Blog

Visible Blog

Resources to support ambitious founders and the investors who back them.

All

Fundraising Metrics and data Product Updates Operations Hiring & Talent Reporting Customer Stories

founders

Fundraising

Reporting

Valuing Startups: 10 Popular Methods

Every startup is aiming for a high valuation for their business. In business, valuation is the process of evaluating the present value of the asset in hand, in this case the overall value that a startup is worth. For startups, there are a variety of popular methods folks use to evaluate a business and determine its overall valuation. Different valuation methods are used for different reasons. To help break it down, we’ve outlined 10 popular methods for valuing startups.

Related Reading: Pre-money vs Post-money: Essential Startup Knowledge + 409a Valuation: Everything a Founder Needs to Know

1. The Berkus Method

Startups are risky. Less than 10% of startups make it past the first year of existence so determining the valuation of a startup, especially a brand new one with only months of lifespan can be extremely challenging. The Berkus Method is an attempted way to assess value without the traditional revenue metrics that many methods take into account for more mature organizations.

The Berkus Method quantifies value by assessing qualitative qualities instead of quantitative ones. Value is assessed in the Berkus Method with five main elements. The elements considered within the Berkus Method include value business model (base value), available prototype to assess the technology risk and viability, founding team members and their abilities or industry knowledge, strategic relationships within the space or team, existing customers or first sales that prove viability. A quantitative value can be tied to each relevant quantitative factor with the Berkus Method.

Source: Angel Capital Association

Pro Tip: When To Use This Method

The Berkus Method should be used pre-revenue. It can be a valuable valuation method when a new startup is formed with expert founders or former successful startup leaders at the helm or when a strong, viable product is in place. In these examples, there is enough qualitative information at hand to justify a quantitative value.

Related Resource: What is Pre-Revenue Funding?

2. Comparable Transactions Method

This valuation method at the highest level is essentially valuing the business based on what consumers would currently pay for it. This is one of the most conventional methods of valuation. To make a comparable transaction valuation, an investor or evaluator will look at companies of a similar size, revenue range, industry, and business model and see what they were valued at or sold for. This method is looking at validation from what others were willing to pay for similar companies in an acquisition or merger and use that to make a fair, or comparable, offer on the company seeking valuation.

Pro Tip: When To Use This Method

The most common scenario where the Comparable Transaction Method might be used is through a big M&A (Merger and Acquisition) deal.

3. Scorecard Valuation Method

When a company hasn’t produced any revenue yet, as an early-stage startup, it can be hard for investors to make a solid bet on the probability of their investments’ success. The Scorecard Valuation Method is one method that relies on the past investments of others taking similar bets and risks on pre-revenue startups. Similar to the comparable transaction method, the scorecard valuation method looks at similar startups or companies in the company at questions’ industry.

This valuation method looks at these similar companies and sees what types of valuation they received by other investors. From there, the median will be calculated from the value of all the similar companies’ valuations and this median will determine the average value of the target company. In addition to the median value placed on the competitive landscape, scorecards are looking at the strengths and weaknesses of the market as assessed by other investors and scoring their investment in question weighted with the following criteria compared to the other companies in the space:

Board, entrepreneur, the management team – 25%

Size of opportunity – 20%

Technology/Product – 18%

Marketing/Sales – 15%

Need for additional financing – 10%

Others – 10%

A company may be valued higher than the median with the scorecard method if the size of opportunity or board/management team is exceptional quality or vice versa, maybe docked if the tech is strong but the leadership is assessed as in-experienced.

Pro Tip: When To Use This Method

This method may be used by a startup that is in a crowded space such as marketing tech, sales tech, fintech etc.. and is pre-revenue; With a lot of similar or adjacent companies raising rounds and receiving valuations, a scorecard can be used successfully because there are is a lot of adjacent validation in the market.

4. Cost-to-Duplicate Approach

Startups are a risky investment for many reasons, but one big one is that it typically takes a lot of capital to run and scale a business and many startups struggle to manage their run rate and burn rate efficiently.

The Cost-to-Duplicate Approach to valuation considers all costs and expenses associated with the startup. The costs and expenses reviewed include the development of the product and the purchase of physical assets. A fair market value is then determined based upon all the expenses at hand. The negative of using this type of valuation approach is that it does not consider the future growth and potential of the company, only the current efficiency based on expense and it also doesn’t take into account intangible assets such as the talent of the leadership team, brand, patents, etc.

Pro Tip: When To Use This Method

The Cost-to-Duplicate Approach might be the right approach to asset valuation when the product is simple and won’t require a lot of expensive development, the team is lean and the burn rate of capital is extremely slow or even non-existent. Lean startups with one or two folks at the helm, or with a founding team that isn’t taking a salary yet could use this method to justify their first infusion of cash to start taking a salary or start making bigger financial moves.

5. Risk Factor Summation Method

Every venture capital fund or any investment firm is spending time unpacking the potential risks of each and every new investment they make. The Risk Factor Summation Method is used with risk as the primary method for evaluation. This approach values a startup by taking into quantitative consideration all risks associated with the business that can affect the return on investment.

An initial value is calculated (possibly even using one of the other methods discussed in this post) and then the risks are assessed, deducting or adding to the initial value calculation based on said risks to the return. Some of the different kinds of risks that are taken into account are management risk, political risk, manufacturing risk, market competition risk, investment and capital accumulation risk, technological risk, and legal environment risk.

Pro Tip: When To Use This Method

This method is often used by investors when looking at a new space or as a second pass on assessing the value of a potential investment.

6. Discounted Cash Flow Method

This method is predicting the valuation of a company based on its assumed future cash flows. The hope is that the DCF (Discounted Cash Flow) is above the current cost of investment resulting in projected positive return and higher valuation. A discount rate is used to find the value of present future cash flows.

For example, the discount rate might be the average rate of return that shareholders in the firm are expecting for the given year. That percent (maybe 5%, 10%, etc.) is then used to make a year-over-year assumption. This hypothetical informs investors that based on the current cash flow and discount rate chosen to asses, the expected cash flow can be anticipated from this investment.

Pro Tip: When To Use This Method

This is a great valuation method to use for a company that has relatively predictable and stable up and to the right growth up until the time of investment.

Related resource: Discounted Cash Flow (DCF) Analysis: The Purpose, Formula, and How it Works

7. Venture Capital Method

This method is one of the most common, if not the most common method used for evaluating startups that are pre-cash flow and seeking VC investment. The VC Method looks at 6 steps to determine valuation:

Estimate the Investment Needed

Forecast Startup Financials

Determine the Timing of Exit (IPO, M&A, etc.)

Calculate Multiple at Exit (based on comps)

Discount to PV at the Desired Rate of Return

Determine Valuation and Desired Ownership Stake

Its ultimately a quick, rough estimate informed by as much information as is available based on the market, comps, any existing quantitative and qualitative info from the company at hand, and an assumed amount of risk from the VC Firm.

Related Resource: A User-Friendly Guide on Convertible Debt

Pro Tip: When To Use This Method

Most startups should expect that this valuation method will be applied when seeking early rounds of funding, especially from popular venture capital funds.

8. Book Value Method

The Book Value of a company is the net difference between that company’s total assets and total liabilities. The idea of this valuation method is to reflect what total value of a company’s assets that shareholders of that company would walk away with if that company was completely liquidated. Book Value is equated to the carrying value on a balance sheet. To calculate book value, look at the total common stockholder’s equity minus the preferred stock and then divide that number by the number of common shares in a company.

