Blog

Metrics and data

Resources related to metrics and KPI's for startups and VC's.

All

Fundraising Metrics and data Product Updates Operations Hiring & Talent Reporting Customer Stories

founders

Metrics and data

What’s an Acceptable Churn Rate?

Calculating Your Customer Churn Rate

How do you know how many customers you can lose? Of course, you want to lose as few customers as possible and save as much revenue as you can. However, the reality is any startup is going to shed some clients no matter how well they perform. But both churn rates can help answer two vital questions facing your company: are you targeting the right customers? Is your company big enough?

Customer churn isn’t the same as revenue churn. The first refers to the number of customers that cancel their subscriptions. Revenue churn is simply the amount annual money lost in a month or year.

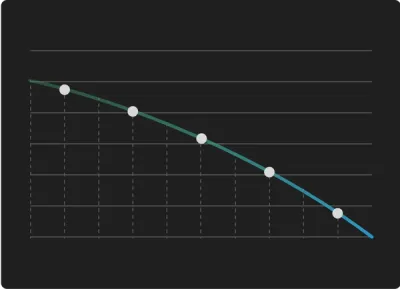

In the early days, you should have a higher churn rate than what your company will average over its lifespan. In your first few years, you can expect as high as a double-digit churn rate and not need to hit the panic button. But if you’re not seeing a steady drop year over year, you may have the wrong client base or need to invest more money in your client success team.

Talk to your clients that renew. Why did they continue the service? If they love what you offer, they may be the key to unlocking the best set of customers you can target. You don’t want your startup to waste time worrying over cancelled subscriptions if these clients are a natural mismatch and your current set of renewals can help find signal for your product and its go-to-market fit. Sometimes the best strategy for reducing churn rate happens at the acquisition stage.

When it comes to determining an acceptable churn rate, it’s every bit as important to understand the size of your customers’ business as it is your own company. You can accept about three to five percent of your small to medium sized businesses portfolio every month or less than 10 percent annually. As enterprise level businesses go, aim for a churn rate less than one percent. Your churn rate should continue to decline in subsequent years until you reach negative churn.

Reaching negative churn—monthly or annually—is going to be one of the most attractive metrics your company can showcase to its investors. It’s good to have a portfolio of customers “that are like high-yield savings accounts.” Negative churn, also known as account expansion, occurs when the new revenue you are earning from current customers (whether it comes from upsells or cross-sells) exceed the revenue you are losing from customers that cancel their subscriptions. As Lincoln Murphy writes: “Remember, it’s a lot easier to get more money from a customer who’s happy and already paying you than it is to get money for the first time from non-customers.”

Negative churn can also serve as one of the key metrics to judge your client success efforts, as expanding your account revenue beyond your subscription loss will help determine if your team is moving in the right direction. Tomasz Tunguz has even advocated for startups to aim for negative churn when deciding their pricing model and developing a customer success strategy. You’ll want to keep your eye on your minimizing your churn rate and show a sharp decline as years go on, but make sure to set forth on a path that will reach negative churn as your holy grail.

Related Reading: How To Calculate and Interpret Your SaaS Magic Number

founders

Metrics and data

Sales Development Rep (SDR) – KPIs Template

A Google Sheet Template for SDRs

Last week, we talked about the importance of SDRs. Sales Development Representatives (SDRs) have become an increasingly popular position to hire the past 10 years. Just check out this Google Trend from 2010 to now:

If you want to learn a little more about the history and progress of the role, PersistIQ has a great post here. When it comes to SDR teams, the process and metrics always vary depending on multiple factors like company stage, contact sizes, sales cycles and more. There may be no one size fits all playbook and the strategies and processes to get there could vary by a wide amount.

But in our research we found one important commonality in success SDR teams: handing off qualified leads to Account Executives (AE) is an essential goal.

Some teams consider a qualified lead a company that schedules a demo. Other teams wait for the AE to officially qualify the lead after a demo. Either way, you must allow AE’s to work on the most relevant deals to maximize their time and increase their likelihood to close.

Every company should also know the progress of their SDR team, the goals they need to hit and make sure management understands the return. Don’t forget about the intangibles either. Conner Burt, Chief Operating Officer at Lesson.ly, said the long-term prospects for SDRs can often be about more than just filling a funnel.

“Your building a bench that you can use to promote SDRs to quota bearing sales people. That’s an intangible benefit.”

With this in mind, we built a simple SDR KPIs template for sales teams in Google Sheets. It is flexible so you can remove any irrelevant info, manipulate it or add anything missing that fits your process. The template will also easily plug into your Visible account! Get it below!

Click here to get the Free SDR metrics template!

Feel free to copy the sheet and drop in your own goals, metrics and KPIs. Hopefully this is a great reference to get you started! Send any any all feedback our way to marketing at visible dot vc. If you want to integrate with your Salesforce account schedule a demo!

founders

Metrics and data

Why Revenue Per Lead is Really Important to Track

Are you tracking revenue per lead?

Sales can fix a lot of problems. As company growing pains continue as a business scales, it’s easier to focus on marketing initiatives or nip product bugs in the bud if your Monthly Recurring Revenue (MRR) regularly surpasses its goal. Drilling down to the core metrics that drive sales performance is one of the best ways to expose how well a startup scales after reaching initial traction.

As we’ve discussed before, Lead Velocity Rate (LVR) is the favorite metric many VCs want to see to evaluate a company’s sales. Jason Lemkin unabashedly loves LVR, calling it the #1 metric to determine the trajectory of SaaS company’s sales. But Lemkin is also an advocate of measuring Revenue Per Lead (RPL), noting it as the second crucial sales stat to track.

How do you measure RPL? The equation is simple division:

Revenue Generated/Number of Leads = RPL

On the other hand, the benefits of RPL can be widespread for your sales force. Take individual sales rep performance. Once you’ve established your company’s current RPL and track its growth, you’ve created an evolving benchmark that can help measure the effectiveness of everyone on the team. RPL will showcase which reps are able to convert leads into customers at the highest rate. It can also determine how many leads one rep can handle before the workload becomes counterproductive and RPL starts to slump.

More than Monthly Recurring Revenue (MRR), RPL can reveal whether or not your funnel is actually filled with Sales-Qualified Leads (SQL). It will also outline how well your team is converting SQLs and able to achieve additional revenue on each sale as the business scales. As Lemkin told InsightSquared:

“Leads are precious for a long time in startups, and if you can get 20 percent more out of each lead, that’s magic. But if you don’t measure it down to the individual rep level and you just look at MRR, you’re missing an opportunity to improve things.”

So for founders and investors, noting RPL in regular updates provides an easy top-line metric to communicate a startup’s health. It also a powerful indicator within a company of whether or not the business is steady as it scales.

Related resource: Lead Velocity Rate: A Key Metric in the Startup Landscape

founders

Metrics and data

When & How to Calculate Market Share (With Formulas)

What is Market Share?

One of the first steps to building a business is understanding the market and understanding the viability of a successful business. Regardless if the goal is to be a multi-billion dollar company or a local joint that can sustain a few employees — understanding the market, and your share of the market is vital.

As Investopedia puts it, “Market share is the percent of total sales in an industry generated by a particular company. Market share is calculated by taking the company’s sales over the period and dividing it by the total sales of the industry over the same period. This metric is used to give a general idea of the size of a company in relation to its market and its competitors. The market leader in an industry is the company with the largest market share.”

Why is Market Share Important to Understand?

