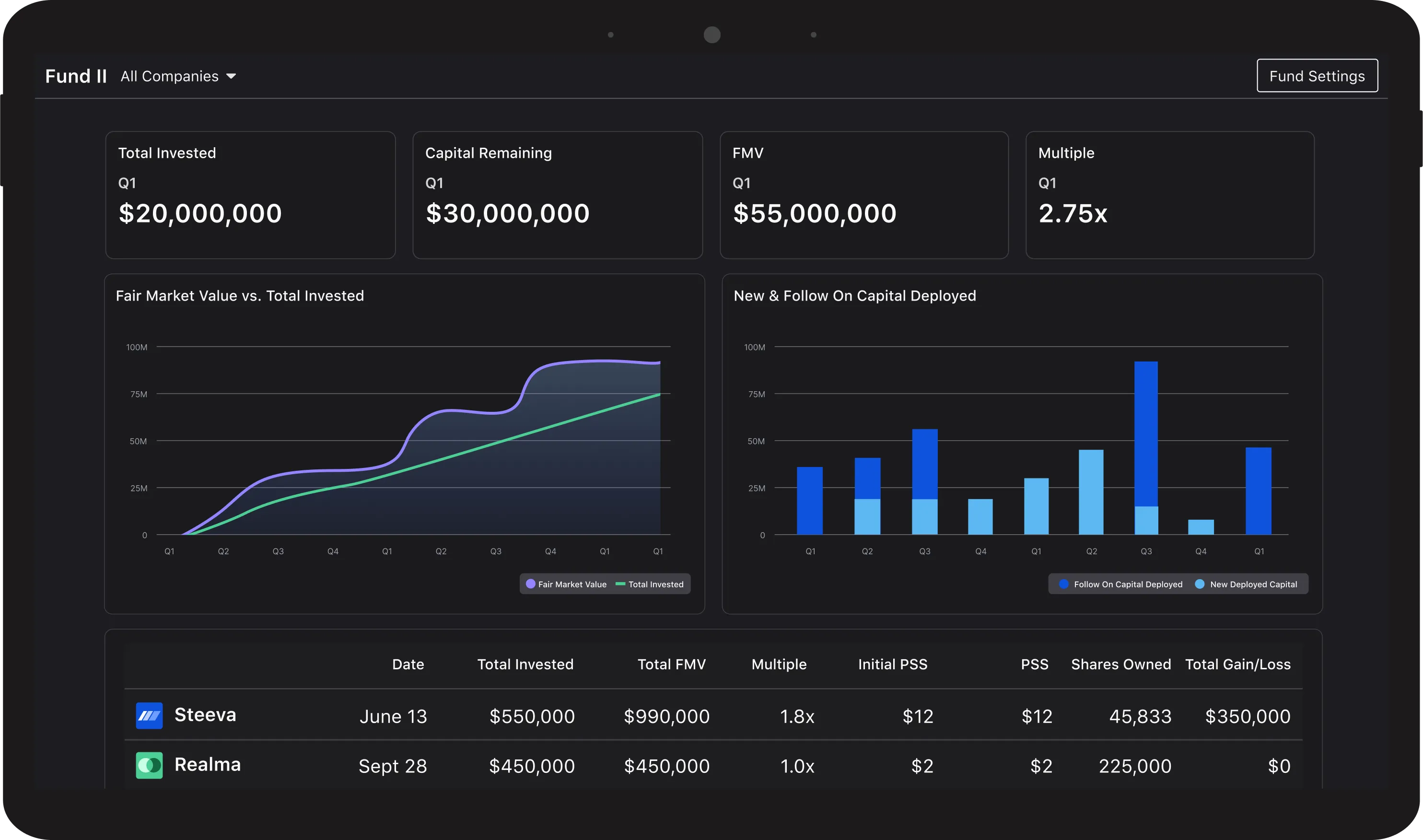

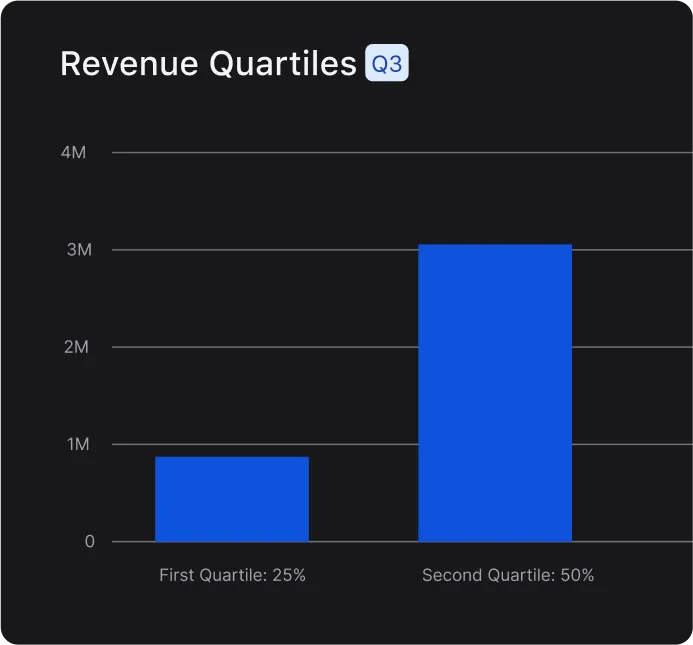

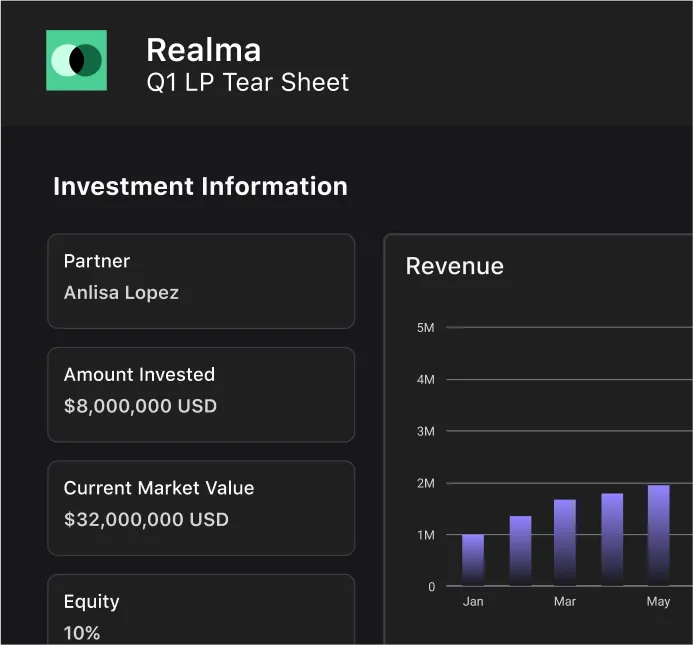

Choosing the best VC fund management software depends on a firm’s needs, but there are essential features that investors should look for. Portfolio tracking and analytics provide real-time data on investments, valuations, and exits. LP reporting and compliance ensure that firms meet reporting requirements and maintain strong relationships with stakeholders. AI-powered insights and automation improve deal sourcing, risk assessment, and performance tracking. Customizable dashboards offer features like VC portfolio management stock tracking and VC portfolio management stock price monitoring to help VCs assess market trends.

Additional features include automated financial reporting, deal flow management, and communication tools that allow investors to stay in sync with their teams and LPs. Many modern platforms also integrate with accounting and compliance tools, reducing administrative burdens and ensuring that funds remain audit-ready at all times.

The Role of AI in VC Fund Management

Artificial intelligence is revolutionizing how VCs operate. AI-driven venture capital software can automate due diligence and investment screening, enhance VC research with predictive analytics, optimize venture capital strategy with data-driven forecasting, and integrate with existing VC tech stack to improve efficiency. With AI-powered VC portfolio management software, firms can gain deeper insights into market movements and portfolio performance.

AI also helps streamline risk assessment by analyzing historical data and identifying patterns that indicate the potential success or failure of an investment. Some platforms use machine learning to suggest optimal investment allocations, helping funds maximize returns. Furthermore, AI-powered tools can scan market trends and emerging sectors, providing investors with an edge when sourcing new opportunities.

"Over 235 venture firms have embraced data, automation, and AI to drive better decisions, stronger returns, and leaner teams.” -Data-Driven VC Landscape Report 2025

Comparing Free vs. Paid VC Fund Management Software

Many firms explore VC fund management software free options before investing in premium solutions. Free software typically offers basic portfolio tracking, while paid software includes AI-driven insights, customizable dashboards, comprehensive LP management, and advanced compliance and reporting features. While best VC fund management software free options provide basic features, paid solutions offer scalability and advanced capabilities.

Firms must weigh the pros and cons of free vs. paid solutions carefully. Free tools may lack key integrations, automation, and advanced reporting features that can significantly improve operational efficiency. Paid solutions often provide dedicated customer support, compliance tracking, and seamless integration with existing software ecosystems. In the long run, investing in a premium solution can save funds time and resources, leading to better decision-making and improved investor relations.