Pro Tip: When To Use This Method

This valuation is extremely helpful in determining if a company’s current stock value is under or overpriced when attempting to determine overall valuation.

9. First Chicago Method

Named after the VC arm of The First Chicago Bank, this valuation method uses a combo of multiple-based valuation and discounted cash flow to make a valuation of a company. Essentially, this method allows you to take into account many different possible outcomes for the business into the valuation – to keep it simple, you can think of this method as taking into consideration the business’s best case scenario, worst-case scenario, and average scenario.

Looking at all 3 scenarios, an estimate is made as to how likely each scenario is. Next, you multiply the probabilities by their respected values and add them up. This gives you a weighted average valuation from the combo of the 3 most likely scenarios – valuing the business on the average of what will probably happen.

Pro Tip: When To Use This Method

This valuation method is recommended for dynamic, early-stage growth companies. It’s used when companies have a future with many possible outcomes that could come about based on the next decisions made.

10. Standard Earnings Multiple Method

A multiple is a fraction in which the top number (the numerator) is larger than the bottom number (the denominator). The earnings of a business are defined as income or profit. The Standard Earnings Multiple Method looks at the earnings of the business over an industry-standard multiple. Every industry and sector may have a slightly different average multiple.

Pro Tip: When To Use This Method

One common scenario where this method is used is to measure stock pierce earnings with price/earnings ratio, which measures stock price to earnings. P/E ratio tells what the market (stock buyers) are willing to pay for the company’s earnings with a higher ratio indicating that people are willing to pay more.

Share Your Startup Valuation With Visible

Use Visible to communicate with your current investors. Raise capital, update investors and engage your team from a single platform. Try Visible free for 14 days.

Related Resources:

A Complete Guide on Founders Agreements

Who Funds SaaS Startups?

Types of Venture Capital Funds: Understanding VC Stages, Financing Methods, Risks, and More

Top Creator Economy Startups and the VCs That Fund Them

investors

Product Updates

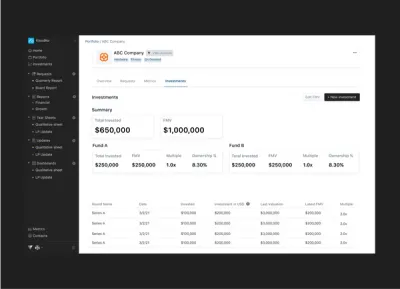

Product Update — Improve Your Fund Analytics with Multiple Funds

We’re excited to share that our Multiple Funds feature is now live. This means you can now drill into your investment data and fund analytics with even more precision than before.

Assign investments to different funds to view and compare individual fund analytics. Slice your data even further with custom segments. Answer questions like “How does the multiple for our SaaS companies from Fund I compare to the multiple for our SaaS companies in Fund II” in seconds.

Get started with Multiple Funds within your Visible account or schedule a call here to learn more.

founders

Operations

Customer Stories

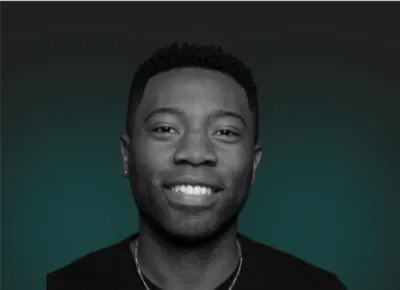

How This Founder Leveraged Social Proof to Grow Their Customer Base

About Yaw

Yaw Aning is the CEO and Founder of Malomo. Malomo is a shipment tracking platform that helps eCommerce brands turn order tracking from a cost center into a profitable marketing channel.

Episode Takeaways

Yaw joined us for season 3, episode 2 of our Founders Forward Podcast to dive into his career as a founder. He started his career in consulting which eventually led him to founding Malomo. Since founding Malomo, the team has rapidly grown and they’ve raised $8M+. Before ever thinking about funding, Yaw and the team had to determine what problems they were going to solve and did everything in their power to find their first customers.

Yaw joins us to break down:

How Malomo found their first customers

The importance of finding a co-founder

How and why you need to solve customer’s problems

How Yaw found his co-founder

The importance of being able to shut down

How to prioritize time

Watch the Episode

Give episode 2 with Yaw Aning a listen below (or give it a listen on Spotify, Apple Podcasts, or wherever you normally consume podcasts)

The Founders Forward is Produced by Visible

Our platforms helps thousands of founders update investors, track key metrics, and raise capital. Try Visible free for 14 days.

founders

Operations

The Main Difference Between ISOs and NSOs

Hiring and attracting top talent is a major responsibility of any startup founder. In order to compete with large corporations, startups oftentimes have to get creative to attract top talent.

One of the top benefits a startup can offer is employee stock options. This gives an employee potential upside and ultimately aligns both parties. There are two major forms of stock options — NSOs (non-qualified stock options) and ISOs (qualified incentive stock options).

How do you know what type of stock options to use for your company? Check out our breakdown of both ISOs and NSOs below:

Note: We always recommend seeking advice from lawyers or councils when working with your equity.

What Are Qualified Incentive Stock Options or ISOs?

As put by the team at Investopedia, “An incentive stock option (ISO) is a corporate benefit that gives an employee the right to buy shares of company stock at a discounted price with the added benefit of possible tax breaks on the profit. The profit on qualified ISOs is usually taxed at the capital gains rate, not the higher rate for ordinary income. Non-qualified stock options (NSOs) are taxed as ordinary income.”

The main difference between ISOs and NSOs are the tax structure and possible benefits. Traditionally, ISOs are awarded to high-value employees.

How Are ISOs Taxed?

As mentioned above, ISOs are taxed at the capital gains rate. This means that ISO holders are subject to tax benefits as the capital gains rate is generally lower than the ordinary income rate. It is worth noting that ISOs are taxed at the time of selling the stock (not when vesting or exercising).

When an employee (or person) is granted sock options there is a strike price (which is the value at the time of granting). Once an employee decides to exercise their options, they have the ability to sell their stock or hold on to the stock. If the same person sells their stock at (the fair market value) at a later date the difference between the strike price and fair market value is the profit — or what the employee is taxed on.

Check out the long-term capital gains tax rates in 2022 (for the US) below:

Learn more about other tax implications and the alternative minimum tax (AMT) in our next section.

The Impact AMT Has on ISOs

According to the IRS, “The alternative minimum tax (AMT) applies to taxpayers with high economic income by setting a limit on those benefits. It helps to ensure that those taxpayers pay at least a minimum amount of tax.” So what does this mean for ISOs?

While very rare and generally reserved for high-earning individuals, the AMT can be triggered if the profile from selling ISOs is large enough. This means that the stock seller will be subject to more taxes and negate some of the benefits of an ISO.

What Are Non-Qualified Stock Options or NSOs

On the flip side are non-qualified stock options (NSOs). As put by the team at Investopedia, “A non-qualified stock option (NSO) is a type of employee stock option wherein you pay ordinary income tax on the difference between the grant price and the price at which you exercise the option.” NSOs are generally more common than ISOs.

While they might not have the tax benefits of ISOs, NSOs are generally more common than ISOs and offer their own benefits. It is worth noting that NSOs can be granted to non-employees as well (board members, advisors, mentors, customers, etc.) Learn more about NSOs and their tax structure below:

How Are NSOs Taxed?

The main difference between NSOs and ISOs comes down to how they are taxed. If you recall, ISOs are only taxed at the capital gains tax when they are sold. NSOs can potentially be taxed on two occasions.

To start, NSOs are taxed when the stock options are initially exercised. If/when someone decides to exercise their NSOs they will pay a tax on the difference between the fair market value and the strike price.