Understanding the market share is vital to determining the viability, and success of a company. In the earliest days, market share will help understand if a business is worth pursuing. Later in a business’s life, it can help stakeholders understand how they are performing compared to their competitors and can help shape roadmaps for future markets and products.

When building out financial models and projections, market share can certainly play a role. Market share has the opportunity to help shape and impact your future go-to-market strategy and product development. \

On the flip side, understanding your market share can oftentimes help shape your financing options. Your ability to capture a % of a market, large or small, will help funders and lenders understand the likelihood of receiving a return at a later date. For example, if you’re pursuing venture capital you need to demonstrate you can build a large business that will generate returns for them.

How to Calculate Market Share

Revenue vs. Units/Customer Count

Market share can be broken down a few different ways. Generally, the 2 most common ways to break down market share is by revenue or by # of units/customer count. Calculating either follows the same general steps as below (but you will sub out units for revenue and vice versa).

1. Determine what you’re calculating

Like any startup metric, you have to first determine how and why you are calculating something. A couple of questions to ask yourself when calculating market share:

What period of time am I analyzing?

What specific market am I evaluating?

Am I calculating our share of revenue or units/customers?

For example, let’s say we have a store, Visible Bread Co, and sell artisan bread in Chicago. We want to calculate our % of the artisan bread market sales over the last year in Chicago.

2. Calculate company data

First things first, you need to calculate your revenue (or units/customers) for the specified period of time. For companies that have multiple products that span different markets, make sure you are focused solely on the product and market you are evaluating.

Continuing on our example, let’s say Visible Bread Co. did $100,000 in artisan bread sales over the last year. (Keep in mind, if we were calculating our share based on units that might translate to something like 30,000 units/loaves of bread)

3. Calculate market data

Now that you understand your company’s performance in a specific market, you need to understand how the market is performing as a whole. Calculating the market data is a mix of art and science. Depending on the market, there may be publicly available reports and data you can leverage. On the flip side, if there is no publicly available data you may need to piece together your data and assumptions to estimate the market.

To help, you can check out our total addressable market template here.

For Visible Bread Co., we found sales from a local association that shows there has been $1,000,000 in total artisan bread sales in Chicago over the past year.

4. Calculate your market share

Now that we have our data in place, it is time to do a simple calculation. Simply take your sales or units and divide it by the sales or units for the market as a whole. Times by 100 and that is your market share.

For Visible Bread Co., that looks like this $100,000/$1,000,000 = .10 x 100 = 10% of Chicago artisan bread sales over the last year.

5 Things to Consider When Evaluating Market Share

There are few better ways to measure your business against competitors than by calculating market share. Knowing how big your slice of the pie is helping keep founders and investors on the same page when it comes to tracking a product or services’ participation in the market. So how do you do it the right way?

1. Is now the right time for market share?

Depending on company size, investors may disregard market share as a progress indicator. Especially in the early days, this metric doesn’t matter if your company doesn’t have already own a significant percentage to track. Sizing your company up against the market leaders may be a fruitless exercise if you’re still in the process of rolling out a product. For founders and investors talking about a startup in its first few rounds of financing, now is likely not the time to worry about your share of the market.

2. Understand your Total Addressable Market (TAM)

You can’t measure your market share without first knowing the Total Addressable Market (TAM) you’re pursuing. It’s essential to conduct a thorough assessment of long and short-term market factors, as determining TAM can be a tricky exercise. But make the best estimate of the number of customers in your market, the different types of customers you’re targeting, how much they’ll pay, how you expect the market to grow, and project revenue for 100% market penetration.

3. Measure market penetration

Now you’ve got a reasonable idea of how many total customers are there for the taking. How many are currently under contract? Treat the total number of customers like units and simply calculate your current client base percentage from the total number. For instance, if your SaaS company has an installed customer base of 200 in a TAM of 200,000, your market penetration is 1 percent.

4. Determine market share

How much are customers actually paying under each contract? In your TAM exercise, you’ve assessed your client’s propensity to pay, now determine how well that’s translated into contract value. Again, it’s a simple equation: if you currently own $1,500,000 of a total sales volume of $150,000,000, 150,000/150,000,000 = 1 percent market share.

Now, your market share and market percentages won’t align if your contract value underperforms or exceeds projections. However, both data points will help underscore your evolving market share and provide insight.

5. Track over time

Growth or decline in market share or market penetration can be powerful communication tools for your business narrative. A sagging market share may expose a surge in competition, whether that’s revealed to be a battle over price or new challengers to the game. On the other hand, it’s hard to argue with a founder that’s showing steady growth when it comes to the company’s fight for market dominance. Keeping market share in your regular investor communication will be greatly useful once you’ve determined that your company has reached a significant percentage threshold.

How to Expand Market Share

Most businesses are constantly looking to expand and grow (some are not, which is great too!) their share of the market. At the end of the day, this requires finding new customers and/or expanding your existing customer base. A few ways companies generally find success when looking to grow their customer base and capture more of a market:

1. Lower prices.

Lower prices can be a quick way to convert more customers (be aware of underpricing your product or service!). Note, lower prices can have an impact on your overall revenue, especially for SaaS businesses.

2. Innovate new products and features.

One way to grow your share of a market is by introducing new features and products. Using existing research and customer feedback, you can make an informed decision about the development of new products and features.

3. Appeal to new demographics.

Going hand-in-hand with building new products and features, is finding a new demographic. You may dominate one small segment of an overall market but have the opportunity to pursue new personas.

4. Delight your customers.

Word-of-mouth and happy customers can take your business to a new level. Having customers that are eager to spread the word about your business can be an incredible, and organic, way to grow your share of the market.

Download our Template!

In order to help calculate your market share and your potential to build a large business, it helps to calculate and understand the total addressable market and sensitivity analysis. Check out our free total addressable market template below:

founders

Metrics and data

The Startup Metrics That VCs Want to See

From working with hundreds of customers and users, we get a lot of questions around ‘what kind of information should I be including updates to my investors?’

We break this down to 4 different sections.

Financial

Key Growth Metric

Industry/Market Standards

Investor/Advisor/Board suggested

1. Financial

– Money money money. Finances are the lifeblood of a company, you can tell how well a company is growing, how smart they are spending, how healthy they are, or how many more months they have left before they disappear.

-Look at any standard Cash Balance Sheet and Income Statement, you should have the major line items of this for your investors.

-Depending on what kind of product you sell, there could be some important ones to highlight like gross margin or wages or marketing expenses. Always highlight the items that affect the company the most.

2. Key Growth Metric

– There are lots of things that accrue a company’s growth, but there is normally just one or two numbers that you look at for showing your growth and success. We talk about how to find your ‘Most-Valuable-Metric’ and the best way to tell your company’s story in The Ultimate Guide to Startup Data Distribution

-This can be a numeric or monetary amount, and it changes for each company/business plan/industry. For SaaS, this could be MRR, for a messaging app, it could be number of users, average messages per user.

Main Point: This metric(s) is(are) they key segment(s) that needs to grow to continue your success to Unicorn Ranch.

3. Industry/Market Standards

– Don’t reinvent the wheel. When you’re growing a company in a specific industry or market, there are always benchmark numbers and stats people talk about. Use these for your own reporting so you can have your stakeholders look at the market, their experiences or expertise, and your company (aka – make them work for that equity they bought/earned). For SaaS (I’m in SaaS so I talk SaaS), this would be items like Churn Rate, Average MRR Value, Total ARR, Cost per Acquisition, Lifetime Value, etc.

