Blog

Visible Blog

Resources to support ambitious founders and the investors who back them.

All

Fundraising Metrics and data Product Updates Operations Hiring & Talent Reporting Customer Stories

founders

Metrics and data

How to Easily Achieve Product-Market Fit

What does product-market fit really mean?

The first goal of every startup is to find product market fit. But what is product market fit in the first place? How do you know when you have it? The most famous and widely accepted definition of product market fit is one that Marc Andreessen coined in 2007, “Product-market fit means being in a good market with a product that can satisfy that market.” Andy Rachleff has expanded on this definition, adding that product market fit means identifying who you’re trying to serve (the market), what you’re going to offer (your product), and how you’re going to deliver upon that offering in a way that allows you to capture the value created by the product (your business model).

How do you achieve/find product-market fit?

Achieving product-market fit is about identifying needs in the marketplace and testing different ways of satisfying them. You must be thoughtful about how you can serve customers, and iterate quickly with your product based on their reaction to your offering. It’s also critical to understand your potential business model and how that relates to the market you’re trying to serve.

Learn how Yaw Aning, Founder of Malomo, found their first customers when searching for PMF below:

Defining Your Target Customer

The process of defining your target customer is the first step in finding product market fit. This step is about choosing your market. If you don’t know who you want to serve, you’ll have no idea what to build, and instead spend time and money on building a product that no one needs. It is key here to identify a sufficiently promising market. As this post by Andreessen Horowitz explains, a great product in a lousy market has no chance of succeeding, while a decent product in a great market has a much greater chance of finding product-market fit.

Identifying Your Value Proposition

Once you’ve identified a market and customer you’d like to serve, you’ll need to develop a value proposition to test in the marketplace. This value proposition does not have to be perfect. In fact, you should expect to iterate upon it and potentially decide to change it altogether. After all, the Twitter team started by building an app for podcasting, and Slack started off as a video game. If you assemble a talented team that works well together and don’t stop iterating, you can eventually identify the value proposition that makes sense for your market.

Building Your MVP

The MVP is designed to be your first entry into the market. Popularized by Eric Ries and his Lean Startup Playbook, an MVP is meant to help you test your value proposition. Today, many companies are using no-code or low-code platforms like WebFlow and Bubble to create basic versions of products and testing them in the market. These tools enable non-technical founders to test their ideas in the marketplace before building a full-fledged product with a team of engineers.

You often won’t know for sure if customers value your product until you put it into the market. This is why it pays to move quickly and release your product before you feel ready. This is especially true if your product is a mobile or web application that is easy iterate on (medical device or biotech founders should tread more carefully). Reid Hoffman, the founder of LinkedIn, has often said that ‘if you aren’t embarrassed by the first version of your product, you launched too late.’

Find Product-Market Fit Before Scaling

You should work to solve for product market fit before you worry about finding the perfect growth strategy. Andy Rachleff has said that you should work on solving for your value hypothesis before solving for your growth hypothesis. A 2011 study by Startup Genome found that 70% of the 3200 startups they studied scaled prematurely. To avoid being one of the 70%, focus on finding product market fit before you focus on growing your business. It’s tempting to raise giant sums of money and shoot for the moon – you just first need to make sure that you’ve built something in the right market that people really want.

Indicators of Product Market Fit

Once you’ve released your MVP into the wild and started iterating, you’ll likely wonder how to gauge whether you’re making progress toward product market fit. In fact, Facebook executive Alex Schultz has said that a major cause of startup problems happens when founders think they have product market fit, when they really don’t.

It’s easy to get caught up in vanity metrics that don’t indicate whether or not your product is succeeding. You should identify what metrics are real determinants of progress in the market – things like new revenue, customer retention, and NPS can be good examples of metrics to focus on. Perhaps the greatest measure of product market fit is your ability to grow without much investment in sales or marketing. Word of mouth growth is an outstanding sign that you’re on the right track. But, at the end of the day, product market fit is often clear. “As Eric Reis says, if you need to ask whether or not you have product-market fit, you don’t.”

Word of Mouth Growth

‘Word of mouth’ is a vague term that marketers use to describe the phenomena that happens when your product grows organically based on positive reviews from users. It’s difficult to measure, but many agree that it is one of the most powerful forces in the marketing universe. If your product grows through word of mouth, without significant spending on advertising, it can be a great sign that you’re on the path to product-market fit. Keith Rabois recounts an excellent story about Square growing exponentially with every new hardware device that was sold. Other potential users were seeing the Square point of sale device in person and becoming customers. To Keith and Jack Dorsey, this was a clear sign that they were finding product market fit. In their case, they had found a clear path to viral growth as well.

Keep Testing to Find Product Market Fit

One of the best ways to find product market fit is by looking at the process through the lens of the scientific method. You can develop a hypothesis around what users will want and then test it in the market. By viewing it in this way, finding product market fit can become a game. This frees you to overcome the fear of shipping. Rather than trying to build the perfect product at the start, you can continue building as you gain more clarity based on market feedback.

When people like Reid Hoffman talk about the importance of shipping early, they don’t mean that you should intentionally create something terrible. Rather, you should err on the side of releasing your product into the market because the feedback you’ll receive in return will provide information that can either support or falsify your hypothesis. Sometimes, the feedback you get can take you down a new road altogether. Startups are cash constrained, and need to find product market fit before they run out of money. It’s often better to release too early and get this critical feedback before you blow through half of your cash on what you believe to be the perfect idea, only for it to backfire.

Related Resource: 7 Startup Growth Strategies

How can you tell when you've achieved product-market fit?

When product market fit happens, it sometimes feels magical. Other times, it’s less obvious. In a consumer application that is built on viral marketing, it may be glaringly obvious when you hit product market fit – growth rates might explode and you could have a quick hit on your hands. In other areas, the process might take longer. If you run an enterprise SaaS business with a 6+ month sales cycle, it will take longer to see the fruits of your labor. Tyler Tringas of Earnest Capital calls this “the long, slow, SaaS grind.” If product market fit isn’t always obvious, how do we know when we’re on the right track?

In the case of the SaaS app, it may be realizing that you’re gaining new customers via word of mouth, or churn rates are very low. In other cases, an incredibly well received MVP (minimum viable product) could be an indicator of potential product market fit. Finding product market fit can be more of an art than science, but there are some things you can watch out for.

How do you measure product-market fit?

At its core, product market fit means that you’ve built something that solves a real problem for people or businesses in a large enough market. When you have it, potential customers will often start seeking out you to use your product without the need of marketing spend. If you believe that you’ve found product market fit, and can reliably predict your customer lifetime value, it could make sense to step on the gas with sales & marketing spend as a part of your growth strategy. Paypal after all was burning $10M/month at one point in their journey as their customer acquisition strategy revolved around giving users a free $10 to use their product. If your customers are loving your product and it has a high lifetime value, then a Paypal-esque strategy may make sense. Regardless of your strategy for finding product market fit, here are 2 things to observe when measuring your progress:

Know Your Customer Lifetime Value

When measuring product/market fit, you’ll need to make sure that you’re in a market & selling a product that makes your customer lifetime value high enough to pursue for the long term. If you sell a SaaS product that costs $10/month on average, but costs $10/month to support due to its complex nature, then you probably don’t have product market fit. On the other hand, if you have a product that sells for $1000/month and costs $5000 to build up front, you could have an excellent win on your hands (provided that churn is sufficiently low). Pricing is one of the toughest things to figure out in startups, but it’s critical to be aware of your customer lifetime value & the potential size of your market when making early decisions.