Next, NSOs are taxed when someone sells the actual stock — similar to ISOs. Depending on how long someone holds their stock between the time they exercise it and sell it, will determine if they pay short term or long term capital gains tax.

The Impact AMT has on NSOs

As we mentioned earlier, an alternative tax minimum (AMT) is a potential downside of ISOs. Unlike their counterpart, NSOs are not subject to AMT.

ISO vs NSO Which One is Right For You?

Now that we understand the difference between qualified incentive stock options (ISOs) and non-qualified incentive stock options (NSOs) it is time to understand how and when you should be using both. Both have expected use cases and their own set of pros and cons depending on the use.

Related Reading: How to Fairly Split Startup Equity with Founders

When to Choose an ISO

Of course, most employees will likely want an ISO plan as it offers tax benefits. However, it is lesser used and should be reserved for high-value employees. As the team at Investopedia writes, “This type of employee stock purchase plan is intended to retain key employees or managers.” A few times for when you should choose a qualified incentive stock option for your employees:

When offering stock options for an employee (ISOs are not eligible with individuals who are not employees)

When trying to incentivize and retain a high-value employee — this might be a manager or executive that is closely aligned with your companies success.

When your company is in a financial position to offer ISOs instead of NSOs

When to Choose an NSO

While they do not necessarily have the tax benefits of ISOs, NSOs are widely used and are more common than ISOs. Below are a few examples and pros of choosing an NSO instead of an ISO:

When issuing stock options to non-employees. This could be consultants, board members, mentors, and more.

From the team at Pasquesi Partners, “With NSO, companies are able to take tax deductions when the employee chooses to exercise their option in the stock. Because of the way they are structured, NSO earnings are viewed as income for the employee, hence the tax deductions.”

When looking for a more simple option and straightforward stock option to offer employees

Share Stock Option Information With Your Investors with Visible

No matter how you structure your cap table and share equity with investors, employees, and more, it is important to be straightforward and transparent the entire time.

Want to improve your investor reporting and communication? Let us help. Raise capital, update investors and engage your team from a single platform. Try Visible free for 14 days.

founders

Fundraising

A Quick Overview on VC Fund Structure

Startups have different options when it comes to financing. One of the most popular options is venture capital. To better understand if venture capital is right for your business, check out our breakdown of different types of venture capital below.

If you believe you are ready to raise venture capital, understanding how and why the function will improve your odds of raising capital. To learn more about raising venture capital, check out our “All-Encompassing Startup Fundraising Guide.”

Related Resource: Types of Venture Capital Funds: Understanding VC Stages, Financing Methods, Risks, and More

What are the Types of Venture Capital Funding?

As venture capital continues to grow and evolve so do the types and expectations of funds. As the team at Crunchbase found, venture funding by year is growing, mainly between early-stage and late-stage funds:

Related Resource: Exploring VCs by Check Size

Learn more about different types of funding below:

Seed Capital

Seed funding, which oftentimes includes “pre-seed” funding, is generally the first round of financing for a startup. There typically tend to be funds that specialize in pre-seed/seed-stage financings.

However, as the seed stage has continued to grow so have the funds — later stage funds are now moving their way down to make seed investments. As the team at Crunchbase put, “One of the reasons many venture firms are stockpiling funds to invest into seed startups is that getting in at the earliest stages with a young startup lets those investors have a say in crucial decisions early on.”

Check out the average seed size (from “large” investment funds) over the last 10 years below (from the team at Crunchbase):

VCs will typically get more attractive terms as they are taking on more risk at the seed stage. Because of this, seed-stage investors oftentimes make more investments in the hopes that a small percentage of their investments will turn into huge returns (learn more about the power-law curve in VC here).

Related Resource: Seed Funding for Startups: A 101 Guide

Early Stage Capital

Post seed or pre-seed funding comes to Series A and Series B funding. While some might categorize them as a later stage, both are earlier stage financings that come post-seed round.

Early-stage capital is often when a company might have some traction and promise that it can grow into a massive company that is worthy of an exit.

Related Resource: How to Model Total Addressable Market (Template Included)

Related Resource: The Rise of Venture Capital in Utah: A Look at Utah’s Top 10 VC Firms

Related Resource: Breaking Ground: Exploring the World of Venture Capital in France

Expansion Capital

Once a company has proven they have product-market fit, a massive market, and a repeatable sales process — chances are they are ready to expand. With this comes larger check sizes that will help you put your growth strategies to work.

Venture funds at this stage are likely huge funds that make fewer investments with larger check sizes. At the point of investment, most companies will have proven success to in turn will raise at higher valuations.

Related resource: Understanding the Role of a Venture Partner in Startups

Late Stage Capital

Lastly comes late-stage capital. These are borderline private equity funds and can be used to bridge financings for larger companies. This might be a final injection before a company sets to go public or to fund expansion into a totally new market.

Related Resource: Private Equity vs Venture Capital: Critical Differences

Rolling Funds

More recently, “rolling funds” have become a point of interest in the space. While they are not typically dedicated to a specific stage (like the examples above) the way they raise financing and treat the general partner to limited partners relationship differs. Learn more about rolling funds here.

Related Resource: 12 Venture Capital Investors to Know

Venture Capitalist Fund Structure

To better improve your odds of raising venture capital, you need to understand how they function. When pitching investors you’ll want to keep a few of these things in mind so you can fit into their duties as a VC.

Check out a visual of how venture capital funds are structured below:

Related Resource: A Guide to How Venture Capital Works for Startups and New Investors Guide

A couple of key terms to understand when it comes to a venture funds structure:

1) Venture Fund

As the Bank for Candian Entrepreneurs puts it, “A venture capital (VC) fund is a sum of money investors committed for investment in early-stage companies.” A venture fund is simply capital that is ready to be deployed by the venture capital firm (or the management company).

2) Management Company

The management company is the people behind the fund itself. Not be confused with a venture fund. A venture management company can raise multiple funds. As the team at AngelList writes, “A management company is a business entity created by a venture firm’s general partners (GPs). It’s responsible for managing a venture firm’s operations across its funds.”

Management companies often receive a management fee from their funds to help deploy and grow their funds.

A management company is responsible for prospecting investments, collecting fees and expenses, branding, and more.

3) General Partner (GP)

A general partner is someone who manages a venture fund and likely the management company. As defined by the team at Angel List, “A GP is a manager of a venture fund. They may be a partner at a large VC firm like Sequoia, or an individual investor using AngelList. Like fund managers in other arenas (stocks, mutual funds, crypto, etc.), they analyze potential deals and make the final call on what to do with the money they manage.”

General partners are typically paid between their carried interest and management fees. Carried interest is typically where a general partner makes a living. Typically carried interest for a GP is 20% which means that 20% of a funds profits will be paid to the GP.

It is worth noting that GPs oftentimes invest their own money so they have skin in the game. You can boil down a general partner’s responsibility into 2 key things — deploying capital in high-quality companies and raising future capital.

4) Limited Partners (LPs)

You might be asking yourself where does capital for a venture fund come from? The answer is limited partners. Limited partners are generally much larger funds and are looking to diversity their investing via venture capital funds. Traditionally, limited partners tend to be:

University endowments

Sovereign funds

Family offices

Pension funds

Insurance companies

Etc.

Because VC funds are competing with traditional assets, it is vital that they provide outsized returns to improve their odds of raising venture capital in the future. Learn more about the power law curves in our post, “Understanding Power Law Curves to Better Your Chances of Raising Venture Capital.”