4. Investor/Advisor/Board Suggested

– Your key stakeholders (investors, advisors, board members), if you picked them right, will have experience, knowledge, connections, and more to help you become even more successful. From speaking with them, they’ll probably find a few metrics not already covered that they want you to focus on or track. This only helps leverage them in the future and allow them to be proactive towards that ten-figure exit.

Checkout Visible’s list of Most-Valuable-Metric and see if there is something you have been missing.

Enjoy Your Day, Go Create Something, and Make Someone Smile

Nate Morris

founders

Metrics and data

How to Model Total Addressable Market (Template Included)

What is Total Addressable Market (TAM)?

According to the Corporate Finance Institute, “The Total Addressable Market (TAM), also referred to as total available market, is the overall revenue opportunity that is available to a product or service if 100% market share was achieved. It helps determine the level of effort and funding that a person or company should put into a new business line.”

Related resource: What Is TAM and How Can You Expand It To Grow Your Business?

“TAM” is one of those buzzy acronyms that VCs love to throw around. For those following along at home, TAM = Total Addressable Market. It helps paint the picture of how big the opportunity is and if the business deserves to be venture-backed.

TAM is a funny thing. Early on, many investors passed on Uber, wrongly seeing it as little more than a black car service for affluent San Franciscans.

The type of analysis that led many to overlook Uber (when it was still called UberCab) mirrors the approach that Benchmark’s Bill Gurley criticized NYU professor Aswath Damodaran for a couple of years later in a piece called “How to Miss By A Mile: An Alternative Look at Uber’s Potential Market Size”

“Let’s first dive into the TAM assumption. In choosing to use the historical size of the taxi and limousine market, Damodaran is making an implicit assumption that the future will look quite like the past.” – Bill Gurley

The most forward-thinking investors were able to see past the limited size of the initial niche targeted by the company and see something closer to what the company has become — a $50 Billion valuation with operations in 67 countries and offerings ranging from food delivery to carpooling.

TAM vs. SAM vs. SOM: What’s the Difference?

Total addressable market (TAM) is often associated with SAM and SOM. First, let’s understand SAM and SOM:

TAM: Total Addressable Market

SAM: Serviceable Available Market

SOM: Serviceable Obtainable Market

TAM looks at the overall market but you can dial this number in with a more realistic approaching using both SAM and SOM.

SAM (Serviceable Available Market)

As defined by Steve Blank, “The serviceable available market or served addressable market is more clearly defined as that market opportunity that exists within a firm’s existing core competencies and/or past performance. The biggest consideration when calculating SAM is that a firm most likely can only service markets that are core or directly adjacent to its current customer base.” This means that SAM is how many customers (in revenue) actually fits your company and product line your are building. This differs from TAM as your TAM is a look at your entire market, not factoring in what percentage is actually achievable to close.

Related Resource: Total Addressable Market vs Serviceable Addressable Market

SOM (Serviceable Obtainable Market)

SOM or serviceable obtainable market dials in your target market one step further. SOM is the percentage of the market that you can actually reach with your product, sales, and marketing channels. This should be a realistic view at the customer base your company can pursue.

Related resource: Service Obtainable Market: What It Is and Why It Matters for Your Startup

How to Calculate TAM

When it comes to financial modeling and building a TAM for your business, there are a few different approaches. The most common being top-down and bottom-up approaches.

Top-Down

While a top-down approach to modeling is oftentimes the easiest, it is generally less accurate than a bottom-up approach (more on this below). According to inc.com, “A top-down analysis is calculated by determining the total market, then estimating your share of that market. A typical top-down analysis might go something like this: ‘Hmm… I will sell a widget everyone can use, and since there are 300,000 people in my area, even if I only manage to land 5 percent of that market I’ll make 15,000 sales.’”

For example, if you were to find a market to be $10 billion and you believe that you can capture 1% of the market that is $100 million in revenue. This number might get circulated when fundraising, only to find out that there are many more factors that go into penetrating a new market.

Bottom-up

On the flip side is a bottom-up approach. Oftentimes more accurate but also requires more work and more data. As the team at inc.com describes a bottom-up approach, “A bottom-up analysis is calculated by estimating potential sales in order to determine a total sales figure. A bottom-up analysis evaluates where products can be sold, the sales of comparable products, and the slice of current sales you can carve out. While it takes a lot more effort, the result is usually much more accurate.”

For example, let’s say we have software that sells for $10/mo. This means that the average consumer would spend $120/year. From here, we need to figure out how many consumers or customers we could add. Using past marketing website data, we believe that we can add 100 customers a month or $12,000 in recurring revenue (learn more about metrics here). Next, we can begin to model the growth of marketing site users and conversions to forecast what revenue might look like in 12 months.

Related resource: Bottom-Up Market Sizing: What It Is and How to Do It

Value Theory Approach

As put by the team at HubSpot, “The value-theory approach is based on how much value consumers receive from your product/service and how much they’re willing to pay in the future for that product/service.” This requires certain data and assumptions that might take some added research.

For example, let’s say that we sell snowboards and the ones we are creating are lighter, faster, and better for the environment than the normal snowboard. We could calculate our value theory by taking the price shops are selling a traditional board for, let’s say $300, and figure out how much more they’d be willing to sell your state-of-the-art product for — maybe $350 or $400.

External Research

One of the quickest ways to calculate your total addressable market is by using professional data from outside sources. There are countless companies (like Gartner and Forrester) that produce rich data reports on specific markets and verticals that can be a great launching point. Note: these often come at a hefty price. This is generally not the best approach as it is difficult to understand where the data came from and how it is being calculated.

Questions to Ask Before You Calculate TAM

There are many different approaches when it comes to calculating your TAM. At the end of the day, you’ll want to make sure you are setting realistic expectations and are painting a picture of reality. A couple of questions to consider asking before calculating your TAM:

What are the characteristics of our current and potential customer profiles?

What industries should we target to maximize sales?

Where are the companies in those industries located?

Who buys our solutions? How big are these companies?

What are the market conditions like? Is the market growing? Are there new entrants?

How does our budget compare to our competitors’ budgets?

Where is growth expected?

The Free Visible Total Addressable Market Template and Evaluation Model

In order to help founders model their TAM and sensitivity analysis, we created a free Google Sheet template.

You can find the Google Doc here: Visible.vc – Market Sizing, TAM & Sensitivity Analysis. Simply open it up and click the arrow on the bottom left sheet and copy it to your own Google Sheet workbook. Below, I’ll explain the process and instructions.

You’ll see step-by-step directions for using the template below.

Where Does Your Total Addressable Market Start (and End)?

Before calculating the actual size of the market you are looking to capture, you first need to try to build an understanding of where that market begins and ends.

Many companies, like Uber, start out in a specific niche with plans to scale into adjacent markets that allow them to apply their product and operational expertise to a different set of customers or a different geographic location. However, taking a company that is excelling in one niche and extrapolating their growth across multiple markets is a difficult task for both companies and the investors evaluating them.

“Sequencing markets correctly is underrated, and it takes discipline to expand gradually. The most successful companies make the core progression—to first dominate a specific niche and then scale to adjacent markets—a part of their founding narrative.” – Peter Thiel, Zero to One

One year ago, Uber’s Gross Revenue in San Francisco was $500 Million. Assuming a 20% cut, we get to just $100 Million a year. 5 years ago, connecting the dots forward to see how they could move from that to what they have since become took a combination of masterful storytelling from Travis Kalanick and his team as well as a large leap of faith by the investors evaluating them. This is a potential pitfall of using a TAM based on historical market sizes for truly game-changing businesses (as Gurley’s quote from above illustrates).