How to Choose the Right VC Software for Your Fund

Selecting the right venture capital apps depends on several factors. Fund size and complexity play a role, as smaller funds might benefit from free VC tools, while larger firms need comprehensive solutions. Integration capabilities ensure compatibility with existing VC software and financial tools. Ease of use and reporting features simplify VC portfolio management and LP reporting. Security and compliance considerations are also important when selecting a venture capital software list entry that meets industry regulations.

Other factors include customization options, scalability, and customer support. Investors should look for software that can adapt to their evolving needs, allowing for seamless expansion as the fund grows. Demoing different platforms, reading user reviews, and consulting peers in the industry can help investors make an informed choice.

Top Venture Capital Tools to Streamline Fund Operations

To build an effective VC tech stack, firms must consider various VC tools. Portfolio management software is essential for tracking investments and financial performance. Deal flow and CRM tools help organize leads and manage relationships. AI and data analytics automate research and risk assessment. LP and fund administration software ensures compliance and transparent reporting. A well-curated VC tools list helps investors optimize efficiency and performance.

Additionally, collaboration tools, financial forecasting software, and workflow automation platforms can further streamline operations. With the right combination of tools, VCs can enhance productivity, strengthen LP relationships, and reduce the time spent on administrative tasks.

Venture Capital Portfolio Management Best Practices

Effective venture capital portfolio management requires data-driven decision making, utilizing venture capital portfolio management software for real-time insights. Active public portfolio monitoring is necessary for regularly evaluating VC portfolio management stock price trends. Diversification helps manage risks through diversified investment strategies. Engaging with founders and providing resources and guidance for startups also contributes to success.

Investors should establish a structured approach to portfolio reviews, setting clear performance benchmarks and rebalancing investments when necessary. Maintaining strong communication with founders and offering strategic guidance can lead to better business outcomes and higher returns. By leveraging technology, VCs can gain real-time visibility into portfolio performance, allowing for proactive adjustments.

The Future of VC Tech

The VC landscape is evolving with new technologies and strategies. AI-driven investment strategies are improving risk assessment and deal flow analysis. LP-focused innovations are leading to more sophisticated LP management software for improved investor relations.

Other emerging trends include increased automation in due diligence processes, the use of big data to identify investment opportunities, and more advanced scenario modeling for risk assessment. As technology continues to evolve, firms that leverage these innovations will gain a competitive edge in sourcing, managing, and optimizing their investments.

Investing in the Right VC Software for Long-Term Success

Adopting the right venture capital software is essential for modern investors. Whether exploring VC tools for free or investing in premium solutions, firms must prioritize efficiency, compliance, and data-driven decision-making. With the best VC fund management software, investors can streamline operations, enhance transparency, and make smarter investment choices that drive long-term success. By continuously evaluating and upgrading their tech stack, VCs can stay ahead of the curve and ensure that they have the necessary tools to adapt to changing market dynamics. Investing in the right technology today will not only improve efficiency but also lead to sustained growth and profitability in the long run.

Frequently Asked Questions

What is VC fund management software and why is it essential for venture capital firms?

VC fund management software helps firms track investments, manage limited partner (LP) relationships, and maintain compliance. A well-designed platform offers intuitive tools for real-time portfolio insights and data-driven decision-making, enabling firms to improve returns and build stronger investor trust.

What key features should the best VC fund management software include?

The best solutions provide comprehensive portfolio tracking, automated financial reporting, LP management, and compliance tools. Look for customizable dashboards and integrated analytics that make it easy to monitor performance and make faster, smarter investment decisions without adding complexity to daily operations.

Are there reliable free VC fund management software options?

Free options can handle basic portfolio tracking and reporting, but they often lack scalability, advanced analytics, and dedicated support. Premium solutions deliver deeper insights, automation, and integrations that help firms grow confidently while keeping operations efficient and investor-ready.

How does AI enhance venture capital fund management?

AI-driven tools automate due diligence, forecast market trends, and improve risk assessment. Platforms that integrate predictive analytics and real-time alerts give firms actionable insights, helping them optimize allocations and reduce operational costs while staying ahead of emerging opportunities.

What factors should firms consider when selecting VC fund management software?

Key considerations include fund size, integration with existing tools, reporting needs, and security. Scalable platforms with strong customization and user-friendly interfaces ensure that as a fund grows, the software can adapt and continue delivering accurate data and streamlined workflows.

How does VC fund management software improve LP relations?

Modern software simplifies LP communication with automated updates, transparent performance metrics, and compliance tracking. This keeps investors informed and confident, while freeing up valuable time for fund managers to focus on strategy and relationship building.

Is private equity fund management software similar to VC fund software?

Yes, both share features like portfolio tracking and LP management. However, software tailored to venture capital typically offers more flexibility for early-stage investments and dynamic deal flow management, giving firms the specialized tools needed to manage a fast-moving portfolio effectively.