Blog

Reporting

Resources to help level up your investor reporting.

All

Fundraising Metrics and data Product Updates Operations Hiring & Talent Reporting Customer Stories

founders

Reporting

Founder Collective “Fill-In-The-Blank” Investor Update Template

While there are countless number of investor update templates the “Fill-In-The-Blank” template below from Micah Rosenbloom, Partner at Founder Collective, was right in line with the best practices we have seen. (You can find the original Founder Collective post using this link).

We created a Visible Update template so you can fill-in-the-blanks and have your next investor Update out the door in just a few minutes.

TL;DR

A quick recap of any major milestones, concerns, and figures from the last period. Always a good idea to piggyback off of any product updates, metrics, projects, concerns discussed at previous meetings/updates.

Key Metrics

Take a deeper dive into your “Key Metrics” that you have defined and report to your investors. Make sure to keep they key metrics you are reporting consistent from update-to-update. Be sure to mention any changes to the key metrics you are reporting (how you are calculating, renaming, etc.).

Fundraising

If you are actively fundraising be sure to include any details, asks, and supporting documents here.

Learnings Since Last Update

Follow up to any of the major discussion points from your last update or meeting. How did marketing campaign X end up performing? What did you learn from any product updates? Etc.

What I Feel Good About

Include any major wins or significant gains in your key sales/marketing metrics.

What I Am Freaked Out About

What is keeping you up at night? Be sure to mention any major concerns that your business is facing. This could be anything from frustrations with hiring to a change in the market.

What I Need Help With

Arguably, this is the most important section of the Update as it allows your investors to step in and help with their experience, network, etc. At the end of the day, your investors are there to help you and are missing a valuable resource if you do not make the asks.

founders

Reporting

Board Meeting Packet Template

With Q3 wrapping up in a few days, we put together a Pre-Board Meeting Update Template that you can share with your board to help you make the most of your meeting time. By sending over a quick packet before your next meeting it will allow everyone to have time to prepare and come ready to discuss the topics that truly matter to the business.

VIEW THE TEMPLATE HERE >>>

For the sake of simplicity, we broke our Update Template into 5 major sections:

Overview of Previous Quarter

A quick overview of the previous quarter. How did you track against your goals you set at your last meeting? Big Wins? Concerns going into Q3?

Key Metrics

A high level overview of the key metrics you have been sharing with your investors/board. Make sure to include any key events/descriptions for your data over the past period and leave time to discuss any questions at the start of your meeting.

Agenda

Preview the agenda and schedule for your upcoming meeting. Use input from previous meetings and 1-on-1s to set the agenda and make sure the time will be useful for everyone involved. We suggest checking out Sequoia’s template for a board meeting to get started.

Topics of Discussion

Offer an overview of the major issues you would like to tackle during your meeting; “working time”. Without throwing too much information at your investors give them the proper data, questions, asks, etc. that will allow them to ponder the issue beforehand and come to the meeting ready.

Meeting & Financial Documents

Include any necessary financial and meeting documents prior to the meeting. Always a good idea to include financial statements and documents/presentations for your meeting.

VIEW THE TEMPLATE HERE >>>

founders

Reporting

How to Get the Most Out of Your Next Board Meeting

As Q3 comes to an end, it is easy to get behind trying to close last seconds deals, make the right hires, or push product updates but it is vital to stay organized for your Q3 board meeting.

A board meeting is not something founders and CEOs should lose sleep over. If executed and prepared for properly board meetings can become an integral part of your company’s success. However, it is easy to lose focus and can easily turn into hours of tracking down data, reading bullet points off a slide, and losing grip of the conversation.

To help lighten the load of board meeting prep we’ve put together a short guide to help have your ducks in a row before your meeting:

Pre Board Meeting Reporting

Being the CEO presenting at a board meeting it can feel like all eyes and pressure are on you. With sending over a structured report before the meeting you can turn the tables and put the pressure on the board to come to the meeting prepared. You never want to spring any surprises during a board meeting, by sending out the packet ahead of time you’ll avoid said surprises and set the expectation that everyone should come prepared. This will also give everyone a chance to read through the packet, request any changes and avoid tedious discussions during the meeting.

“Sometimes, if someone asked about something and clearly hadn’t done their homework, I’d say, ‘Oh yeah, that’s in the board pack.’ That’s the most damning thing that can happen to a board member — realizing that all of their peers prepared for the meeting and they didn’t.” – Jeff Bonforte (Former CEO of Xobni)

With that being said, it is important that you supply the board with the correct information in a timely manner. Most founders/CEO have found it best to send over their pre-meeting report/packet at least 4 days in advance.

Make the report comprehensive and relevant. This can include financials, wins, losses, near term concerns, plus goals for the next quarter.

Putting together a pre-meeting report can be a long process (and probably should be) as you reflect on the past quarter and lay out your vision for the next quarter. Putting the time in will be worth it as it will save precious time and allow you to discuss what truly matters.