Another oft-committed mistake surfaces with many Ecommerce companies, who claim to be chasing the $1.6 Trillion Global Ecommerce Market. Sure, it is a huge number. But it is one that investors will see right through, much like highly inflated financial projections or overly ambitious product roadmaps. In reality, most ecommerce businesses are addressing the X $ spent each year on Y problem(s).

Why Should Startups and Growing Companies FOcus on TAM?

Going through a marketing sizing and pricing exercise can help shape your business and the decisions you make when it comes to your go-to-market strategy.

How many customers are there in our market? What is their propensity to pay? How many customers can we realistically support? What % of the market can we get in 10 years? Can we be the market leader?

Forecasts

Using TAM is a good base for creating future forecasts and projections. Using a bottom-up approach is a great way to help forecast where you believe your business can be in the future. This is particularly important when thinking about fundraising, hiring, and budgeting for the next X months.

Related Reading: Building A Startup Financial Model That Works

Fundraising

Different investors might have different preferences when it comes to presenting TAM during a pitch. If an investor does want to see your TAM estimates, it is generally suggested to use a bottom-up approach.

As the team at DreamIt Ventures puts it, “The biggest mistake we see with regard to TAM is when founders present a “top-down” estimate of market size. A top-down estimate is when a founder uses outside data to find the market size and then, usually somewhat arbitrarily, predicts that the startup will achieve a piece of that invariably massive pie.”

Related Reading: How to Write a Problem Statement [Startup Edition]

Related Reading: 6 Types of Investors Startup Founders Need to Know About

Building Your Total Addressable Market Model

You can find the Google Doc here: Visible.vc – Market Sizing, TAM & Sensitivity Analysis. Simply open it up and click the arrow on the bottom left sheet and copy it to your own Google Sheet workbook. Below, I’ll explain the process and instructions.

First, you’ll want to start either with a top-down or bottom-up approach (more on the differences here). For this model and exercise, we recommend bottom-up.

If you are a SaaS company you may want to break down between SMB, Middle Market, and Enterprise and the yearly contract sizes for each type. Ecommerce companies may want to break down by yearly revenue per customer type. The model should work for any type of business. For marketplaces, we would recommend your transaction cut and not “Gross Merchandise Value.”

Feel free to replace the “Customer Type” headers with your own descriptions. The green cells are the inputs for a number of customers and pricing for each respective type. The 100% market penetration is a quick gut check to say “If we captured 100% of the stated market how big would our business be?”

After the inputs have been entered you’ll see a Sensitivity Analysis that provides Yearly Revenue based on your % of Market Penetration and Pricing. We use the Total Number of Customers from your inputs and various Yearly Revenue numbers to provide the results.

In the first column, I just added a simple calculation for the Number of Customers. This simply takes % of Market & Total Customers. It also provides a quick gut check…e.g. “Is it reasonable to acquire and service X customers?”.

The analysis is color-coordinated. Red means your business is below $10 Million a year, yellow is $10 Million to $100 Million and green is >$100 Million a year in revenue. Most investors will want to see a clear path to $10 Million per year and the vision to get you to $100M. Anything short and they will likely tell you that “your business is not venture backable and you won’t be able to return our fund.”

We hope you enjoy this template. If you have any feedback, suggestions, or questions send them our way! If you found this to be valuable we’d love for you to share it. Just click this link and it will craft a pre-populated Tweet (that you are welcome to edit).

Streamline and Deliver Investor Updates with Visible

Raise capital, update investors and engage your team from a single platform. Try Visible free for 14 days.

founders

Metrics and data

Building A Startup Financial Model That Works

You’ve heard the stories about companies getting funded based on a sketch on the back of a napkin. If your name is Ev Williams or if that napkin sketch is as compelling as Amazon’s, you may have a shot.

If you aren’t a founder of Twitter, Blogger, and Medium or spend your free time saving journalism and launching rockets, people evaluating your business are far less likely to take your proclamations about the future at face value.

In this blog, we write a lot about the importance of storytelling for a company. No matter who you are talking to – team members, investors, potential investors – company storytelling doesn’t stop, it simply changes contexts and mediums. A financial model is one of those mediums through which your company can tell its story, even without the operational history one might assume would be necessary to persuade investors or make smart decisions about the direction of the business.

Related Resource: How to Create a Startup Funding Proposal: 8 Samples and Templates to Guide You

At Visible, we work with VC backed companies on a daily basis. To get a better understanding of what it takes to build a compelling and useful financial model, we turned to our experience and conversations with customers and laid out our findings below.

Why Startup Financial Models are so Important

When Warren Buffett invests in a company, he makes holistic decisions about the quality of the business as if he is buying the whole thing and not simply a decision about the direction the stock might move.

When building a financial model, a similar philosophy applies. Before breaking the business into discrete pieces and asking yourself which direction each will go, first look at the business as a whole and understand both what you as an organization are trying to accomplish as well as what the intended use of the model and startup financial projections you are building will be.

What do we need to accomplish over the next x months…

…in order to put ourselves into a position to successfully raise a Series A round?

…for this partnership with Big Co. to make an impact on our bottom line?

…so that we can hit profitability and maintain optionality over how we finance our future growth (customers vs. investment)?

…for this product or distribution decision (which puts a significant amount of capital at risk) to pay off?

The goal of a financial model is not to be exactly right with every projection. The more important focus is to show that you, as a founding or executive team, have a handle on the things that will directly impact the success or failure of your business and a cogent plan for executing successfully.

There are a few key reasons why it is an important exercise for startup founders to model and project their future growth:

Fundraising

Different investors will have different opinions on financial projections. Some like to see them to see how a founder is thinking about their business. Others won’t ask for them as most startups likely will miss one way or another. Mark Suster of Upfront Ventures puts it similarly:

“See I don’t care if your projections prove wrong over time. I care about your assumptions going in. I care about the thought that you’ve given to the customer problem. I care about how much you’ve thought about market share, competitors, adoption rates, etc.”

However, projections and financials will become more important later in your lifecycle stage. Where a seed round investor might not necessarily care about forecasts in the early days a Series C investor might want to see more concrete data to model growth.

Related Reading: 6 Types of Investors Startup Founders Need to Know About

Related Reading: A Quick Overview on VC Fund Structure

Related Reading: How to Secure Financing With a Bulletproof Startup Fundraising Strategy

Hiring Plans

Building a financial model is a great way to understand how your overall business performance can impact hiring plans (and vice versa). By modeling different scenarios you can see how adding headcount can impact your bottom line.

Go to Market Strategy

In the earliest days of your business, a financial model and marketing sizing exercise will help you wrap your head around go-to-market strategy. This could be finding a more efficient way to acquire customers or maybe a new playbook for handling churn.

With that being said, financial models and projections can take many shapes and sizes…

Types of Startup Financial Model Structures that Work

Financial projections are essential for any business, even if it’s not yet generating revenue. A variety of specific methods exist for performing this task, but they can generally be classified into top-down and bottom-up approaches. Financial analysts often use both methods as checks upon each other.

Among technology companies – especially ones located in a certain geographic region – the very mention of a financial model evokes thoughts of calculator toting, tie-wearing, number crunchers sitting somewhere in a suburban cubicle.