5) Startups

Of course, there are the actual startups and investments that a venture fund are making. For a startup to be deemed venture-worthy they generally have to operate in a large market, have promising economics, and the ability to create a massive return for their investors (and their LPs).

Related Reading: Building A Startup Financial Model That Works

Limited Partnerships & LLCs Role in VC Fund Structure

As the team at Investopedia puts it, “A limited partnership (LP)—not to be confused with a limited liability partnership (LLP)—is a partnership made up of two or more partners. The general partner oversees and runs the business while limited partners do not partake in managing the business. However, the general partner of a limited partnership has unlimited liability for the debt, and any limited partners have limited liability up to the amount of their investment.”

Because LPs do not partake in managing the business (e.g. the venture firm) they are relying on the GP and venture firm to be experts at investing. At the end of the day, every venture fund and firm wants to set out and raise a new fund every 10 years or so. This means that GPs need a strong record with LPs so when they seek further capital they have someone they can lean on.

This also means that LPs are expecting massive returns as they are trusting and deploying their capital with a general partner, likely in a space lesser-known to them.

Related resource: What is a Capital Call?

Three Examples of How Returns Are Generated

Of course, the goal of any venture fund is to generate returns for its limited partners. As we put in our post on power-law curves,

“A small % of VC funds take home a large % of venture returns. VCs are constantly working to make their way into the “winning” part of the curve so they can continue to attract capital from limited partners.

How does a VC fund become a “winner?” The best VC funds portfolio returns also follow a power-law curve. A small % of a VC funds investments will yield the majority of their returns.”

This means that VCs need to create liquidity and get returns to their investors so they can go out and raise capital again. This generally comes in 1 of 3 ways:

Related resource: Carried Interest in Venture Capital: What It Is and How It Works

1) Mergers and Acquisitions (M&A)

One of the most common ways that a startup exits are via a merger or acquisition. As put by the team at Investopedia, “Mergers and acquisitions (M&A) is a general term that describes the consolidation of companies or assets through various types of financial transactions, including mergers, acquisitions, consolidations, tender offers, purchase of assets, and management acquisitions.”

The terms of the merger or acquisition will impact how a VC is paid back. For example, an investor that invested at the seed stage will likely be greatly diluted if the exit is later in a companies lifecycle.

Related Resource: From IPOs to M&A: Navigating the Different Types of Liquidity Events

Related resource: What is Acquihiring? A Comprehensive Guide for Founders

2) A Buyout of Shares

Less common is that startups shares will be bought out. This means that a new entity is taking a larger or majority stake in a company. This could come via a specific fund exiting their position or a founder finding liquidity. No matter the case, the terms, and conditions will greatly impact any fund.

3) Startup Reaches an IPO

Lastly, there is an IPO (initial public offering). Becoming rarer, an IPO has the opportunity to create huge returns for a venture capital fund — especially their seed and early-stage investors.

Looking To Get Funding for Your Startup?

Understanding if venture capital is right for your business is a small part of the battle. Determining how to raise capital, what investors to raise from, and pitching investors is where the real fun begins. Having a system in place to raise venture capital is a great way to increase your odds of raising capital.

Related Resource: All-Encompassing Startup Fundraising Guide

Related Resource: 8 Most Active Venture Capital Firms in Europe

Related Resource: 7 Best Venture Capital Firms in Latin America

Related Resource: Exploring the Growing Venture Capital Scene in Japan

If you’ve read this post and determined that venture capital is a good fit for your company, let us help. Raise capital, update investors and engage your team from a single platform. Try Visible free for 14 days.

founders

Metrics and data

Customer Stories

Getting Over the Cold Start Problem with Nick Loui of PeakMetrics

We are back with another season of the Founders Forward Podcast! This season is all about founders in our community. Our goal is to sit down with startup founders and break down 3 things that have transformed their career or company.

About Nick

We’ll try to keep the episodes to 10 minutes or less so you can get back to what matters most — building your business.

For the first episode, we welcomed Nick Loui, CEO and Founder of PeakMetrics. PeakMetrics uses machine learning to spot trends & predict message resonance across news, social, and TV/radio. In this episode, we break down:

Episode Takeaways

Getting over the cold start problem

Creating value through aggregation

Narrowing down your target audience

Watch the Episode

Give episode 1 with Nick Loui a listen below (or give it a listen on Spotify, Apple Podcasts, or wherever you normally consume podcasts)

The Founders Forward is Produced by Visible

Our platforms helps thousands of founders update investors, track key metrics, and raise capital. Try Visible free for 14 days.

investors

Reporting

Customer Stories

[Webinar Recording] Best Practices for Portfolio Monitoring & Reporting With Gale Wilkinson

As more capital flows into venture as an asset class, investors increasingly compete for LP dollars and space on the cap table from the best founders they work with. Gone are the days when capital is enough of a differentiator for a VC fund to get on a hot startup’s cap table.

Considering the average VC + Founder relationship is 8-10 years (longer than the average marriage in the US) — founders are beginning to look for a true partner out of a VC fund. For a VC fund or emerging fund manager to stand out among other funds, they need to have the optimal data and systems in place.

Gale Wilkinson, Managing Partner and Founder of Vitalize Ventures, has led investments in over 70 companies and deployed $50M+ of capital. During her time at Vitalize and Irish Angels, Gale has turned into a leader in the space as emerging managers and founders turn to her for advice on all aspects of fund and startup building.

Gale joined us on February 15, 2022 to discuss how and why VC funds should build a system to track and monitor their portfolio companies.

Topics discussed during the webinar include:

The history and founding of Vitalize Ventures

The resources, network, communities, that has Gale has leveraged as she grows her managing partner skillset

How she put together the Vitalize tech stack

What metrics and data she collects from portfolio companies

How she reports portfolio performance to her LPs

Visible for Investors is a founders-first portfolio monitoring and reporting platform. Schedule time with our team to learn more.

founders

Fundraising

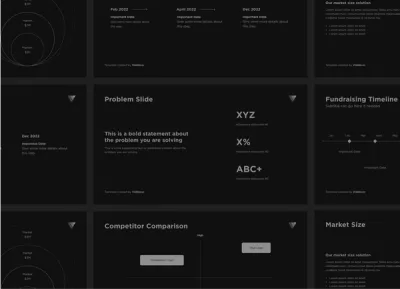

Our Teaser Pitch Deck Template

When communicating with investors in your fundraising funnel, you must make sure you tell a compelling story about why they should invest in you.

Pitch decks are a powerful tool that can help you tell that story. Different investors will have different opinions about pitch decks. Some investors might want to receive them before the meeting, some might only want them sent via PDF or link, and some investors might not care if you have a pitch deck at all.

Through all the noise, one idea we have seen emerge is having a send-away (or email deck) that founders can share with investors before a meeting. Brett Brohl of Bread & Butter Ventures recommends a four- or five-slide deck that can be easily shared with potential investors.

While there is no prescriptive pitch deck template that will work for every startup, here is a 5 slide example email deck we have seen work well for founders (or check out the example deck directly in Visible here):

Slide 1 — Title Slide

Pro tips:

Make sure your logo is high quality and easy to read

Feel free to include a one sentence description of what your company does

Want to use this template? Download here.

Slide 2 — Problem Slide

Pro tips:

Clearly articulate your problem

Use data to demonstrate how big the problem is

Use stories and pain points to build empathy from investors

Want to use this template? Download here.

Slide 3 — Solution Slide

Pro tips:

Clear overview of what your solution is

Use data and stories from customers to help investors understand why your solution is best

Want to use this template? Download here.