Be on the lookout for a pre-board meeting Visible Update template early next week!

Set an Agenda

Lets face it, getting a group of people in a room to stay focused is next to impossible. To make the most of your time, lay out an agenda and stick to it! We have found that most board meetings should last anywhere from 2-4 hours. Below you will find an example agenda from the team at Sequoia Capital:

Read Sequoia’s guide for preparing a board deck/agenda here.

Ideally, if you sent over your metrics and data beforehand you should be able to shorten the time needed to discuss specific metrics. This will allow to focus on what truly matters over the next quarter; fundraising, hiring, product improvements, etc. Not a bad idea to include your agenda when sending over your board report/packet as well as your board deck.

Related Resource: Crafting the Perfect SaaS Board Deck: Templates, Guidelines, and Best Practices

1-on-1 Meetings

If you are able to carve out time with each of your board members beforehand to discuss any topics one on one – do it! No need for a lengthy discussion but board members will appreciate being kept in the loop and offering input in setting the agenda. If you have any previous asks left hanging now would be a good time to address those. Additionally, this gives you an opportunity to feel out how certain members feel about different topics and votes so you can be prepared to answer any questions and avoid surprises.

Provide Solutions

Take a look back at the previous quarter and ponder your wins, losses, product updates, etc. and have answers ready to any questions you might face. Instead of an in-depth product review it might be most efficient to focus on any of the improvements you made over the last quarter and why you made them. This way you can avoid countless product requests being thrown around from people who are likely not even using your product.

If your sales were down in July, why was that? If your churn was high in August, why was that? While it’s never fun to look back at losses from the quarter it will make your life much easier to have an answer and solution moving forward.

founders

Reporting

How do Your Investors View You?

Last week, we broke down the most popular days to send your investor updates. Check out the charts and data below for a quick refresher:

The least popular date is the 30th of the month. When the page turns on the past month and updates/reports start flooding VC inboxes how do they view you?

The Clockwork CEO

The favorite CEO among investors (when it comes to monthly Updates ;). The “Clockwork CEO” has the same time on the same day set aside every month to sit down and crank out their stakeholder updates. The Clockwork CEO has likely created a rhythmic cadence with their investors and give them a “story” to look forward to on a monthly basis.

The Weekend Warrior CEO

The rare breed of CEO personas (We’re looking at you R.J. Taylor) the Weekend Warrior is one and the same as the Clockwork CEO. Setting aside their Saturday or Sunday morning to sit down and reflect on the past month likely before heading out with the family for the weekend.

The Good Times CEO

The “Good Times CEO” leaves investors feeling great about the company… until the next month when they receive no updates or news from the founders. After a big win or great product improvement the Good Times CEO Update will land in their investors inbox the next morning. Don’t get us wrong – we like to let the good times roll just as much as The Cars but investor’s offer their most value when you are struggling and have specific asks/issues from the previous period.

The Non-Comparable CEO

The “Non-Comparable CEO” sends over structured Updates on a regular basis but still leaves a big question mark in the mind of their investors. Switching, changing, and manipulating metrics on a monthly basis leaves everyone involved scratching their head as the next set of data comes rolling in. So how do you avoid misleading numbers?

The Buzzer Beater CEO

The “Buzzer Beater CEO” leaves their investors on the edge of their seats and always get their Updates across; even if it is the last second. As end of month tasks pile up, the dreaded investor update takes a back seat and is often missing major details and leaves dots for the investor to connect.

The Missing in Action CEO

The “MIA CEO” is the one that keeps their investors up at night. After the initial enthusiasm that comes with new investors, you find yourself in the “trough of sorrow” and have yet to send an Update after that first polished and optimistic Update. Believe it or not, most investors have made it through the “struggle” and are an integral piece in helping your company bounce back to that initial enthusiasm.

founders

Reporting

Most Popular Times to Send Your Investor Update

When should I send my investor updates?

We often get asked questions from customers and prospects ranging from:

When should I send my investor update?

How long should my investor update be?

What should I include in my investor update?

While there is no hard and fast rule there are some best practices. (Our first piece of advice is don’t overthink it and just send it! Check out our Techstars presentation for more best practices on Investing in Investor Updates)

We have a meaningful dataset at our fingers tip so we brushed up on our SQL query skills to break out some insights with how our customers are using Investor Updates.

On average, Visible users are sending investor updates out to ~12 recipients and including ~4.5 charts. Fun fact: The most recipients for a given update is 130 and most charts coming in at 40 (alert: information overload).

Here is a breakdown of investor recipients. This is a count for the past quarter and is truncated to show 5 to 20 recipients.

Finally, we wanted to see the most popular day of the week investor updates are sent. Unsurprisingly, Monday is the most popular day of the week followed up by Tuesday and Friday.