What’s Your NPS?

NPS (net promoter score) is a way to evaluate how likely your customers are to recommend your product to other people in their network. It’s been heralded as a key metric to track in recent years to evaluate customer satisfaction and gauge how effectively their company will grow via word of mouth. While it’s not perfect (qualitative metrics are notorious for having variance), it’s still a good thing to measure to determine how well your product is resonating. You should also look at other indicators related to NPS. How excited are your customers about your product? Are they posting about it on social media, or telling you about how it’s changed their lives? What about churn rates? A high NPS with a high churn rate usually means that you’re missing the mark.

Improving product-market fit requires you to iterate

Iterating on product market fit, as we mentioned earlier, requires you to take action and evaluate the results of that action. This process mirrors the scientific method – you start with an insight, do background research to observe what’s already been done, and formulate a hypothesis in the form of an initial product that you release into the market. Even if you receive a lackluster response, you formulate a new hypothesis & iterate on your product, repeating this process.

Sometimes, you’ll find that you were totally off in your initial product, or that your product was used in unexpected ways. If everyone knew how the market would react to new product offerings, there would be no point in building and developing new products! This is why it’s critical to get your product into the hands of users early to test your offering.

Most software businesses are perfect for this model – it helps to produce products that can be iterated upon immediately. Companies that produce hardware or more security-intensive products can also benefit from demonstrating prototypes to early adopters and getting early feedback on your concept, or offering pre-orders. The worst thing you can do is spend months or years building a new product that you realize nobody wanted. You’re better suited releasing an early version and building along with market feedback. Another great option is releasing an MVP and then launching a kickstarter campaign or offering pre-orders. Madelin Woods, a founder in our community, is a great example of this. She created prototypes of her burrito-eating tool ‘Burrito-Pop’ that generated buzz amongst friends & acquaintances. Her Burrito Pop Kickstarter fundraise generated enough funding to get version 1 to market.

Collect Data Consistently to Shorten Feedback Loops

Setting up short feedback loops is also critical. The more quickly you can get feedback from the market on your idea, the better, as compound interest applies to the iteration of products. You’re better off iterating 100 times on your offering, than spending 100s of hours on developing one version. It’s beneficial to keep an eye on metrics that are key indicators of growth & usage. At Visible, we measure key indicators of product engagement and conduct regular customer development calls when we build new product offerings. Mike, our CEO, will take demos and sit in on calls as we build. You can adopt the same mentality as you work to find product/market fit.

Build Quickly to Iterate Quickly

You can only iterate as fast as you can build. Using best practices for product development, we at Visible work in 6 week cycles where we choose key initiatives and ship product quickly. It’s key to have your product team working well together to ensure that your team is free to ship product on a consistent basis. Ryan Singer of Basecamp’s Shape Up provides an outstanding framework to help you ship product more quickly with less stress and headaches. The Visible product team endorses this process of development as it has helped us ship consistently on big projects every 6 weeks.

Be Ok With Changing Your Mind

As Winston Churchill said: “To improve is to change; to be perfect is to change often.” It’s critical to avoid the ‘sunk cost fallacy’ – continuing to invest in products just because you’ve already spent time or money on them. You must be willing to abandon projects or initiatives that no longer make sense for your business. Before you have product market fit, you cannot be too stubborn about the route you want your company travel. If Stewart Butterfield at Slack would have insisted on developing a video game, he could never have built the workplace app that runs thousands of companies around the world. This is challenging to do as a founder, as you and your team may need to abandon things you’ve worked hard on in exchange for something different. One of the greatest skills an early stage founder can have is inspiring their team to change directions when it’s needed.

Finding product market fit is the first challenge of building a company. If you stay focused on users, operate in a large enough market, and keep iterating, you’ll always have a chance. Once you have it, it’s time to pour more talent and capital onto the fire to grow your business – but that’s a topic for another day.

founders

Fundraising

How Rolling Funds Will Impact Fundraising

Raise capital, update investors and engage your team from a single platform. Try Visible free for 14 days.

Relatively speaking, venture capital is a fairly new asset class. Innovations have been consistent since Y Combinator came to market in the early 2000s. Since then there have been countless innovations that are creating more funding options for startup founders. The most recent innovation has been rolling funds. Learn more about rolling funds and what they means for startup founders below:

What are Rolling Funds?

Pioneered by Angelist, a rolling fund is a new VC fund structure that allows funds to raise money on a continuous basis – creating a new fund structure as quickly as every quarter. These funds can also be publicly marketed under Rule 506(c). While rolling funds are still relatively new, there have been early benefits and signs of more innovation to come. To learn more about rolling funds and their impact on startup founders and investors, read more below:

What are the benefits of Rolling Funds

Rolling funds have the opportunity to transform the venture capital space. As we begin to scratch the surface on rolling funds and how they fit into the space, there have been some clear benefits so far.

1. Attract New Types of Investors

These funds also lower the barrier of entry into VC for aspiring investors by allowing them to get started with less up front capital. Angelist can manage most of the legal and administrative aspects of rolling funds too, further lowering the overall amount of knowledge and capital needed to get started. Because of this, rolling funds may create many new types of investors.

2. Provides More Funding Options for Founders

More investors means more funding options for startup founders. As we mentioned above, rolling funds will lower the barrier to entry for emerging VCs, in turn creating more funding options for startups. As more competition pops up in the space, the more competitive it will become to get on a startup’s cap table. Because of this, funds will have to create more resources and terms for startups.

Related Resource: The Understandable Guide to Startup Funding Stages

3. Continual Limited Partner Fundraising

Rolling funds allow VC’s to continue to raise money from limited partners on a regular basis, essentially turning the process of LP investing into a quarterly subscription-based model. If an LP decides that they don’t want to continue backing an investor, they can stop allocating resources to them immediately. On the other hand, if they see that a given investor is making good bets, they can invest more money in them very quickly. This is especially useful for VC’s who would like to fundraise opportunistically in the case of portfolio markups.

4. Shortened Feedback Loops

This new structure will shorten feedback loops for venture capitalists. Startups take a long time to reach full maturity, but they still have clear milestones throughout their journey. If an investor has several companies in their portfolio that succeed in securing future funding or obtaining product market fit, they can be rewarded instantly by raising more money during the next quarter. This is good for LP’s too, as they can make small, periodic investments in rolling funds based on the real time performance of the investor. This is quite different from having to write very large checks every 10 years. It opens up LP investing to smaller funds and individuals – rather than just institutions.

How are Rolling Funds Structured?

As we mentioned, rolling funds will allow more people to become VC’s. Because companies like Angelist will allow these small investors to outsource many fund management responsibilities, more people with A+ networks and good judgment can get into the game.

For example, a star employee at Stripe or AirBnB might have access to many startup deals and the judgment needed to allocate capital effectively. Traditionally, if they wanted to get into VC, they would have needed to slowly work their way into an established fund or quit their job to start their own. If they didn’t want to do this, then they could angel invest, but then may not have hit the threshold needed to be an accredited investor (and even then they were confined to only investing their own money). Rolling funds allow them to start investing part time, and without needing to hit accredited investor requirements (although LP’s do need to be accredited). These new operator investors will be able to attract LP investment from many different sources, such as their managers, successful friends, and others who are impressed by their network and experience.

Maybe you, a current founder, have always thought that you’d be a good VC and wish you could allocate capital into your other founder friends’ deals. With rolling funds, you can start a fund as a side hustle. This enables you to capitalize on your access and judgement by investing in other founders.