Slide 4 — Market Slide

Pro tips:

Make sure to use a bottoms up approach when modeling TAM (more from Gale Wilkinson here)

Show the market in dollars

VCs need huge exits — demonstrate why you can win your market

Want to use this template? Download here.

Slide 5 — Team Slide

Pro tips:

High quality headshots for key teammates

Include relevant experience and skills

Want to use this template? Download here.

Related Resources:

Visible Connect, our investor database

Building Your Ideal Investor Persona

How to Build an Investor List with Gale Wilkinson of Vitalize

All Encompassing Startup Fundraising Guide

Investor NPS: How likely are you to refer your current lead investor to fellow founders?

Some Advice Before You Hit the Fund Raising Trail

founders

Fundraising

How To Build a Pitch Deck, Step by Step

Pitch Decks are put together by startup founders when they are seeking a round of investment funding to back their business. A Pitch Deck tells the story of your company, the problem it solves, why it matters, and most importantly why a potential investor should care and want to donate thousands if not millions of dollars. Every investment a venture fund or private investor makes is a calculated risk and a strong pitch deck is often the key tool a founder has to showcase the risk is worth it.

Investors care about how they are going to make their money back plus a profit and want to see in your pitch deck how this will be possible for them. However, According to TechCrunch, investors only spend on average only 3 minutes and 44 seconds reviewing a pitch deck. Other sources have found that time to be less than 2 minutes. Its a safe bet to assume you have less than 5 minutes of an investor’s time to articulate why your company deserves their backing so taking the time to build a pitch deck that packs a punch in 5 minutes or less is critical.

Communicating all that you need to in a pitch deck, to summarize why your business is worth a big investment, is much easier to do in concept than in practice. A strong pitch deck should be simple and clear but still compelling. Building a strong pitch deck is a skill founders should take time to learn as early on as possible to ensure every 5 minutes or less spent on their deck by VCs gives the best chance for investment and future success. To assist, we’ve built out a step-by-step guide to help you build a quality pitch deck for your business.

Related Resources: 23 Pitch Deck Examples for Any Startup

1. Choose the Right Tools

Let’s take it from the beginning – choosing the right presentation tool to build your pitch deck. This may seem like a small decision, but in reality, there are pros and cons to building your pitch deck on different presentation solutions.

Keynote

This might be the best tool if you’re going to have a brand or product designers working on your deck. Keynote comes installed on all Mac computers and has tools and functionality that is a bit more detailed and flexible allowing trained designers to create custom, clean, original designs and layouts. If you’re not a designer or don’t have design resources available for your deck creation, Keynote may not be a strong choice as it can be a bit hard to navigate and collaborate on without the knowledge and eye for all of its features.

Google Slides

Google Slides is a strong free option for crafting simple decks. Anyone can use Google Slides and collaboration is seamless. If you’re a solo founder or an extremely lean, cash-strapped team without design resources, Google Slides will allow you to build a super clean deck that’s easily shared. Past a certain level of company maturity, however, Google Slides may not be a strong option due to its lack of customization on the design side – it’s much harder to demonstrate the product and brand design in Google Slides.

PowerPoint

Another good free option, PowerPoint can be used on the web for free by anyone with a Microsoft account. Similar to Google slides, this can be a good simple, clean option for early founders without design resources. The paid version of PowerPoint is a bit more robust and can allow for a more mature, established design (even without design resources). The one main con of using PowerPoint for your pitch deck is that the presentation experience can often be clunky and the shared version isn’t as friendly to access as a Google slides or Keynote for non-Microsoft users.

Canva

For established startups with a clear brand and product aesthetic, Canva can be a great option as it provides more customization and design options than Google Slides and PowerPoint. Even the free version of Canva allows you to access many strong Canva-specific templates for customized pitch decks. Because Canva is a web-hosted platform that can make it challenging to present in some circumstances and doesn’t allow for as smooth off-line presentations, however, Canva is a strong design-centric option that is easy to use for founders and not as technical as Keynote.

Later on, we will dive into the specifics of pitch deck design, but once you select your pitch deck creation tool, you can start exploring templates and popular deck flows that successful startups have used. Here at Visible, we recommend starting with these free pitch deck templates to generate some ideas.

2. Craft Your Message

Knowing your pitch deck will most likely only get 5 minutes or less of review, crafting a clear message that tells the story of your company and a clear business plan including details like financial models and product roadmap is critical. Crafting your message can feel overwhelming knowing the window of review will be so small.

There are many formats and philosophies you can use to craft a strong pitch deck. A popular methodology that many founders follow is Guy Kawasaki’s 10/20/30 rule – 10 slides that are readable in 20 minutes or less (aim for less here!) and use a 30 point font. This is a good structure for framing the flow and digestibility of your content. For the actual content, the message of this 10 slide deck, we suggest thinking about the message in 3 distinct parts: The Company Purpose, Problem, and Solution.

Company Purpose

This is the most important part of your message to keep simple. Articulate, ideally in 1 slide and only 1-2 sentences, why your company exists. The company’s purpose is often well articulated as a mission statement. With the company purpose, you are leading into the problem but not particularly addressing the problem just yet. You are simply sharing why your company exists. A few examples from successful companies on the market:

Twitter: To give everyone the power to create and share ideas and information instantly, without barriers.

PayPal: To build the Web’s most convenient, secure, cost-effective payment solution.

Tesla: To accelerate the advent of sustainable transport by bringing compelling mass-market electric cars to market as soon as possible.

The Company Purpose should articulate in a simple way, why your business exists. Establish a clear, strong mission statement that articulates this and the rest of the deck will be built off of that articulated goal.

Problem

Now that you’ve established the company’s purpose, establish the problem that the company will be solving. This section shows not only the problem that exists, but the opportunity for the company or solution that can solve said problem.

To ensure you are keeping the problem section clear yet powerful, lean on as much data as you can to validate the impact of the problem at hand. If there is a certain number of people or businesses that are impacted by this problem, paint that picture. If there is a cost associated with this problem or money currently being spent in the space the problem exists in, articulate that as well.

According to TechCrunch, 73% of successful pitch decks include a breakdown of the market size and opportunity and 46% address “why now” or why this problem should be addressed at this point in time. Another way to think about articulating the Problem is to think about articulating the scope of the opportunity – ie, if the problem is this big, this is the opportunity that exists to solve it and this is why now is the right time to do so. Similar to the Company Purpose, keep the Problem explanation brief – 2-3 slides is our recommendation for tackling the Problem section.

Solution

The Solution section of your pitch deck should be the most comprehensive. In theory, your solution is your comprehensive offering from your product or service to your marketing and customer success. At the end of the day you want investors to be able to answer, “What is their competitive advantage or “secret” sauce?”

Because of this your solution might fall into a few slides but oftentimes you can still create a specific single solution slide the example below:

Why Now?

Investors are oftentimes incentivized to collect as much data as possible during a raise. You need to give them the information they need to move quickly and invest today. Using market data and your own display why now is the right time for them to invest.

Market Size and Opportunity

Venture capital follows a power law curve. Investors are looking for startups that are poised to dominate a market or take a solid percentage of a massive market. In order to help win over investors, demonstrate that your company can become large enough to create significant returns to their investors (Uber is a great case study in how to properly model your market).

Related Resource: How to Model Total Addressable Market (Template Included)

Product

This is the slide where you introduce your company’s product and how it solves the problem at hand. While investors will certainly have questions about the technical aspects of the product down the line, for the sake of a concise deck try to keep the product slide high level and easy to understand. Make this slide as visual as possible including product screenshots or even a light click-through animation.