With the direction sentiment is shifting in the early-stage market, this mindset couldn’t be further from reality. A well-constructed financial model displays a professional approach to running your business and shows that you “take seriously the fact that you are deploying other people’s capital.”

A good financial model consists to two things:

Well thought out projections about the future of the business

A properly structured, understandable, and dynamic spreadsheet

Bottoms Up Startup Financial Projections

A bottoms-up financial model – where you start with 5 – 15 core assumptions about the business – is most useful for a company contemplating a specific product direction, distribution strategy (i.e. invest in paid advertising), or a certain partnership that could potentially have a major impact on the business.

Top Down Startup Financial Projections

A top-down financial model may be most useful for a company that, for example, knows that it will need to go out and raise $X million in a Series A round 15 months from now and has spent time gathering data on what types of revenue, margins, and growth numbers they need to hit to have a successful fundraise. (Note: If you are a SaaS company, the Pacific Crest SaaS Survey is a great starting point to benchmark yourself)

Maybe in this case, those numbers are $1.5MM in MRR with at least 100% YoY growth. With those in mind, you can work backward to understand how much you need to grow and which distribution channels may provide the best bridge from where you are now to where you need to be.

3 Deliverables Included in Every Financial Model

There is not a one size fits all template for financial modeling. The structure of a model for seed-stage SaaS and a Series C eCommerce company will greatly differ. However, there are a few things that should be included in any solid financial statement, regardless of type:

Financials Statements

Every financial model should weigh your different financial statements. While projected financial statements may not be as vital/accurate in the seed stage/early days of a business, they will become more important and accurate in later stages.

Related Resource: Important Startup Financials to Win Investors

Cash Flow Overview

Cash flow overviews are a vital part of a financial model because it will help you understand the true financial health and cash flow of your business. In the seed stage/early days, cash flow is incredibly important to monitor as you are in search of your first customers.

KPI Overview

Using actual metrics and data from your sales & marketing process is important to any financial model. You want to be able to understand how different go-to-market strategies impact your business and give you an idea of where and how you can grow your funnel (and revenue).

5 Metrics Needed for Every Financial Model

As we mentioned above, not every financial model is the same. However, there are a few key metrics that can be translated across most financial models.

Revenue

At the end of the day, revenue is the lifeline of any business. Bringing new revenue in the door is the basis of every model. In a good financial model, you can use other inputs to help you model how your revenue is impacted in different scenarios.

Cost of Goods Sold (COGs)

No matter if it is the cost of goods sold or your expenses at a software company, COGs are a necessary part of any model. You need to understand what it costs to acquire new customers or build a new product.

Operating Expenses

The expenses that go into operating your business are also a necessary part of a financial model. You need to understand how and where your company is spending. Ideally, you’ll be able to model different scenarios with headcount and hiring plans to model how OpEx can impact your overall revenue.

Burn Rate and Cash on Hand

Going hand-in-hand with OpEx are your burn rate and cash metrics. You can use different hiring and OpEx inputs to help model your cash flow. This will be important when weighing different financing options.

Acquisition Metrics

While the name of acquisition metrics will change names from market to market, the idea behind them is consistent. You should include acquisition metrics so you can model how different GTM strategies and plans will impact your overall financial health.

How to Build Your Startup Financial Model

Bottoms Up Startup Financial Projections

The bottom-up approach uses specific parameters to develop a general forecast of a business’s performance. This method might start the number of people you expect to pass by your business each day, also known as footfall. You would then estimate the percentage of footfall that will enter your store and make a purchase. The next step is to estimate the average value of each purchase to project your annual sales. Bottom up projections are based on a set of individual assumptions, allowing you to determine the impact of changing a particular parameter with relative ease.

You may use a bottom-up approach to select a location for a new business. You can obtain an accurate estimate of the footfall by direct observation. You can also observe similar stores in that area to estimate the percentage of footfall that are likely to enter your store. The prices that your competitors charge will give you a good idea of the price you can expect to charge.

Projections

Some investors tend to prefer a bottoms up projection. As we previously wrote, “The reason being that a top-down approach relies on self-reported data from private companies, which can often be misleading, inaccurate or interpreted incorrectly. A bottom-up approach, however, uses firsthand data and knowledge of your own company and reduces the risk of the data being wrong or taken out of context.”

Spreadsheet

For example, assume for this example that an average of 10,000 people pass by a particular location each day. About one percent of this traffic in this area enters a store and makes a purchase, and the average total of each sale is about $5. The expected annual sales revenue in this example is therefore 10,000 x 0.01 x 5 x 365 = $182,500. You can then refine this estimate by considering additional factors such as price changes, closing on weekends and seasonal fluctuations.

Template(s)

At the end of the day, investors view TAM as a picture of how big your business can be. Correctly modeling the market is vital to proving that your business should be venture-backed.

If you need a little help painting a picture of the market your solution could address, try using our TAM template! It has everything you need to start modeling the market your business can capture.

Top Down Startup Financial Projections

A top-down method of estimating future financial performance uses general parameters to develop specific projection numbers. You’ll often use a top-down approach to determine the market share that your new business can expect to receive. You might start with the market value of your product, narrowing it down to a particular location as much as possible. You would then assume that your business will receive a specific portion of that market and use that estimate to generate a sales forecast.

A top-down approach is comparatively easy since the only parameters it really requires is the total market value for your area and the market share you expect to receive. This method is most useful for checking the reasonableness of the projections resulting from a bottom-up approach. However, top down projections aren’t recommended for preparing detailed forecasts.

Projections

Some investors will be weary when pitched using top down projections. However, this does not mean that there is no value in a top down approach. A top down approach is best used for a new endeavor where you may not have proper data yet. For example, if you are a pre-seed company with little to no revenue, it may be best to share your top down projections using outside and general market data.

Spreadsheet

For example, assume for this example you plan to open a business in an area where the total annual sale value of your product is $2 billion. You believe that your business might get 0.01 percent of that market, resulting in annual sales of $200,000. Note that your financial projection is entirely dependent upon the accuracy of your estimate on the product’s market value and your market share. Furthermore, the top-down approach doesn’t ask you “what if” type questions.

Template(s)

At the end of the day, investors view TAM as a picture of how big your business can be. Correctly modeling the market is vital to proving that your business should be venture-backed.

If you need a little help painting a picture of the market your solution could address, try using our TAM template! It has everything you need to start modeling the market your business can capture.

Common Financial Modeling Mistakes

Failing to hit both of the requirements we mentioned in the last section – well-thought-out projections and a well-constructed spreadsheet – will quickly render your model unusable and will reflect poorly on you as a founder and on your company.

Projections

Assuming that revenue will come with scale. While this has long been a criticism of social networks and consumer apps hoping to monetize a critical mass of eyeballs through advertising, many companies who have revenue models built into their businesses from the start (think SaaS or Marketplaces models) still falsely assume that revenue, to the extent they need to be sustainable, will happen once they reach x number of users or “decide to turn on the spigot”.

Focusing too much on point estimates and not range estimates – As Taylor Davidson puts it in a post on his own blog, “instead of agonizing over whether your conversion rate will be 2% or 5%, focus on the possible range or conversion rates and evaluate the results based upon the range of estimates, not the point estimate of 2% or 5%.”

Underestimating Customer Acquisition Costs (CAC) – Just go read this post.