506(c) Funds

Rolling funds are structured as a 506(c) offering. According to the SEC:

“Rule 506(c) permits issuers to broadly solicit and generally advertise an offering, provided that:

all purchasers in the offering are accredited investors

the issuer takes reasonable steps to verify purchasers’ accredited investor status and

certain other conditions in Regulation D are satisfied”

Put simply, a 506(c) requires that all LPs are accredited investors. As Investopedia puts it, “An accredited investor is an individual or a business entity that is allowed to trade securities that may not be registered with financial authorities. They are entitled to this privileged access by satisfying at least one requirement regarding their income, net worth, asset size, governance status, or professional experience.”

LP Subscriptions

Accredited LPs, limited partners, are the investors behind a rolling fund. As the name implies, rolling funds are raised on a rolling basis.

Quarterly Funds

As the team at Rolling Fund News puts it, ‘A rolling fund is structured as a series of limited partnerships: at the end of each quarterly investment period, a new fund is offered on substantially the same terms, for as long as the rolling fund continues to operate. With this fund structure, rolling funds are publicly marketable and remain open to new investors.”

Contributions

The fund managers are responsible for deciding what the contribution minimum or maximums are for LPs. Currently on the AngelList rolling fund marketplace the quarterly minimums range anywhere from $2,500 to $50,000.

Fee Structure

Like any venture capital fund, there are fees associated with a rolling fund.

Admin Fee

For all rolling funds on AngelList there is a 0.15% admin fee. The fee is similar to more traditional funds and syndicates offered through AngelList.

Management Fees

There are also management fees associated with rolling funds. Most management fees are 2% but can generally range anywhere from 0% to 3%. As defined by AngelList, “Each fund will pay the fund manager a customary management fee. Management fees generally accrue over the first ten years of each fund’s life and are typically payable in advance over four years. Like a traditional fund, GPs can waive fees on an LP-by-LP basis.”

Check out an example from AngelList below:

How to Get Involved with Rolling Funds?

The rolling fund structure opens up VC investing to many people who would have otherwise had a difficult time getting started. For example, imagine a fund built entirely around an independent media creator with a strong brand. High quality tech bloggers or university professors with a deep understanding of startups and a large audience can raise funding quickly on top of their brand and expertise. It could create an additional income stream for these individuals and allow them to build wealth through venture investing.

Networking

A common thread is that rolling funds will open up the opportunity to create a VC fund to anyone with a great network, access to deals, and good judgement around startups. Whether it’s an elite tech blogger, current founder looking to invest on the side, or startup executives who wants to benefit from their understanding and access to early stage companies – there will be new players in the VC game that might be different than the typical venture investor.

Exploring

Since launching rolling funds, AngelList has launched a marketplace where anyone can peruse and check out different funds that are currently raising. You’ll be able to check out the different funds (and their managers) to get an idea of who is in the space. Check it out here.

Invest

With lower investment minimums and more availability, rolling funds are becoming a feasible investment for non-traditional investors. Founders particularly are beginning to invest in rolling funds to invest in other founders. Of course this is an incredibly risky investment and should seek advice before investing.

How Rolling Funds Could Impact Fundraising

As we previously discussed, rolling funds have created more funding options for startups. Because of this it has the opportunity to impact the current VC fundraising process.

Related Resource: All Encompassing Startup Fundraising Guide

Increase in Total Number of VCs

Rolling funds will lead to an increase in the total number of VC’s. More entrants into the VC business will lead to pressure on the traditional players in the ecosystem and more competition for deals. This competition will lead to better prices for founders raising capital. Would you rather take money from your long time friend’s rolling fund or a Sand Hill Road VC during your Seed round? These options may be real in the next 5-10 years.

Rise in Early Stage Investing

At first, rolling funds will primarily impact early stage investing. Most of these new funds have raised relatively modest amounts of money compared to large VC’s. Due to the large amounts of capital needed to play at later stage investing, rolling funds might not have an impact there just yet. However, due to the nature of compounding, some rolling funds might grow much larger than expected. VC is dominated by power laws, and the most successful rolling funds might find themselves with LP’s begging to get into future rounds. A rolling fund with a few smash hit successes can instantly raise additional LP capital. Traditional VC’s would have to wait longer to do so. One can even expect large VC’s to adopt the rolling fund model in the future.

Easing Exit Pressure

A final way that rolling funds will help founders is by easing exit pressure. All VC investors (including those who run rolling funds), will want your company to swing for the fences and seek to be a massive outlier. Traditional VC funds, however, need to show returns to LP’s on a roughly 10 year time horizon so that they have the momentum necessary to raise additional funding. This sometimes gives VC’s an incentive to push your company to exit or IPO within a specific time frame. LP’s want to see returns on set schedules. If your company’s exit would help show better returns, your VC’s might pressure you into selling your company prematurely. With rolling funds, this is not as much of an issue, as they can raise funding from LP’s on a continuous basis, vs having to raise a giant new fund every 10 years.

Rolling Fund FAQs

Because rolling funds are fairly new to most founders and investors – check out a few common questions below:

Can You Market a Rolling Fund?

One of the unique factors of a rolling fund are that the general partners behind them are allowed to market them to the general public. As AngelList writes, “Unlike most traditional venture funds, managers of Rolling Funds (known as general partners or “GPs”) can publicly advertise their offerings to grow their investor network and raise money.”

Because of this, GPs of a rolling fund can attract LPs from different walks of life. More individuals are beginning to invest in rolling funds which means that startup founders will have a more diverse network of investors with more resources and connections available.

What is the Difference Between a Syndicate and a Fund?

As put by the team at AbstractOps, “A startup syndicate – or an investment syndicate – is a special purpose vehicle (SPV) created for the sole purpose of making one investment. Although syndicate investors are typically high-risk (high-reward) investors, through syndicates, they can invest in more deals with small amounts of capital, as little as $1,000 per syndicate. ” This means that a syndicate is only investing in a single company. On the flip side, a fund is dedicated to making investments across many companies.

Related Resource: Accredited Investor vs Qualified Purchaser

Is There a Minimum Investment for a Rolling Fund?

The minimum investment for a rolling fund varies from fund to fund. The list of Rolling Funds currently raising on AngelList varies anywhere from a minimum of $2.5K a quarter to $167K a quarter.

Checkout Visible’s Investor Database To Find the Perfect Investor

Early signs show that rolling funds are here to stay and can be transformational for both venture capitalists and startup founders. If you’re a founder looking to raise capital, check out Visible Connect, our investor database, here. We maintain the database with firsthand data and will continue to add new funds and data as it becomes available.

founders

Fundraising

5 Insurance Policies You Should Understand Before Securing Your Next Funding Round

While you’re busy launching your startup and talking with investors, insurance might not be high on your priority list. But as you start planning to raise your next round, keep in mind that commercial insurance will most likely be a requirement of securing venture funding. Not having insurance can even slow down funding, so it’s wise to get the coverage you need ahead of time to avoid closing new rounds.

Venture capital firms often require certain policies to help mitigate the risk associated with investing in your startup. Here we’ll explain five key policies you should understand to help make your next funding round as smooth and seamless as possible.