Competitive Landscape

A big question for investors if they like the fiscal opportunity of the problem at hand is an understanding of who else is trying to solve this problem. Don’t shy away from highlighting competitors.

Competitors validate that there is an appetite in the market. As you highlight other competitors in the space, be sure to highlight how your product and company are different and better for the problem at hand and also call out where there is missed opportunity in the market that your company can cover (this is especially important in a crowded space like marketing technology).

Business Model

Now that you’ve shown the opportunity in the market and what your solution is to address the problem, it’s important to talk through your plan to take this product to market or how you are currently taking it to market as well as how you plan to acquire customers. Check out our deep look at the Customer Acquisition pitch deck slide to ensure you capture all elements of your business model for investors.

Financials and Metrics

Even if investors like your idea, at the end of the day their choice to invest in your business is a financially motivated one. The Financials and Metrics Slide is a key slide to win over the support of a potential investor. Highlight how much money you have raised to date, your key growth metrics over the lifespan of the business so far, and your plan for the investment round in question. To ensure all key startup metrics are addressed in the Financials Metrics slide, take a look at our overview of key startup metrics.

Related Resource: Important Startup Financials to Win Investors

Team

Use the Team Slide as a final push of confidence that an investment in your business is a good one. Highlight the folks on your executive team and what they bring to the table. For example, highlight the past successful companies they have been a part of and helped build, any relevant industry-specific experience, or any unique skills that they bring to the table that give your company a competitive advantage. The Team slide is also a great way to humanize the company and connect with your potential investors by putting faces to name.

Additional Slides to Consider

If you have room in your deck, consider adding a slide that highlights the product roadmap (especially if this furthers the financial opportunity and “why now” argument for your company). Any existing partnerships that you have in your company that add to the fiscal attractiveness of your business may be worth a slide after you highlight your business Model as well. Finally, if the round you are raising is for a later stage round and you can see an exit trajectory insight, it may be prudent to highlight your exit plan on a slide when you discuss financials and metrics to show a more accurate picture of the type of return your potential investors could see sooner rather than later.

3. Level Up Your Pitch Deck With These Tips

After you’ve spent time designing a well-thought-out and clear pitch deck that articulates the company’s purpose, problem, and solution and have built a version you feel confident in, take the time to consider ways to take your pitch deck to the next level before taking it into the boardroom.

Tailor The Pitch to Your Audience

Personalization goes a long way. Make sure you find simple but powerful ways to tie in your pitch to fit the audience you’re talking to. Prior to making your rounds looking for an investment, do your research on the possible meetings you could have. Organize a list of VCs or investors by tiers based on who you would most like to work with. Additionally, take the time to understand each group’s investing philosophy. Prior to any pitch, make sure to tailor your opening talk track and ask “why now” to fit their specific investment philosophy and showcase why this opportunity would be a great one for their firm specifically. Our Visible Connect network is a great database of VCs that will aid in this process.

Be Transparent, Accurate, and Data-Forward

Don’t leave anything out. If your company has had a period of setbacks or pivots, don’t shy away from highlighting that. Additionally, take out any fluff from your presentation that could be seen as opinion or too high-level and instead back up every point you plan to make with hard data. Show, don’t tell. Numbers are the clearest way to give a transparent, credible view of your business and the opportunity at hand.

Read and Revise (Now Do it Again!)

Remember that you’re going into each meeting asking for thousands if not millions of dollars in support. This is a serious ask and you’d hate for a great opportunity to be jeopardized due to some simple errors. Once you think your pitch deck is in its most perfect state, read and revise it again. Now do it again. Take every possible second you can to look for spelling and grammar errors, design and presentation errors, and ensure it’s as clear as possible for any type of investor to process. Practice the pitch to peers and existing partners and employees as many times as possible to get multiple sets of eyes on it for review and revision.

Related resource: Our Guide to Building a Seed Round Pitch Deck: Tips & Templates

4. Follow Pitch Deck Design Best Practices

Once the content is perfect, take the time to ensure the deck design is up to par. A few best practices on Pitch Deck design to consider:

Use a Consistent Visual Style: This will keep the presentation looking clean, easy to follow, and straightforward. Simple is always better so settle on a design theme and format for your slides and stick to it.

Consider Bullet Points: Too many words on a slide can make an investor’s (or anyone’s) eyes glaze over. Minimize the amount of text on each slide by bulleting out the key points. These will be easier for the investors to remember and remove any unnecessary fluff from your deck.

Keep Graphics simple: If you are going to include graphics or visual elements alongside your bulleted text, make sure they are valuable and not elements that are distracting from the purpose of the deck. Keep visual elements simple and make sure they serve a purpose. For example, product screenshots or data graphs are a good way to present information in a different but still valuable way.

For more pitch deck design best practices, check out YCombinator’s guide on best practices from the thousands of pitches they see every year.

Related Resource: Pitch Deck Designs That Will Win Your Investors Over

5. Prepare to Deliver Your Pitch

Even the most perfect pitch deck won’t stand a chance without the right delivery. Practice makes perfect so ensure you have a clear plan in place and spend the time preparing to deliver your pitch. Determine who on the team is best to present. Pitches can be done by one leader with the strongest presentation skills or divided up across the team. The perks of multiple folks presenting ensure that there is coverage on different elements of the business and provide a good natural change to keep interested throughout the pitch. Regardless of who decides to pitch, make sure they are mock pitching and rehearsing as many times as possible. Get feedback from existing investors, partners, or peers and practice daily.

In addition to preparing to deliver your pitch in person, make sure the way you are going to digitally deliver your pitch is glitch-free, clean, and easy to digest. Check out our template for sharing your pitch deck with potential investors here.

Additionally, Visible can be a helpful platform for managing all elements of the fundraising pitch deck process. Use Visible to track and manage potential investor relationships and report out to existing and future investors as your business grows. Learn more here.

6. Share Your Pitch Deck with Visible

Just as a sales team has dedicated tools for their day-to-day, founders need dedicated tools for managing the most expensive asset they have, equity. Our community can now find investors, track a fundraise, and share a pitch deck directly from Visible and completely integrated.

Want to see a Deck hosted on Visible in action? Take a look here. Manage your fundraise from deck to check with Visible. Give it a try here.

Related resource: Business Plan vs Pitch Deck: The Differences and When You Need Them

founders

Metrics and data

How to Define & Calculate ARR for Startups (with Formulas)

Introduction

ARR, or Annual Recurring Revenue, is a key metric for SaaS startups to understand and track. At a high level, ARR is the annual revenue a startup can expect to make. Zooming in, there are a few more layers that define what ARR really is. Understanding ARR and how to calculate it is critical as you build a successful SaaS startup.

Related Resource: Our Ultimate Guide to SaaS Metrics

What is ARR (Annual Recurring Revenue) for a Startup?

For a startup, ARR, or Annual Recurring Revenue is the profit that they can expect to make in any fiscal year period. However, there are a few requirements that need to be considered for a profit number to truly be ARR. For starters, the revenue model for the startup should be subscription-based, meaning that the product sold is not a one-time purchase but rather a recurring cost.

This subscription should be an annual one but can be fulfilled via a variety of billing structures such as monthly billing, bi-annually, or annual payments. The cost of the subscription should be in a dollar amount and always converted into an annual amount. One-off transactions for your products do not count towards ARR.

For a startup, ARR is so important because it contributes to their overall valuation. Investors, no matter what stage of startup you are at, will expect founders to know, understand, and track their startup’s ARR. Additionally, because it’s only a number made up of annualized subscription-based profit, ARR will be a distinct, different number than accountings revenue.