Not doing your homework – There is a tremendous amount of information available, for free, that can help you gauge your performance and benchmark your growth. We mentioned the Pacific Crest Survey above. Other great resources include AngelList, Mattermark, and the blogs of companies embracing the Radical Transparency movement.

Spreadsheet

Spending too much time on non-material data points – The Pareto Principle applies here, just as it does to many other undertakings in a startup. While it might seem like spending time optimizing everything in your model will yield the best results, the reality is that going deep on your 5 – 15 core assumptions will yield a much more effective result.

Failure to design your model for usability – To make your model most effective, you need to pay close attention to how usable the output is for viewers. That means clear explanations, a simple structure, and making sure to follow convention so there are no surprises. We linked to it above but David Teten of ff Venture Capital has a great post on the topic of standardizing the way you build your startup spreadsheets.

Neglecting to include a sensitivity analysis – This goes back to the idea of understanding what your model outputs look like for a range of estimates. You should also keep in mind that your model should be treated as a flexible, living document. That means that your assumptions shouldn’t be hard-coded. Instead, as Taylor recommends, “create your assumptions so that you can easily change an assumption in one place and all formulas and outputs will recalculate automatically.”

Displaying only financial statements and neglecting key metrics – Financial statements go a long way in showcasing the overall health of a business. Unfortunately, many models stop at the financial statements. What investors want to see is a synthesized look at those financials that make it easier to evaluate your business. As an example, a good model won’t just showcase projected revenue growth, it will look at how things like customer growth (and churn) and contract size work together to contribute to that top line number.

Best startup financial model resources

Unless you spent the first couple years of your career cutting your teeth inside an investment bank, your best bet is to lean on existing resources for the structural composition (i.e. the spreadsheet) of your financial model.

The Standard Startup Financial Model that Taylor Davidson has put together on Foresight.is has been used by over 15,000 people across the world – from one-person operations just getting started to companies raising large VC rounds or considering acquisitions.

And while we don’t recommend building your model from scratch, it is useful to understand how one can construct a professional financial model. Here are a couple quick resources, recommended by Davidson and us here at Visible:

Best Practices in Spreadsheet Design by David Teten of ff Venture Capital

3 Traits of a Great Financial Model from Mark MacLeod

Finally, if you are looking for a less sophisticated model or something to fit a specific modeling use case (user acquisition, revenue growth, or operations) here is a quick list of resources recommended by Davidson:

Revelry Labs resourcing spreadsheet for operations modeling

OpEx Budgeting from IA Ventures

Viral Marketing modeling from Andrew Chen

Modeling SaaS Customer Churn, MRR, and Cohorts from Christoph Janz

Related Resource: A User-Friendly Guide to Startup Accounting

Putting Your Financial Model to Work

Mark Suster offers great advice for taking the financial model you have built and using it to help grow your business:

“Financial models are the Lingua Franca of investors. But they should also be the map and the Lingua Franca of your management discussions.”

Financial models play a key role in all of the major discussions you have about your business with all of your key stakeholders. A comprehensive financial model will have within it a number of different pieces that are relevant to different conversations within your company.

The interplay between your revenue growth, your current burn rate, and the amount of money you have in the bank are all useful when putting together a hiring plan. Your assumptions for revenue can be isolated and used as a jumping off point when discussing a change to your distribution strategy. And as mentioned above, the projections you build around your key performance metrics are a crucial part of a successful fundraising process.

In some cases – whether internally with management or externally with investors – the conversation will be high level and in other instances you will need to be more granular. If you have taken the time to thoughtfully prepare your assumptions around the future of your business, your most critical conversations will be more productive and you give yourself a strong advantage in the daily battle for capital and talent.

founders

Metrics and data

a16z Startup Metrics Template

Andreessen Horowitz Startup Metrics Template

Andreessen Horowitz (a16z) is one of the most prolific VC investors in the market today. With investments across a number of different stages, sectors, and business models, they have seen first hand the lack of (and the need for) standardization in the way private technology companies track metrics and present those metrics to current and potential stakeholders.

While their well known post, called “16 Startup Metrics“, dives deep into a number of great metrics for different business models – Marketplaces and Ecommerce in particular – we focused this video on SaaS metrics and how companies can use Visible templates along with other sources to benchmark themselves against others in the market and set themselves up for fundraising success.

For benchmarking purposes, we leaned on this year’s Pacific Crest SaaS Survey. With over 300 respondents representing different geographies and sizes, the survey provides very actionable insight into how your company is performing relative to others in the market.

Pacific Crest Respondents

SaaS Revenue and Profitability Metrics

In our example, we are looking at a SaaS company with Total Annual Revenue of just under $2 million (we’ll call them ExCo.). At this size, it it likely they would be going out to raise a Series A round of funding.

MRR vs. Service Revenue

There are generally two types of revenue for a SaaS company – the first is Subscription Revenue (called MRR or ARR). This is product focused revenue that is recurring and predictable — especially if you are able to sign customers to longer term agreements. Investors prefer this type of revenue because it signals a high quality product with a path to long-term profitability.

The second type of revenue is Services Revenue which often comes in the form on one-off (read: not predictable) consulting engagements or implementation fees. Because of the human-capital intensive nature of providing these services, they are far less profitable and scalable than Subscription Revenue.

According to the Pacific Crest SaaS Survey, the median gross margin on subscription revenue is almost 80% while the margin on professional services in under 20%

Average Contract Value (ACV)

As defined in the a16z post, ACV is “the value of the contract over a 12-month period.” If you are seeing an uptrend in ACV over time (which is generally the goal), then your company is likely doing one or many of the following things:

Shifting to customers with a larger budget – more seats, usage, etc.

Employing a more effective sales strategy to convince customers to invest more heavily in your product

Building a product that continues to improve and provide increasing value

Effectively upselling existing customers

SaaS Gross Profit Margin

Growing the top line is necessary to build a scalable business but in order to build a sustainable company – or raise capital that helps get you to that point – your profitability (in this case, we are looking at Gross Margin) must be trending in the right direction.

Here, we see Gross Margin increase initially and then fall off in recent periods. This could result from a number of factors:

Churn from high margin customers

Pricing pressure from new entrants or large players

Lower percentage of revenue coming from MRR (subscription revenue)

An increase in the infrastructure required to deliver the product (server costs, support costs, etc.)

In the case of ExCo. we know that ACV is moving up and that the revenue stream is becoming more and more weighted towards subscription revenue so we can rule out a couple of potential causes. What is likely occurring is an increase in the infrastructure required to deliver the product (server costs, support costs, etc.). When the numbers change, it is crucial to know why and to be able to present context and a path forward when discussing those changes with investors.

In spite of the dip, ExCo.’s gross margin still remains in the same ballpark relative to others in the market and is higher than it was the previous year.

As your company moves further and further through the Venture fundraising lifecycle – from Seed to A to Growth rounds – the numbers gain importance in the overall story for the fundraise. The metrics above provide a quick glimpse of high level figures that can be very useful in getting in a foot in the door with some investors — strong MRR growth, a robust Sales Pipeline, growth in the commitment of future revenue (known as Bookings), and low Churn Rate (among many other factors) can also play a significant role in the success of your fundraise and in the long term viability of the business.

founders

Metrics and data

Rockstart Digital Health Accelerator Startup Metrics Template

Rockstart Digital Health Accelerator – Startup Metrics Template

In early 2015 Rockstart, already a well-known name in the European startup community, launched a new digital health accelerator focused on making a sustainable impact on global health systems.