Directors & Officers (D&O) Insurance

D&O insurance will likely be the first policy you need to have in place to secure if you’re raising money from investors. D&O covers you, the company, and your board of directors from a broad array of claims associated with wrongdoing that results from managing the company. Some examples include:

Theft of trade secrets

Misrepresentation that results in a loss for investors

Breach of fiduciary duty

D&O has three main coverage areas:

Side A: Covers individual insureds not indemnified by the corporation

Side B: Covers reimbursing the corporation for indemnifying individuals

Side C: Covers the corporation itself against securities claims, such as company mismanagement

It’s important to note that D&O will not cover any instances of intentional illegal acts, such as fraud or illegal remuneration.

Tech Errors & Omissions (E&O)

Tech E&O is a type of professional liability policy that is specifically designed for the needs of tech startups and can cover liability associated with technology products or services you provide, media content, and network failures. Essentially, this policy covers claims where your products, services, or professional advice results in a financial loss for your clients. As your startup grows this policy will be essential to mitigating these risks. Keep in mind, tech E&O will not cover claims associated with a deliberate breach of contract.

Cyber Liability Insurance

While tech E&O will cover errors or omissions, it will not cover cases of cyberattacks. For that, you’ll need Cyber Liability. This is the only type of commercial policy that will help cover the damages associated with data breaches. You can often add this coverage to your Technology Errors & Omissions policy.

Startups rely on technology to keep their operations going and this leaves them vulnerable to hackers. In fact, a report by Verizon found that almost a third of all cyberattacks involved small companies and the average cost associated with data breaches, like notification and legal fees, will set you back thousands of dollars.

To help cover this risk, it’s important for startups to have Cyber Liability in place. This policy covers liability that originates both internally from employees and externally from hackers, and can cover the following areas:

Loss of digital assets

Business interruption expenses

Cyber extortion

Non-employee and employee privacy liability

Digital media liability

It’s important to note that Cyber Liability will not cover risk mitigation costs or loss of first-party intellectual property.

Employment Practices Liability insurance (EPLI)

As startups secure more funding and hire new talent, the risk for employee-related claims goes up. Since many startups often lack the HR and legal resources that large corporations have, disgruntled employees could easily sue for allegations of discrimination, wrongful termination, or harassment. Not only are these claims costly, but they can also damage a startup’s reputation.

EPLI insurance will cover the startup and employees against allegations of:

Discrimination

Wrongful termination

Sexual harassment

Retaliation

Workplace harassment

Breach of employer contract

Keep in mind, EPLI does not cover claims of bodily injury to employees. That’s what Workers Compensation is for.

Key Man Insurance

Key Man insurance is simply a corporate-owned life insurance policy, typically on the founder or CEO. With startups, the sudden or unexpected death of someone as important as the CEO or founder could sink the company. With Key Man insurance, if this were to happen, the company would receive the life insurance payout.

The Key Takeaway

As you start planning your next funding round, make sure you keep insurance top-of-mind. You’ve worked long and hard to get here, so it’s important your company is adequately protected. VC firms know they’re taking a big risk by investing in your company, so they’ll need reassurances their liability is covered. Don’t wait until the last minute to provide proof of insurance, you should make sure you’re getting the right coverage that fits your budget.

Some startups might find it difficult to secure commercial insurance due to their limited financial history. Make sure you use a broker that specializes in helping startups with broad management liability coverage.

With these policies in mind, you’ll be ready to sign on the dotted line to secure your next funding round in no time.

Related Resource: Down Round: Understanding Down Round Funding and How to Avoid It

By Emily Lazration, CoverWallet

Emily is the Content Marketing Specialist at CoverWallet, a tech company that makes it easy for businesses to understand, buy, and manage commercial insurance online. She has written for several outlets including Inc., Ooma, and Fundera covering small business news and advice.

founders

Fundraising

What Are Convertible Notes and Why Are They Used?

What is a Convertible Note?

A convertible note is a type of short term debt that converts into equity. Convertible note holders essentially get paid interest in the form of discounted equity shares, rather than regularly scheduled payments. They are often used by early stage startups when closing a seed round, and later stage companies looking for more cash in a ‘bridge’ round before their next planned fundraise. Convertible notes have a few key components:

Conversion Discount — The discount at which the investor will receive shares at the date of maturity or the next ‘qualified financing’ (i.e. the next round of funding).

Valuation Cap — The cap on the valuation (i.e. price) that the investors will pay for their equity during the company’s next fundraise.

Interest Rate — This interest rate will be added to the principal amount invested when the debt converts into equity. Most convertible notes in 2020 have a low rate to keep the value primarily on the equity conversion & reflect the current interest rate environment.

Maturity Date — Like some other forms of debt, convertible notes have a maturity date at which the investor can request full payment back from the company. This date is mostly designed to set expectations for the date of the next round of funding.

It depends. They have some clear advantages in that they tend to allow deals to get done faster. However, many in the VC community have been critical, citing that they come with more complexity and hidden risk down the road if both sides are not careful.

Related resource: Liquidation Preference: Types of Liquidation Events & How it Works

Are Convertible Notes Good or Bad?

When Convertible Notes Are Good

Convertible notes are good for quickly closing a Seed round. They’re great for getting buy in from your first investors, especially when you have a tough time pricing your company. Paul Graham wrote a post in 2010 called ‘High Resolution Fundraising’ in which he argued that innovation in convertible securities allows for more accurate & personalized pricing in early stage funding. If you need the cash to get you to a Series A that will attract a solid lead investor at a fair price, a convertible note can help.

When Convertible Notes Are Bad

Convertible notes are destructive when used carelessly. Having too many notes or poorly structured notes outstanding can put your company and later negotiations at risk by complicating your cap table. You should partner with a lawyer who understands the ins and outs of convertible notes, and educate yourself prior to closing a round with this type of funding. Convertible notes are great for speed in Seed rounds, but they must be well thought out to avoid problems later on.

What Happens When a Convertible Note Matures?

When a convertible note is issued, both the investor and founders are expecting the debt to ‘mature’ by converting to equity during a financing round within the next 1 to 2 years. However, notes also come with maturity dates, enabling the investor to get their money back (with some interest added to the principal) if that financing round does not happen on time.

There have been instances in which companies are either acquired before their initial equity round or choose to not raise any equity funding. These are both rare occurrences, but they create tough situations. See investors are not making an exceptionally high risk investment just to get their principal back plus a small interest rate. VC’s and angels win by having huge outliers in their portfolio – if they don’t get equity and you become a unicorn, they lose. It’s best for founders to add language into their convertible notes that state what investors can expect to get in these situations.

Do You Have to Pay Back a Convertible Note?

Convertible notes are just like any other form of debt – you’ll need to pay back the principal plus interest. In an ideal world, a startup would never pay back a convertible note in cash. However, if the maturity date hits prior to a Series A financing, investors can choose to demand their money back. This could effectively bankrupt the company. After all, the startup raised the money because they didn’t have the cash in the first place. If a company raises money using multiple convertible notes, this risk is even greater. Because of this, neither side of the table wants a convertible note to reach its maturity date prior to the next round of funding.

Is a Convertible Note Debt or Equity?

Convertible notes begin as short term debt, but convert into equity during a later round of financing by allowing the investor to receive a discount on shares at a future date. The investor technically has downside protection in the event that the company goes out of business until the note converts. They are entitled to their principal in a liquidity event prior to the conversion date, or if the note reaches maturity prior to a qualified financing.

Related Resource: A User-Friendly Guide on Convertible Debt

How Does a Convertible Note Convert?