Why do startups like ARR?

Not only is ARR a metric that all investors expect startup founders to know and track, it’s also a favorable metric for founders beyond just pleasing investors. A few reasons why startups like ARR as a metric include:

Forecasting and Growth Planning: Company planning is typically done on an annual basis so when revenue is measured with ARR, it makes company planning that much easier. ARR can help inform not only the annual budget but ARR growth predictions as well. A clear forecast can allow leadership to make smarter, more tactical growth moves around hiring, raising rounds of funding, and eventually, exiting or going public with their business. Related Resource: Building A Startup Financial Model That Works

Customer Payments: With annual subscriptions, customers are only responsible for a single bill every year. This makes the headache of billing, potential delays in customers’ paying, and chasing down revenue that much easier. When the bill is 1x a year for each customer, it’s a huge time saver and allows for more on-time payments by customers and more predictable work for the finance teams at startups. Related Resource: Customer Acquisition Cost (CAC): A Critical Metrics for Founders

Standardized Subscription Terms: Naturally, with software sales, there may be some negotiations around term length for various customers. Most companies have a standard term they prefer (2 years, 18 months, 12 months). With ARR, regardless of term length, each customer’s payments are standardized to one year. This means that payments will always be billed in 12-month increments so all customers produce annual revenue for the business and all billing and contracts are treated the same. Startups love this again for the simplicity for finance teams but also for predictability of growth.

Why do investors like ARR?

As noted earlier, investors value ARR as a key metric when evaluating startups and their founders as potential investments. A few reasons why investors like ARR as a metric are:

Revenue Predictability: This is a big factor for investors to feel confident about an investment. If a product comes with a monthly commitment instead of yearly or a business operates solely on 1-time purchases, this can be a red flag for investors in the business-to-business space. With annualized revenue, there is no risk for seasonality to a product or slow months where monthly or 1-time revenue can not be relied on. With ARR, investors can be ensured that there is clear profitability on an annual basis which provides more security for their investment.

Competitive Landscape Insight: In competitive spaces, investors want to align themselves with the company and product that will ultimately come out on top. It can be hard for investors to evaluate the true best investment in a crowded space where all companies are growing their customer base and employee base and seemingly showing positive growth every year. ARR can help investors understand who the true rocket ships are in a space by understanding the annual revenue growth over time. A dip in ARR year over year can be a red flag but growing ARR even when bringing on new investors that change valuations are a huge positive for investors in evaluating a competitive space. Related Resource: How to Model Total Addressable Market (Template Included)

Ease of Business Valuation: At the end of the day, a steady increase in recurring revenue reassures investors that they will most likely see a return on an investment in your business. ARR is critical because just as it allows founders to plan for the predictable growth for their business, it allows investors to more easily and accurately predict what the value of a business will be based on its ARR growth in 5, 10, 20 years post their investment. A multiple of ARR is a clear way for investors to predict an accurate valuation of a startup’s business and make smart investment decisions.

Related Resource: The Understandable Guide to Startup Funding Stages

How to Calculate ARR

Knowing ARR is the annual recurring revenue for your business over a 12 month period, it may seem like a straightforward metric to calculate. That’s not necessarily the case. ARR can look differently depending on the company. There is nuance to how it is calculated for every business.

Traditional ARR Calculation

Traditionally ARR is calculated for standard annual contracts where a client commits for a 1-year term. The ARR is the total cost of the recurring product or services (what would be billed again after 1 year if the customer chooses to subscribe for another year of product). So if your product is $10,000 dollars annually but you also charge a $3,000 onboarding fee. The ARR on that customer deal would just be $10,000. The 3k is not included as it is not recurring and is only a 1-time fee.

Multi-Year Contract ARR Calculation

If you have a customer that opts in upfront for a multi-year contract, meaning they won’t be up for renewal or re-subscription until that first multi-year contract is complete, this gets factored into the ARR calculation.

Sticking with our example, the recurring fee of your product is 10k a year. If a customer signs up for a 3-year contract, the ARR is found out by multiplying the annual cost by the number of years (10k x 3) and then dividing that total by the number of years (30k / 3) leaving the ARR at $10,000.

This only gets tricky when the contract is not a straightforward multi-year contract but rather a contract length with a number of months that doesn’t quite add up to exact years. If your client has signed up for an 18-month term at 10k a year. The total cost of the product will be multiplied by the result of 12 divided by 18. $15,000 x (12/18) =$10,000 ARR. For a 15 month contract it would read: $12,500 x (12/15) = $10,000 ARR and so on.

MRR Based ARR Calculation

Monthly Recurring Revenue or MRR is income a business can count on receiving every single month. Similar to ARR, it is on a recurring basis however the outcome is a 30 day period vs. an annual period. In some cases, MRR can be used as a basis for ARR calculation.

If your company operates a subscription business where the standard term is monthly (maybe with an upfront commitment of 6 months for example) your MRR can be used to estimate ARR for forecasting purposes. Simply take your total MRR (found the same way you would find traditional MRR, just looking at it month over month) and multiply by 12. So if a customer is paying for a product that is $100 a month, the ARR on that contract would be $100 x 12 = $1,200 ARR.

Common Mistakes Calculating ARR

While overall ARR might seem like a pretty straightforward metric to calculate, many startup leaders make a few common mistakes early on when pulling together ARR calculations. A few of the most common mistakes seen when calculating ARR include:

Including Free Trials

Time granted to a customer to use a product for free or at a temporary trial-period discount, regardless of how long, should not be included in ARR calculations. These should be treated as one-off payments. When the trial converts to an annual subscription, that cost can be used to calculate ARR but only if it is converted to a recurring subscription.

Not Factoring in Discounts

Often, discounts are offered for a portion of a contract to incentive partnership, however, discounts can affect your final ARR. If a customer has a discount for their first year or for any duration of their contract, it needs to be reflected in the ARR. So if the discount is 25% off for the first year bringing a cost down to $750 from a 1k list price, that needs to be reflected in the ARR and $750 should be used as the calculating number. If the discount is only for a set year, upon renewal, the full price can be used for ARR but not before then.

Treating Late Payments like Churn

If a customer is late on a payment, they haven’t churned so their contract should still be included towards ARR. The only difference the company might see here is when the payment hits the bank account but the commitment to a yearly contract is still in place so deals with late payments should be included in ARR calculations.

Other common nuances that should be included in ARR calculations include lost payments from churned customers, upsells on current customer subscriptions, downgraded subscriptions. Common nuances that should not be included in ARR calculations include set-up fees, account adjustments, or any other non-recurring charge.

Track ARR and other KPIs with Visible

ARR is a crucial metric for any successful startup founder and team to master. Calculating ARR can help founders and executives plan for growth, make accurate forecasts, showcase more predictable revenue for investors, standardize their subscription terms, and increase the valuation of their business.

An accurate calculation of ARR can be tricky but is a critical skill to learn. Visible can help founders and investors alike keep track of ARR and a handful of other metrics in a clean, painless, and delightful way. Check out how Visible helps with metric tracking for SaaS businesses here.

founders

Fundraising

How to Write a Business Plan For Your Startup

While a business plan might feel like a dying practice for startups there are countless benefits of building out and thinking through a plan. A startup business plan can be the backbone of pitch decks, investment memos, and strategy as you set out to build your startup.