We have partnered with Rockstart to put together a template that you can start using today to get a high-level understanding of how your business looks today and where your growth is leading you in the future.

We went a little longer than 3 minutes with this one but we promise it is worth it!

What startup metrics matter to an early stage digital health company?

As with any early-stage company, focus is key. This is why Rockstart puts each company’s Most Valuable Metric front and center on the business dashboard. The primary reason to have a single, understandable metric for your business is to cut out the noise that comes with trying to track (and take action on) every single thing so that you can hone in on the one thing that drives your success. Read any startup post-mortem and you’ll quickly realize the negative impact that lack of focus can have on a company.

In the digital health sector, companies don’t all fit within the same bucket from a business model perspective. The first Rockstart Digital Heal Accelerator class has hardware companies (like Med Angel), marketplaces (like Dinst), and SaaS businesses (like Mount) who all likely have different true north metrics.

Revenue and Net Burn – Are you becoming more cash efficient over time?

The reality in many early stage technology companies still searching for a sustainable business model is unprofitability. In many cases, companies focus solely on top line (revenue) growth and neglect the need to control costs around things like user acquisition. Taking this approach results in a very cash inefficient business model.

In cash efficient businesses, like the example in the video, a company grows revenue at an exceedingly faster rate than it grows its net burn. This leads to (eventually) a self-sustaining business and, in the interim, the ability to raise capital at more company-friendly terms. If you want to learn more about startup cash efficiency, we highly recommend this post from Hyde Park Ventures’ Guy Turner.

founders

Metrics and data

Version One Ventures Marketplace Metrics Template

Version One Ventures Marketplace Metrics Template

Version One Ventures, which closed a $35 million fund in late 2014, is one of North America’s top early stage VC investors. With investments in marketplace companies like Angellist, Indiegogo, and HandUp they are experts in taking companies from growth to scaling. Recently, the firm released a Guide to Marketplaces compiling those insights and and learnings to help you build your business.

What Marketplace Metrics should I be tracking?

This metric template, which you can access within Visible is inspired by a post from Version One’s Angela Tran Kingyens who was herself inspired by Christoph Janz and his SaaS Metrics template. Here is a deeper look at some of the marketplace metrics we talk about in the video and how you can apply them to your own business.

Gross Merchandise Volume (GMV), Revenue, and Take Rate

Simply put, Gross Merchandise Volume (GMV) is the total dollar value being transacted through your platform during a given time period. So if in one month there are 100 transactions done through your marketplace with an average size of $50, your GMV will be $5000. Pretty basic.

As Andreessen Horowitz put it in the Startup Metrics blog post, it is the “real top line” for a marketplace business.

As a single number, GMV is useful in helping understand the high level growth of the business and looks good in press releases and investor conversations. From an operational perspective, GMV gives you a starting point to better understand all of the underlying aspects of your business to more effectively allocate growth-focused resources.

GMV by time of year (think Airbnb and seasonal differences), time of day (Uber and rush hour vs. late night volume), and by location or market (any on-demand marketplace opening new markets)

GMV by acquisition channel. Marketplace companies, especially in the on-demand space, are often reliant on customer referrals and other types of paid advertisement to get to initial liquidity. If you understand how that channel compares with others (social, organic, etc.) – assuming you also know how much it costs to acquire a customer through each channel – your GMV trends by channel play an important part in helping you allocate your sales and marketing dollars.

A word to the wise…GMV is NOT the same thing as Revenue for a marketplace business. This is something to be aware of when discussing the growth of your company with investors, potential employees, or partners. To calculate revenue for a marketplace company, multiply your GMV by your Take Rate. Take Rate is the % that your business “takes” from each transaction on your platform.

In recent periods, companies either ignorant of the proper terminology or looking to play sleight of hand in order to spur investor interest have come under fire for misrepresenting the size of their business by using GMV to mean Revenue. Don’t make this mistake.

Marketplace Activity Growth

As we noted above, marketplaces are all about efficiently matching buyers and sellers. When a marketplace is making these matches successfully at scale, it is said to have reached liquidity. Maintaining liquidity over time is not an easy proposition, as human (customer support for both sides), technical (matching or suggestion algorithms), and hybrid (how to price your offering) considerations bring about a daily balancing act.

To add even more complexity, some marketplaces have more moving parts than just a single buyer and seller. For example, DoorDash customers are buying a product from the end restaurant but also the service of having a DoorDash driver pick up the food and deliver it in a timely manner.

Net Promoter Score

Net Promoter Score was also featured in our recent Shopify Ecommerce Template and for good reason. Any time two parties are transacting, trust is a key element. Am I getting a fair price? Is the product or service going to meet my expectations? Do I have protection in the event something goes wrong?

As the conduit for these transactions, maintaining a high degree of trust from buyers and sellers is crucial for a marketplace. Net Promoter Score, which asks customers (and sellers in the case of a marketplace business) how likely they are to refer your product or service to a friend or colleague, serves as a proxy for trust. If people and businesses on both sides are having good experiences on your platform, it can be assumed that they are being treated fairly and finding the value they are searching for.

Visible Templates make it quick and easy to get started on the path to successful Data Distribution. Whether you are looking to raise money, send investor updates to your current shareholders, or just keep your team operating smoothly, Visible Templates give you a framework to tell a story around your most important key performance data.

We have partnered with top VC investors, high-growth companies, and successful entrepreneurs to create templates that take just a few minutes to set up.

See All Visible Template Posts

Start Using Templates in Visible

founders

Metrics and data

Video: Shopify Ecommerce Dashboard

In building Visible and working hands-on with companies and investors from around the world, we have learned the importance of customization when it comes to what metrics your company tracks and how you track those metrics. For example, a late stage venture-backed Ecommerce company has different needs and goals than a 10 person online store. Both, however, have stakeholders who need to know how the business is performing and what they can do to help the business grow.

Thankfully, for every type of business, there are a ton of resources to help you understand what to track and how to track it. With Visible Templates, we have partnered with the creators of these resources – top VC investors, high growth companies, and successful entrepreneurs – to make it easy for you to build a metrics framework and a business dashboard that suits your company.

The Visible Shopify Ecommerce Dashboard

Shopify is one of the world’s largest Ecommerce platforms and a huge supporter of small businesses and Ecommerce startups anywhere. With thousands of companies of all shapes and sizes using the platform to build online stores and sell their products, Shopify truly has domain expertise when understanding what Ecommerce metrics are most important and how they can be applied to help you grow your business.

What Ecommerce metrics should I be tracking?

This template was initially inspired by a post from Mark Hayes, Shopify’s Director of Communications where he outlines 32 of the best Ecommerce metrics for a company to track. In the videto above, we have talked through a few of our favorites. Below, we jump in even further to three of the most important Ecommerce metrics your company can start using today: Net Promoter Score, Average Order Value, and Conversion Rate.

By the way…did you know you can now export all of your Visible charts in PNG, SVG, and JPG formats? That means better visuals for your pitch decks and other company storyelling materials.

Net Promoter Score (NPS)

In the past, we’ve written about Net Promoter Score as a way to gauge how likely your current investors are to refer you to other investors, partners, and key employees. The same concept holds true for measuring Ecommerce Net Promoter Score, which asks current customers a simple question on a scale of 1-10: How likely is it that you would recommend our company to a friend or colleague?