A convertible note converts at the next ‘qualified financing round.’ In most cases, convertible notes are issued during a seed round, with the Series A round being the expected conversion event. However, it’s critical to understand the terms at which the note will convert because it will have a huge impact on dilution (this article goes into depth on convertible instruments and dilution). There are three options, all of which are explained in great detail in this post from CooleyGo and this one from Alexander Jarvis

Pre Money Method

In this instance, the convertible note converts based on the pre-money Series A valuation of the company. The dilution in this case will be passed from the founders on to the note holders and new Series A investors.

Percent Ownership Method

With this method, the note will convert based the percent ownership that the incoming Series A investor expects to receive. Founders bear the brunt of all of the dilution, which benefits the convertible note holder in addition to the new investor.

Dollars Invested Method

This method is unique in that it includes the value of the convertible note in the post money valuation of the company. In the Pre Money Method, the founder is favored at the expense of investors, while in the Percent Ownership Method, the founder gets diluted more than they expect. The Dollars Invested Method serves as a middle ground between the two, and allows the dilution to be shared amongst the Seed investors, Series A investors, and founders.

Why Are Convertible Notes Used By Startups?

Convertible debt has obvious advantages in that it can allow you to get deals done faster. By giving your first investor(s) a good deal, you compensate them for taking a risk on your team by allowing them the option to take a future stake in your company at a discount, while protecting their downside risk. However, you should be warned that these early benefits can come with nasty long-term consequences if you are careless with convertible notes. It’s best to be careful, do your research, and understand the terms so that you’re protected for future rounds.

When Should Convertible Notes Be Used?

When they can help you close your seed round faster:

If a company is trying to raise a seed round, one of the biggest challenges they’ll face is getting the first investor to say yes. There is an old saying in the startup world that the most common question investors ask is ‘who else is investing?’ There is a ‘herd mentality’ stereotype that is often applied to VC’s.

Even though it drives founders crazy, investors have a point. Startups almost always need cash to succeed, and if they’re not fundable, they’ll fail. For an investor to see a return, the company will need many other investors to see the same value.

No investor takes more risk in this regard than angels or early stage VC’s. They need to take the first chance on a company, typically long before it has any substantial financial or user data to make a convincing funding argument that’s based on fundamentals. Angels are making high risk bets on an idea, a team, and a market. Convertible notes allow founders to provide better deals to investors who take this risk, and ultimately give you a chance to scale your company.

To give you more time to determine a valuation:

One of the most difficult problems when getting an early stage deal done is agreeing on a valuation. Seed stage founders don’t have much data to help price their company, and every investor wants to wait until someone else agrees on a given valuation to get on board. Investors keep the company arms length, waiting for another fund or angel to take the first step.

With convertible notes, founders can offer better terms to an investor who writes the first check, and delay having to put a firm price on their company. Notes also enable companies to avoid extra legal fees associated with negotiations that take place during equity financing . This allows them to save cash and get deals done faster (although there are now templates like Series Seed documents that make this easier).

When Should Convertible Notes NOT Be Used?

When they can overcomplicate your cap table:

If a company raises money with multiple convertible notes, the cap table can get complex and the founders may place themselves in an uncomfortable position. This is especially the case if they don’t hit the next qualified financing on time. Convertible notes are still debt prior to their conversion. You may be liable to pay back cash that you don’t have if your future round doesn’t go as planned. This also gets awkward if founders don’t raise another round of funding at all (i.e. if the company gets acquired, hits profitability, or goes out of business). The key is to remove the complexity by trying to include these scenarios in your thinking prior to closing the seed financing. We suggest reading more about this from Jose Ancer on his insightful blog: Silicon Hills Lawyer.

When they come with extra dilution and liquidation multiples:

We touched on dilution in convertible note conversion earlier in this post, but they can also pose another challenge: liquidation multiples. Here’s a quick example on how a hidden liquidation multiple can surface with a convertible note:

Let’s say an investor who gives us a convertible note worth $1M at a $10M valuation cap (more math to come later). If we raise a $20M seed round, this investor ends up owning roughly 10% of a company that is now worth $20M. They only paid $1M, but now are entitled to $2M in the event of a liquidation. This investor will now receive 2x what they paid in the event of an early liquidation that is worth less than the initial valuation. This is quite disadvantageous for the founder (and potentially other investors). You can avoid this situation by adding some additional language to your convertible notes – similar to this this paragraph suggested by Mark Suster (but consult your lawyer first).

Related Resource: Everything You Should Know About Diluting Shares

What the pros say:

Many investors, such as Jason Lemkin, Fred Wilson, and many others have been critical of convertible notes. They would rather put a price on the company and believe that, due to their experience, they can negotiate a fair price quickly. They also argue that the valuation cap essentially puts a price on the company by default. If you’re willing to price your company, why not just raise the equity and avoid the headache that can come with the conversion? Jason Lemkin also argues that investors who invest with convertible debt are less incentivized to be involved early on. After all, they don’t yet have any control or stake in the company. To some investors, the complexity of convertible notes is not worth the time saved – it’s simply pushing important conversations down the road while exposing both sides of the table to unnecessary risk.

Convertible Note Examples

Let’s say you’re a founder of a seed stage company who just raised $1M via convertible note. The valuation cap is $10M and the discount rate is 20%. Then, you raise a Series A round 18 months later at a $20M valuation. If there are 1M shares outstanding, then new investors will pay $20 per share, while the investor who issued the convertible note will receive equity based on either a valuation cap or the discount – typically whichever is most advantageous for the investor on a price per share basis.

Example 1 - If the note converts based only on the $10M valuation cap, then the $1M invested will convert into a $10 per share price vs a $20 per share price ($20/share multiplied by ($10M cap divided by $20M Series A valuation), turning the $1M investment into $2M in simple terms. The $1M investment will now convert into 100,000 shares. The seed investor will get an effective 50% discount on the shares ($10/share vs $20/share) and a 100% return on their investment.

Example 2 — On the other hand, if the note converts at the 20% discount rate, the investor will be able to buy the shares for $16/share rather than $20/share. This would allow the investor to convert their $1M investment into 62,500 shares ($1M / $16/share) rather than 50,000 shares had they invested in the Series A. The $1M investment converts into equity worth 1.25M, a 25% return on their investment.

In this case, the investor would convert the shares on the basis of the cap, because it provides better economics. The math works out similar to what would have happened had they simply invested $1M at a $10M post money valuation, but they did not have to bear as much risk as typical equity holders and likely got less dilution. The investor, in exchange for taking an early chance on a company, gets a better deal than those who came in later. This is an overly simple example of how a convertible note works, but it’s useful to see how the conversion math looks in practice.

Looking for more resources on fundraising, investor updates, and navigating the unsteady waters of startups? Subscribe to our newsletter — The Visible Weekly, Curated resources and insights delivered every Thursday.

founders

Fundraising

Product Updates

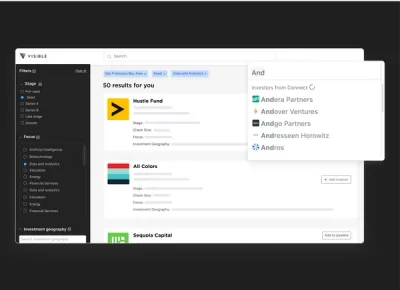

Visible Connect: Introducing Our Investor Database

TL;DR — We are excited to announce Visible Connect, our investor database. Visible Connect uses first hand data and directly integrates to our Fundraising CRM. You can give Visible Connect a try here.

Fundraising is a challenging, time consuming process for startups. One of those challenges is finding the right investors. Founders spend countless hours trying to understand:

Is this investor active? What deals have they done recently?

Will they lead? Take a board seat?

What geographies do they invest in? What stages? What verticals?