Related Reading: How to Secure Financing With a Bulletproof Startup Fundraising Strategy

In our guide below, we lay out 8 concepts that will help you build a business plan as you begin your startup journey. You can skip around to specific sections below:

Eight Key Concepts To Include In Your Business Plan

As we mentioned above, the 8 concepts below are a great starting point to think through when forming your business. Inevitably, you’ll face questions and issues around all of the issues so having a well-thought-out plan and approach to each will pay dividends as you build your business.

Related Resource: How to Create a Startup Funding Proposal: 8 Samples and Templates to Guide You

1. Build an Executive Summary

As put by the team at Inc.com, “The summary should include the major details of your report, but it’s important not to bore the reader with minutiae. Save the analysis, charts, numbers, and glowing reviews for the report itself. This is the time to grab your reader’s attention and let the person know what it is you do and why he or she should read the rest of your business plan or proposal.”

An executive summary is an opportunity for you to layout the contents of your business plan and set the stage for what is to come. Avoid going too deep into detail and rather lay out the backbone of your plan. You want to balance getting the reader’s attention with supplying the information they need to get a grasp of your report.

A few items that we suggest you include:

What is this product service/service?

Who will benefit from this product/service?

Who is competing with this product/service?

How will you execute on selling your product/service?

As you continue to build out other sections of your business plan, the executive summary might change as you tweak other components.

Related Resource: A Complete Guide on Founders Agreements

2. Identify Your Business Objectives

First things first, you will want to layout the objectives of your business. This should be a deeper dive into what exactly your company does and how it is set up. This will be your opportunity to highlight your market and communicate why your product/service is set up for success. This is also a chance to hit on the mechanics of your business (structure, model, etc.).

A few items that we suggest including when laying out your business objectives:

Gives investors a brief overview of what your company does

Communicate the value of your product/service

Highlights the market opportunity

You will have an opportunity to go into more depth in each of the details above later in the plan so make sure you are giving just enough detail to build interest and give investors a solid understanding of your objectives.

3. Highlight Your Companies Products and Services

Next, you can start digging into the fine details of your products and services. You will want to build excitement here and let investors know exactly what your product offers and why it is built to solve a big problem and win a market.

This is a great opportunity to present any qualitative or quantitative data you have about the market and your ideal buyer. Layout the problem and make your investors feel the pain that you are trying to solve. For example:

Let’s say you have an application that helps people find and book a camping site. You might want to lay out the problem you are solving below:

Next, layout how and why your solution is solving the problem like the example below:

A few other things you will want to make sure you include when highlighting your product or service:

Face-to-face research on problems in the market

How does this product solve the market’s problem?

Data that suggests people are feeling the same pain point

Stories from existing or potential customers that highlight the pain points

The goal here is for you to have your investors understand the problem and start building empathy.

Related Resource: How to Write a Problem Statement [Startup Edition]

4. Define Market Opportunities

After you have laid out the problem and solution, you can start displaying the hard data behind the market. Venture capital follows a power law curve so chances are investors will want startups to demonstrate a large market and the potential to capture a large percentage of the market.

One aspect is modeling your total addressable market. You’ll want to demonstrate a large market that piques the interest of investors. Make sure to use real numbers and a bottoms-up approach here.

In addition to demonstrating your addressable market, we suggest including a few of the ideas below:

Do research on the target audience

Who is the target demographic for your product/service?

What is the target location for your product/service?

What is the typical behavior for your target audience?

Related Resource: When & How to Calculate Market Share (With Formulas)

5. Complete Your Sales and Marketing Plan

Now that you have demonstrated your product and the greater market it is time to start digging into the specifics of you will attract and close new customers. At the end of the day, bringing in revenue is the goal of a business to having a strong go-to-market strategy is an important aspect of your startup’s business plan.

If you’ve correctly laid out your market and the demographics of your target market in the previous sections, investors should have a strong understanding of the space and will be able to have a conversation around your sales and marketing strategies.

You don’t need to go into overwhelming detail here but laying out what channels you will rely on and how you will execute and hire on those channels is necessary. For example, if organic search is a strategy you can lay out what you are doing to execute on that channel but do not need to mention the specific posts and content you are creating here.

To make sure you nail this section, be sure to include a few of the following:

Sales channels

Marketing objectives

Early data points and success

If you do not have any hard data points yet, no worries. Use your research and market data to build compelling cases for different acquisition strategies.

Related Resource: 7 Startup Growth Strategies

6. Include a Competitive Analysis Report

Of course, investors will want to know about the competitors operating in your market. They will want to understand how you are differentiated and why you are poised to beat them in the space.

You’ll want to make sure you are clearly demonstrating who is operating in what aspects of the space. Compare your product or offering to them. Remember to be honest here as investors always have the ability to double-check your research and will do their own analysis of your competitors.

A common way to show this information is by using a market map. Check out an example of what a market map looks like below:

Related Resource: Tips for Creating an Investor Pitch Deck

7. Structure Your Operations and Management Teams

In the early days of a business, most investors will be taking a chance on the founding team and management team. They will want to look at your team’s past experiences and skillset to understand why they are the ones that should execute on a problem.

Highlight what managers and leaders are responsible for what aspects of the business and use their past experiences and skillsets to show why they are fit for the role.

You can also use this as an opportunity to demonstrate hiring plans and how your teams will be structured as you continue to grow. Here are a few examples of what you might want to include:

Define your team of experts and what tasks they are responsible for.

Consider adding an organizational chart to clearly outline your companies structure

8. Financial Analysis

Finally, you should include financial analysis for your business. Depending on who you are sharing your business plan with might depend on the level of financial analysis you would want to share.

If you already have financials and data be sure to include the last 12 months of data. Make sure the data is incredibly easy to understand decipher. You don’t want someone to be looking at your financials and take things out of context to draw conclusions about your business that might be wrong.

Another aspect you’ll want to include is your financial forecasts and goals. While chances are that your forecasts will be wrong it is a good way to demonstrate to your investors that you are thinking about your business in the right way. Check out why Gale Wilkinson of Vitalize Ventures likes to see early-stage founders model their future below:

A few other items that might be worth including with your financials can be found below:

Include revenue

Major expenses

Salaries

Financial goals and milestones

Related Resource: 4 Types of Financial Statements Founders Need to Understand

Related Resource: A User-Friendly Guide on Convertible Debt

Share Your Business Plans With Visible

Once you have your business plan in place it is time to hit the ground running and collect feedback on your business plans and objectives. Use our Update and Deck sharing tools to share your plans with potential investors and stakeholders along the way. Raise capital, update investors and engage your team from a single platform. Try Visible free for 14 days.

founders

Fundraising

How to Write a Problem Statement [Startup Edition]

At the core of every business or startup is a big problem they are trying to solve. Founders are putting forth their expertise and skills to build a solution to help solve this big problem.

In the early days of building a business, many investors and stakeholders will ask to see a business plan to address how you are attacking a market and solving a problem. When going out to raise capital (from angels, VCs, etc.) making sure that investors clearly understand the problem you are solving is crucial.

One of the key aspects of a business plan is the problem statement. Learn more about business problem statements and how to craft one for your business below:

What is the Purpose of a Problem Statement?

As we mentioned above a problem statement is part of a business plan. It should be an overarching thing you are trying to solve that guides most decisions you are making as a business — product development, go-to-market strategies, customer support, etc.

A business problem statement defines exactly what problem you are helping your customers solve. It should be fairly simple but can be the backbone of your decision-making and business strategy.

Note: While you might not necessarily be sharing a “problem statement” with investors during a fundraise, it oftentimes can be useful when crafting your pitch deck. Learn more about crafting your first pitch in our post, “Tips for Creating an Investor Pitch Deck”

Best Practices for Writing a Problem Statement