Because competition is high in the Ecommerce space and switching costs are low for many consumers, successful companies must take a customer-centric approach to growth. This mean embracing NPS as a holistic measure of business performance. Like all important business KPIs NPS doesn’t live in a bubble, it directly impacts other important Ecommerce metrics:

Lifetime Value of a Customer (LTV) – customers who fall in the 7-10 range on the NPS scale are likely happy with your product offering, have an affinity for the brand you have built, and can be expected to continue returning to purchase from your site (if you keep delivering on your company promise, of course).

Viral Coefficient aka K Factor – Your K factor or viral coefficient measures how many new, secondary users, an individual new user helps you acquire over their lifetime. Happier users refer more new business.

Total Orders and Average Order Value (AOV)

Running an Ecommerce business, you have two levers you can pull with regards to bringing money in the door (Revenue). The first is doing more volume, or in other words, increasing the total number of orders placed through your site. The second is Average Order Value (AOV), which is a measure of the size of each order placed on your site.

Increasing your Average Order Value can be accomplished in a number of ways, including offering future discounts, bundling similar products, or offering specials on shipping.

Conversion Rate

How effectively are you moving people from the top of the funnel (Visitors) to the bottom (Customers)? This is a core question you must ask yourself as you are designing your product as well as your marketing plan for your Ecommerce company.

At a high level, your Ecommerce conversion rate is simply the Number of Total Orders / Number of Visitors. As you get more sophisticated, you can begin tracking more steps in the Ecommerce funnel and honing in on how your conversion rates differ depending on lead source, purchase type, or even time of day.

founders

Metrics and data

K Factor: What is your SaaS Company’s Viral Coefficient?

What is the K Factor/ Viral Coefficient?

The K factor or viral coefficient measures how many new, secondary users, an individual new user helps you acquire over their lifetime. For SaaS companies, if the software is good, the individual users will then refer the software to their friends, teams, and companies. In simple terms, a viral coefficient is a number which indicates how many new users a current user is referring to your business. This metric is used to measure the organic growth of a company. Understanding and improving the viral coefficient of your SaaS solution is a crucial part of achieving exponential growth.

How to Calculate SaaS K Factor/ Viral Coefficient

Here’s how to calculate your K Factor or Viral coefficient, according to Culttt:

Take your current number of users (let’s call it 100)

Multiply by the average number of invitations or referrals that your user base sends out (100 x 10)

Find the percentage of referrals that took the desired action, for example, signed up to be a new user. (12%)

If 12% of 1000 invitations signed up for your product you would have 120 new users.

You started with 100 users and you gained 120 users. So you divide the number of new users by the number of existing users to find your Viral Coefficient (120 / 100 = 1.2).

Kissmetrics notes that a positive viral coefficient rate means four things:

You are giving your customers a positive user experience

You’ve found product/market fit

You have a low cost of acquisition

You will probably have high profitability

A viral coefficient of 1 or above means that for every user you acquire, you’ll gain at least one additional user through the referral process. Each round of referrals creates a viral loop of growth.

Note: This is a very basic model that assumes no user growth from other sources (Paid Advertising, Content Marketing, etc.) If you want to start building charts like this to showcase the growth of your business, start your free 14-day trial on Visible

Why it’s important but Not the Only Metric for User Growth

Customer acquisition can be challenging for SaaS companies, but having a positive viral coefficient means you are acquiring new customers essentially for free.

But what if your viral coefficient is lower than 1? Many people argue that anything less than a K Factor of 1 is worthless, because this implies that your SaaS Company is failing. However this isn’t necessarily true. In reality, as long as you have a great product with repeat customers a K-Factor as low as 0.2 will still equate to a free extra user every time a user signs up. Furthermore, recommendations and referrals should not be your only measure of user adoption and growth. Many SaaS companies, such as ShoeBoxed which has a low viral coefficient score of around 0.16, build customer acquisition by using other channels such as SEO or PPC or content marketing to bring in new users. Instead of bringing in one person, they bring in 1.2 – 1.4. For them, the referral program is just a way to enhance the efforts of all other customer acquisition tools.

It’s also important to note that viral coefficient isn’t always predictable, and relying on referral programs doesn’t always equate to short term boosts in users. Some referral processes take longer to make conversions because potential users needed more exposure to multiple referrals before signing up. When digital signature company EchoSign tracked their viral conversions, they found that their average viral cycle (the time from initial user sign-up to successful referral sign-up) was 8 months.

Therefore you should always look at your viral loop as a side growth accelerator that will boost all of your other user acquisition efforts.

Great Resources for Viral Marketing and SaaS

Now that you know how to calculate your K-Factor and understand why it’s a great metric for growth, here are some great articles on viral marketing and some examples of the SaaS companies who are winning the viral marketing game:

How Referrals Built The $10 Billion Dropbox Empire, by Visakan Veerasamy for Referral Candy

The Best Referral Program Examples, by Brandon Gains at Referral SaaSquatch

Customer Acquisition & Monetization, by David Skok for For Entreprenuers

‘Startup Growth Engines: Case Studies of How Today’s Most Successful Startups Unlock Extraordinary Growth’, by Sean Ellis & Morgan Brown

This post is part of our Most Valuable Metrics series, helping your company understand how to develop a holistic framework for tracking your performance and telling your story to everyone who matters to your business. You can find previous posts in the series here:

Your Company’s Most Valuable Metric

How to Calculate Lead Velocity Rate (LVR)

Stealing the Right Growth Metrics for Your Startup

How to Calculate Bookings

What is your Investor Net Promoter Score?

How to Calculate SaaS Churn

How to Steal the Right Growth Metrics for Your Startup

How to Calculate Net MRR

founders

Metrics and data

How to Calculate Net MRR

Learn How to Calculate Different Forms of MRR

This post is part of our Most Valuable Metrics series, helping your company understand how to develop a holistic framework for tracking your performance and telling your story to everyone who matters to your business. You can find previous posts in the series here:

Your Company’s Most Valuable Metric

How to Calculate Lead Velocity Rate (LVR)

Stealing the Right Growth Metrics for Your Startup

How to Calculate Bookings

What is your Investor Net Promoter Score?

How to Calculate SaaS Churn

How to Steal the Right Growth Metrics for Your Startup

Like every SaaS business, consistent subscription revenue is vital to your success. That’s why knowing your Monthly Recurring Revenue, or MRR, is so important. MRR is a measurement of the total predictable revenue you expect to make on a monthly basis.

Here’s a very simple example of MRR. You have three customers with the following subscription rates.

Customer X pays $75/month

Customer Y pays $50/month

Customer Z pays $25/month

Your total MRR is $75 + $50 + $25 = $150.

Net MRR gives your company a holistic overview of revenue gained from new subscriptions and upsells/upgrades and revenue lost from downgrades and cancellations.

MRR might not be part of GAAP (Generally Accepted Accounting Principles) or IFRS (International Financial Reporting Standards) but because of its importance in raising capital and gauging your sales and marketing success, it is crucial to understand and calculate correctly. Unintentionally misrepresenting your business to potential investors or developing your business plan on faulty data could spell disaster for your company.

To start, when calculating your MRR, do not include the following.

Full value of multi-month contracts: If you have quarterly, semi-annual, or annual contracts, normalize them to a monthly rate. Take the full subscription amount paid and divide it by the number of months in the contract. For example, your customer pays you $1,200 for an annual subscription. Dividing that by 12 gives you a monthly rate of $100 which you should use in your MRR calculation instead of $1,200.