What size checks do they typically write?

Have they raised a new fund recently?

Do they have certain traction metrics or growth rates they like to see?

The current patchwork of data sources & resources lack the founder first mentality, can be cost prohibitive and lack insightful data for founders who are fundraising.

This isn’t a novel idea. Founder-friendly individuals who know the pain of fundraising consistently try to solve aspects of this problem with lists like Joe Floyd’s Emergence Enterprise CRM and Shai Goldman’s Sub $200M fund list. We believe these efforts should be coordinated and data aggregated for the benefit of founders everywhere.

Introducing Visible Connect

In the spirit of the Techstars #givefirst mentality, we are thrilled to announce Visible Connect. Our attempt at curating the best investor information in the world and opening it up as a resource for founders to derive investor insights and run more efficient fundraising processes.

Visible Connect allows founders to find active investors using the fields we have found most valuable, including:

Check size — minimum, max, and sweet spot

Investment Geography — where a firm generally invests

Board Seat — Determines the chances that an investment firm will take a board of directors seat in your startup/company.

Traction Metrics — Show what metrics the Investing firm looks for when deciding whether or not to invest in the given startup/company.

Verified — Shows whether or not the Investment Firm information was entered first-handed by a member of the firm or confirmed the data.

And more!

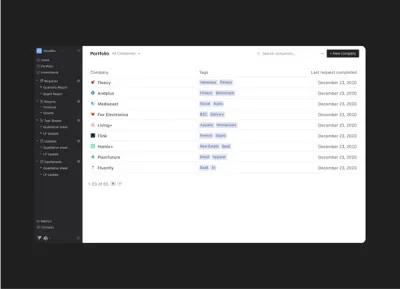

Visible Connect + Fundraising Pipelines

Once you filter and find investors for your startup, simply add them to your Fundraising Pipeline in Visible to track and manage your progress (You can learn more about our Fundraising CRM here).

We believe great outcomes happen when founders forge relationships with investors and potential investors. One of the benefits of the current system is that founders with options are forced to be thoughtful about who they reach out to. However, not all founders feel they have options. They need to know that they do.

We believe Connect is not a tool for founders to ‘spray and pray’ or spam investors with template cold emails. There will be no contact emails provided on the database for this reason.

We believe founders waste precious time trying to figure out investor fit and profile for their given stage when they could be spending that time building potentially fruitful relationships with the right investors. It should not be a core competency of a founder to understand all of the investment thesis for venture investors.

Connect Data Sources

We collect data in three principal ways:

Primary information – Direct attestations from venture capitalists, accelerators and other investment firms about their business

Secondary information – investor lists provided to us by venture capitalists (co-investors) or startup founders aggregated in the course of a fundraise or the ordinary course of business

Public information – third party data sources that are not labeled as proprietary or have terms of use associated. These sources may include: deal flow newsletters, public lists and databases, social media posts, journalistic articles, and more

We’d like to give special thanks to all the individuals who gave their time to build data sources used in the compilation of this ongoing project.

The AllRaise Airtable of investors. All Raise is on a mission to accelerate the success of female founders and funders to build a more prosperous, equitable future.

Data from the team at Diversity VC

The Southeast Capital Landscape built by Embarc Collective, Modern Capital, Launch Tennessee, and HQ1

Joe Floyd and the Enterprise Fundraising CRM

Shai Goldman and the Sub $200M VC fund list

Crunchbase Open Data Map API

NVCA’s membership database

The Fundery’s Essential VC Database for Women Entrepreneurs

Venturebeat’s NYC lead investor roster

This public airtable aggregating investors who invest in underrepresented founders (anyone know who we can give credit to?)

David Teten’s list of Revenue-based Investors (and Chris Harvey’s tweet about it)

Tech In Chicago’s list of Chicago VCs

Clay and Milk’s list of Midwestern VCs

Brian Folmer of XRC Labs

Nick Potts of Scriptdrop

Ideagist’s list of accelerators and incubators in California

Jason Corsello’s Future of Work Investors

Dan Primack’s Pro Rata Newsletter (We manually enter this data daily)

Evan Lonergan’s Excoastal (We manually enter this data weekly)

Austin Wood’s Tech Between the Coasts (We manually enter this data weekly)

We’re always looking to bring on more data sources, contributors and maintainers of the project. If you want to submit a data source or help contribute you can fill out this Airtable form.

founders

Hiring & Talent

Employee Stock Options Guide for Startups

What are employee stock options (ESOs)?

Employee stock options are vital for all startup founders and employees to understand. For startup employees the benefits often come in other forms than salary — one of the major ones being ownership in the company.

Discussing stock options and compensation plans can be intimidating — especially for first time founders or employees working at a startup for the first time. New terms are thrown and legal documents are thrown around in conversation which can lead to confusion and intimidation. However, this does not need to be the case. The guide below is intended to help both startup founders and employees understand the basics on employee stock options.

Investopedia defines employee stock options as, “a type of equity compensation granted by companies to their employees and executives. Rather than granting shares of stock directly, the company gives derivative options on the stock instead. These options come in the form of regular call options and give the employee the right to buy the company’s stock at a specified price for a finite period of time. Terms of ESOs will be fully spelled out for an employee in an employee stock options agreement.”

The benefit of ESOs for early employees is quite simple. By choosing to work for a startup an employee is taking an inherent risk. To get compensated for the risk employees are offered ESOs. If the startup’s stock price rises above the exercise price, an owner of stock options will make out well.

On the flip side, startups are also incentivized to offer employee stock options. By offering stock options founders and startups are incentivizing employees to work towards growing the company’s valuation and also encourages an employee to stay with the company as they have to wait for the stocks to vest (more on that later).

Ultimately, employee stock options are an instrumental part of finding and retaining top talent for startups. While strapped for cash, startups often cannot compete with salary offers from larger firms so can attract top talent by offering equity and ownership in the company.

Is an Employee Stock Ownership Plan (ESOP) the Same Thing?

Similar but not to be confused with employee stock option plans are employee stock ownership plans. As defined by the SEC, “An employee stock ownership plan (ESOP) is a retirement plan in which the company contributes its stock (or money to buy its stock) to the plan for the benefit of the company’s employees. The plan maintains an account for each employee participating in the plan. Shares of stock vest over time before an employee is entitled to them. With an ESOP, you never buy or hold the stock directly while still employed with the company. If an employee is terminated, retires, becomes disabled or dies, the plan will distribute the shares of stock in the employee’s account.”

The key difference between an employee stock ownership plan and employee stock option is that an ESOP is a retirement plan. Whereas an ESO is when an employee has the right to buy shares at a set price over a given period of time.

Related Resource: How to Choose the Right Law Firm for Your Startup

Are there different types of employee stock options?

Employee stock options come in two main types of options: incentive stock options and non-qualified stock options. The main difference between the two mostly revolves around their tax structure. There is a third type rarely used called “restricted stock units.” For the sake of this post we will be focusing on incentive stock options and non-qualified stock options.

Incentive Stock Options (ISOs)

As defined by Investopedia, “an incentive stock option (ISO) is a company benefit that gives an employee the right to buy stock shares at a discounted price with the added allure of a tax break on the profit. The profit on incentive stock options is taxed at the capital gains rate, not the higher rate for ordinary income.” Let’s break that down.

To get started, there are a few tax benefits when it comes to ISO. The first benefit comes when exercising (AKA buying) your shares. Generally speaking, you do not have to pay taxes when buying incentive stock options.

Assuming you exercise your shares and hold on to them for at least one year, you qualify for a tax benefit on the selling end as well. As Investopedia mentions above, when selling your ISO shares you are potentially taxed at capital gains as opposed to ordinary income. Generally speaking capital gains taxes are less than ordinary income taxes. This means that you’ll be taxed at the lower bracket.

However, if you sell your shares immediately after exercising you will be taxes at the ordinary income level (similar to Non-qualified stock options). ISOs are generally awarded to high level managers and high value employees. For a startup, this usually means the early employees and founders.

Non-Qualified Stock Options (NSOs)

On the opposite end of incentive stock options are non-qualified stock options. As defined by Investopedia, “a non-qualified stock option (NSO) is a type of employee stock option wherein you pay ordinary income tax on the difference between the grant price and the price at which you exercise the option.” So how do NSOs differ from ISOs? As we mentioned earlier, it comes down to the tax benefits.

Whereas incentive stock options are only taxed when selling (and potentially taxed at the capital gains rate), non-qualified stock options are taxed when exercising and selling your shares. Non-qualified stock options are more common than incentive stock options.

Related Resource: The Main Difference Between ISOs and NSOs

How Do Employee Stock Options Work?

It is important for both startup founders and early employees it is important to understand how employee stock options work. The different tax structures, terminology, and legal documents can make it an intimidating task. As stock options are an integral part of startup culture there are a few terms and ideas that everyone should be familiar discussing.

Granting

Generally when signing a job offer you will receive an offer grant. This is when the company is offering/”granting” the option to buy stocks. It is important to remember that stock options are not actual shares of stock but rather the option to buy these shares at a set price on a later date. So how do you make money on stock options? When the price between the offer or grant price (the price you can buy the shares at) and the market value of the company rises.

At the time of receiving an offer letter you will also receive a stock option agreement. This document will include different dates, terms, and details that are pertinent to your grant. This includes what type of options you will receive, number of shares, vesting schedule, and the expiration date.

Vesting

Vesting is a mechanism that companies can use to encourage employees to stay longer. As defined by Investopedia, “Vesting is a legal term that means to give or earn a right to a present or future payment, asset, or benefit. It is most commonly used in reference to retirement plan benefits when an employee accrues nonforfeitable rights over employer-provided stock incentives or employer contributions made to the employee’s qualified retirement plan account or pension plan.”

As we mentioned earlier when you receive a stock option this is not actual shares but rather the ability to buy shares at a later date. In order to retain employees, most companies will include a vesting schedule with their offer. This is the schedule in which you will have the ability to exercise your shares. A vesting schedule usually takes place over a period of time and may be split over the course of a few years or milestones.

The most common vesting schedule for startups is a time-based schedule. This means that you’ll receive a set amount of shares over a set amount of time. Usually there is a “cliff” which is a set date where you get the first portion of your shares.

The most common startup setup is a 4 year vesting schedule with a 1 year cliff. This means that after working for a company for a full year, the employee will receive the first quarter of their shares (1 year cliff). After the first year, the employee will receive their remaining shares over the next 3 years on a specific calendar. Usually 1/36 of the remaining shares each month.

What Are the Benefits of Employee Stock Options?

There are clear pros and cons of employee stock options. Generally speaking the benefits of ESOs outweigh the cons. From the perspective of a startup, the benefits of ESOs are quite clear.

Generally speaking startups are strapped for cash and may not be able to compete with larger firms hiring for the same positions. When top talent is evaluating where to work they are generally looking for a few things: ownership, collaboration, transparency, and growth.

Ownership can come in 2 forms, ownership in their work and ownership in the company. Offering ownership in the form of stock options is a surefire way for a startup to find and retain top talent. At the end of the day, early startup employees are taking a risk and likely a paycut to join a team that is attacking an interesting market or building a strong product. Rewarding talent for taking the risk is a must for early stage startups.

Pros

As we alluded to above, the pros of offering employee stock options are quite clear for a startup. On top of the ability they can be used as a tool to attract and retain top talent there are a few other pros:

Employee stock options give employees ownership in the company. This leads them to feel more invested in the success of the business.

ESOs offers startups financial benefits. Instead of paying a large salary they can make more competitive and attractive offers.

ESOs also improve employee retention. This will allow human resources and management to focus on building the business as opposed to hiring new talent.

Employees are directly rewarded for the growth of the company. If the valuation of the company goes up, so does their net worth.

If employees are offered incentive stock options (ISOs) instead of Non-qualified stock options (NSOs) there are plenty of tax incentives.

However, with pros comes cons. While not as plentiful as the pros of offering employee stock options there still are cons of offering ESOs.

Cons

As we mentioned above, there are still cons when it comes to startups offering employee stock options. A few common cons startups often see with employee stock options are:

While the examples above are the most basic forms of tax implications. However the tax structure can get complicated and frustrating for employees.

The more shareholders you have on the captable the more important dilution becomes. Dilution can be costly for investors and employees on your cap table and will be something startups need to be wary of.

Valuing stock options can be difficult. At the end of the day, the value is on paper.

Employees are required to rely on the output of their co-workers and management to make sure their stock is valued as high as possible.

Related Resource: Everything You Should Know About Diluting Shares

While the pros generally outweigh the cons of offering employee stock options. There still are cons that startups and founders need to work through when it comes to offering stock options as a form of employee compensation at their company.

How to Issue Employee Stock Options?

Deciding when and how to issue employee stock options can be a difficult task. A startup or founder needs to understand how much they should pay employees in cash and then add in stock options. When setting out to issue stock options it probably looks something like this:

Define the role you are looking to hire. Decide what their total compensation should be. This can be taken from similar job postings and the market as a whole.

Decide how much of their total compensation you would like to pay in cash (AKA their salary).

Determine the gap between their salary and total compensation. This is entirely up to the startup or founder. It can be difficult to place a number here as the value of the company is solely on paper. Samuel Gil of JME Partners recommends doubling the value here. For example if there was a $10K difference in their salary and total compensation a startup should offer $20K in added compensation.

The next step is to determine the exercise price for the stock options. As Samuel Gil writes, “As we have previously reasoned, we will assume that a fair price for the stock options is the same as the price of the common stock. So, how much is the common stock worth? The most frequent procedure is to apply a discount (e.g. 25%) to the latest preferred stock value, since common stock doesn’t have the same economical and political rights that preferred stock (what VCs usually buy) does.”

Issue the number of shares. This is up to the startup and founder but can be calculated with the logic above. If you find the common stock price to be $5 and need to compensate an employee $20K that would be 4000 shares. This can be quite subjective as we need to remember dilution and valuation can rapidly change.

Related Reading: How do you Determine Proper Compensation for Startup CEOs and Early Employees?

How Are Stock Options Taxed?

As we mentioned above the tax benefits, or lack thereof, are an integral part of employee stock options. To recap here, the main difference comes between incentive stock options and non-qualified stock options.

On one hand, we have incentive stock options. ISOs offer many tax benefits. ISOs are only taxed when selling the shares of stocks — and only taxed at the capital gains rate (which is generally less than ordinary income tax).

On the other hand, we have non-qualified stock options. While more common, NSOs do not offer the same tax benefits as incentive stock options. NSOs are taxed both when exercising and selling.

What Happens When Employee Stock Options Are Exercised?

We’ve covered what stock options are, how they are issued, how they are vested, and how they can be a benefit for both employees and startups. But what happens when ESOs are actually exercised?

As we mentioned above, an employee usually does not have the ability to exercise their stock options until they have vested. For this example, we will say this is on a standard vesting schedule so they are allowed to exercise their options after the 1 year cliff. So what happens after year 1 when an employee is allowed to exercise their options?

Depending on your company, there may be a few different options when it comes to exercising your stocks. Two common options for exercising stock options you might see:

Pay cash — use your own cash to pay for the shares yourself. This is the highway risk approach as you are not guaranteed to make any profit on your share moving forward.

Cashless — on the other hand you can use a cashless approach. This means one of two things. You can either sell enough of your shares to cover the purchase price of your shares. Or you can sell all of your shares in a single move.

Employee Stock Options Terms You Should Know

As we’ve alluded to throughout the post, there are quite a few terms, conditions, documents, etc. that all parties should be familiar with when navigating their employee stock options.

Below are a few employee stock options terms you should know:

Vesting — The process used to reward shares and stocks to employees. Generally this takes place over a period of time so shares are gradually rewarded. A common schedule for startups takes place over 4 years with a cliff after year 1. Vesting allows startups to retain employees by slowly rewarding shares.

Incentivized Stock Options — One common form of employee stock options. Incentivized Stock Options are more preferable for tax purposes. Generally, someone only pays capital gain taxes when selling their shares.

Non-qualified Stock Options — The other common stock option is non-qualified stock options. While more common, NSOs require someone to pay more taxes. NSOs are taxed when exercising and selling their shares.

Restricted Stock Unit — Restricted stock units are grants of stocks a company will offer employees that do not require purchase.

Employee Stock Ownership Plans — Employee stock ownership plans is a retirement plan for employees. Employers contribute stocks to an ESOP account over a scheduled period. An employee participating in an ESOP plan never buy or holds the stocks while being employed by the company.

Employee stock options are an integral part of a startup’s success. ESOs are a powerful tool to attract and retain top talent. In order to best set up your ESO plan, you need to understand the basics of employee stock options. To learn more about attracting and retaining top talent, subscribe to our Founders Forward Newsletter We search the web for the best tips to attract, engage and close investors, then deliver them to thousands of inboxes every week.

founders

Metrics and data

How To Calculate and Interpret Your SaaS Magic Number

In a SaaS business, it’s critical to understand how your sales and marketing spend is affecting your annual recurring revenue (ARR) growth. In order to better help you understand how efficiently you are growing you need to understand your SaaS magic number.

So what is your SaaS magic number? The SaaS magic number is a way to evaluate whether or not you should continue to invest in customer acquisition, or take your foot off the gas.

Related resource: How to Start and Operate a Successful SaaS Company

Why Use the SaaS Magic Number?

Lars Leckie popularized the ‘Magic Number’ as a SaaS metric in the mid-2000s, citing it as a way to help companies decide ‘how much gas to pour on the fire’ of your startup. Subscription businesses are fortunate to have clearly definable payback periods, but it’s critical to understand the influence of today’s spending on future performance. The magic number helps SaaS companies determine the impact of sales and marketing spending on ARR growth.

So why track the SaaS magic number for startups?

Understand Your Sales & Marketing Efficiency

Ultimately your SaaS magic number is a metric intended to uncover just how efficient your go-to-market efforts are. By measuring your magic number, you’ll be able to better forecast future ARR growth and make sure your team is scaling in an efficient manner.

Evaluate Where to Spend

Because your magic number helps you understand your efficiency, you can easily translate this data to find the specific channels and go-to-market methods to put your focus, and dollars, behind.

How to Calculate Your SaaS Magic Number

There are many great resources that explain how the magic number is calculated. The SaaS CFO has an excellent in depth breakdown on the topic. Here is the SaaS magic number formula:

(Current Quarter Revenue – Previous Quarter Revenue) *4 / Previous Quarter Sales & Marketing Spend

Let’s say that you spend $100,000 on sales and marketing last quarter to create a monthly recurring revenue (MRR) increase of $25,000 for the quarter. This $25,000 will become $100,000 in ARR, provided that churn is minimal. In this case, your $100,000 in sales and marketing spend has earned you $100,000 in new ARR, resulting in a SaaS magic number of 1.0 for the quarter. This implies that you’ll pay back your sales and marketing expenses within a year.

SaaS Magic Number Benchmarks

A SaaS magic number of 0.75 or greater is said to be a sign that you should continue to invest in customer acquisition, while anything less than 0.75 means that you should reevaluate your spending. Many in the SaaS community view a magic number of 1.0 or greater to be ideal. However, you need to be careful not to view this in isolation. While the magic number is great at helping you determine how efficiently you can create new revenue, it won’t show the whole picture. Check out the SaaS magic number benchmarks below:

Less Than 1

Between 0.75 and 1.0 is a relatively green zone and represents that you can continue to invest in your sales & marketing efforts. However, if you’re magic number is much lower than that there might be something noticeably wrong in your process. For example, churn could be abnormally high or your customer acquisition costs (CAC) might (learn more about CAC ratio here) not warrant your current pricing model. The goal here is to improve period over period to get closer to a magic number of 1 or greater.

Equal to 1

As we mentioned above anything around 1.0, warrants further investment. Your current go-to-market process is likely working and it is time to start putting fuel on the fire. As Lars Leckie puts it, “if you are above 0.75 then start pouring on the gas for growth because your business is primed to leverage spend into growth.”

Greater Than 1

If your magic number is greater than 1 you likely are building a well-run machine. Revenue growth should almost feel easy at this point. You should pour on more investment and can test new channels and customer acquisition models along the way.

Other Metrics You Need To Use With the SaaS Magic Number

Your magic number may be great, but it doesn’t tell the whole story – be sure to factor these metrics in when evaluating your sales & marketing spend.

Churn Rate

Is your churn rate low? If your sales and marketing expenses are helping you generate new ARR, it doesn’t matter how effective you are at acquiring new customers if you can’t keep them for long. Customer retention is key to a solid SaaS magic number.

Gross Margins

What are your gross margins? If you have high COGS (and thus, lower gross margins), then you should keep in mind that the sales and marketing expenditure payback period will be longer. Just because your magic number may be greater than 1, doesn’t mean you should ramp up spending on customer acquisition until you know how long it will take to truly pay back the cost of those new clients.

Cash Flow

How much cash do you have to spend? This may seem self explanatory, but you should be careful not to break the bank just because you’re efficient at acquiring new customers. Downturns and unexpected events happen – be sure you have your cash flow modeled and keep it in check. You won’t be able to service your new customers if you run out of cash.

How to Track Your Key SaaS Metrics

The SaaS magic number is only one of many metrics that you should be tracking – be sure to check out our Ultimate Guide to SaaS Metrics to make sure you’re keeping an eye on every area of your business.

Track your key SaaS metrics, share investor updates, and engage your team all from Visible. Try Visible for free here.

investors

Operations

Leveraging the Venture Tech Stack to Source New Deals With Ablorde Ashigbi

Finding deal flow is a daily challenge for investors. Every investor has their own "secret sauce" for sourcing new deals. However, there are underlying technologies that investors can leverage to better their deal flow.

In this webinar, we cover:

Using tech to uncover and find new deals

Best Practices for Managing Potential Investments & Relationships

Best Practices for managing current portfolio companies

Other tech in the VC toolkit

5 minute demos of Visible and 4Degrees

founders

Metrics and data

What is a Startup’s Annual Run Rate? (Definition + Formula)

What is Annual Run Rate?

Annual run rate is the rough estimate of a company’s annual revenue based on existing monthly or quarterly data.