The least popular day of the work week is Thursday with Saturday being the least popular across all days. I also took a look to see the date of the month that are most popular for sending updates. The Top 3 are:

3rd – 5.32%

20th – 5.02%

10th – 4.28%

The least popular date is the 30th of the month. Want to learn more? Check out our guide, “How To Write the Perfect Investor Update (Tips and Templates).”

Stay tuned for a follow up post with the best days to increase engagement around your investor updates!

founders

Reporting

What is Your Investor Net Promoter Score?

This is an updated post from our original “What is Your Investor Net Promoter Score?” from May 2015.

It is not a secret that we love Net Promoter Score at Visible. The term “Net Promoter Score” has a corporate ring to it, making it seem like something that startups don’t need to worry about until they “grow up”. In reality, implementing a customer happiness metric like NPS is one of the most important (and easiest) things your startup can do once you begin to acquire customers. An accurate NPS helps you gain an understanding of how loyal your customers will be over the long term and what kind of word of mouth growth you can expect. But it isn’t just the happiness of your customers you should be worried about.

Investor Net Promoter Score for Startups

As a founder and executive team, part of the job description is keeping all of your key stakeholders engaged in the business and customers are just one of the groups you need to be attentive to. Your investors are another, which is why your Investor Net Promoter Score – the percentage of your investors who would recommend you to potential customers, key hires, distribution partners or follow on investors minus the percentage who wouldn’t – is also key to the long term success of your fledgling business.

In theory, your Investor Net Promoter Score should be 100. Why wouldn’t an investor recommend your product or your company culture to someone from the outside? If you close an important sale, bring on a talented engineer or find a new market for your product, your investor’s stake is worth more money, right?

In the real world, it isn’t that cut and dry. Investors, like startups, have resource constraints. More importantly, they have a reputation to protect. And while they want all of their companies to find success, their motivations change over time based on how engaged they remain in each of their portfolio companies.

The question is, if your Investor NPS is not 100 how do you get there?

How to Improve Your Investor NPS

1. Invest in investor updates. Build a regular cadence with your stakeholders.

Build a cadence and keep updates succinct as well as comparable. Consistent communication builds trust and keeps you on top of mind for your investors. Make sure to keep your metrics and format comparable from update to update. Ask for tips and preferences to tailor your updates to a format that is best for both you and your investors.

Take a walk in your investor’s shoes. When an investor comes across a great designer looking to join a startup, who do you think she will recommend? The company she hasn’t heard from since wiring the money, or the one that comes to her each month with a quick overview on how things are going and how she can help?

“The CEO is the investor’s user interface into the business” – Dharmesh Shah

2. Create a culture of candor.

While driving an internal culture of candor results in better decisions, execution and output, the same can be said when communicating with your external stakeholders. Don’t be afraid to share bad news. You are not alone, even though it might feel like it. Be frank about the state of the business and make the appropriate asks. At the end of the day, your investors have been in the same situation and are there to help you through “the struggle” or better yet, help you get to the next stage in your business.

“Investors can only help if you are transparent all the time, not just in good times.” – First Round Capital

3. Respect their time

As touched on before, investors are busy people. Whether they are investing on behalf of a fund or as an individual angel, it is likely that they have other portfolio companies and business ventures that they are dealing with on a daily basis.

Your goal should be to give your investors the ability to make the largest impact on your business with the least amount of exertion. When you are seeking advice or introductions, be specific. By doing this, you increase the probability that your investor will take you up on your request, helping to increase their engagement in your business and start a virtuous cycle of “Investor Success”.

founders

Reporting

What is Your Ultimate Report? Part 1: Pacing

When we talk to our customers and potential customers we love to get an understanding of their “ultimate report”. It’s the report that stakeholders can quickly rally behind and understand how the business is performing, usually to a goal or target. Through this we’ve learned a ton and want to share the learnings with our audience through a 4 part series.

Part 1 of 4: Pacing

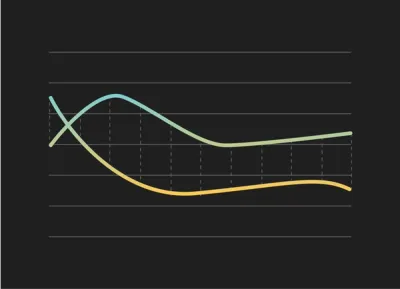

Today is Part 1 of the series, pacing. Pacing is a great way to apply weights to different periods throughout a range. E.g. You may close 40% of your deals in the last month of the quarter as reps have more urgency. Pacing should let you know if you are on track or not.The above chart is an example of pacing. This one in particular related to recurring revenue businesses by day but you can apply it to any business and timeframe. The goal is to be pacing 100% to your goal (the dotted line) throughout a period.

The inspiration for this came from David Skok’s SaaS 2.0 post, specifically from the Hubspot example.

Through a period of time the Hubspot team wanted to know how they were pacing towards their monthly goal this way they could make any adjustments on the fly to hit their goal.

As you can see, the end of a period for SaaS sales may be weighted higher as there is more urgency for a rep to close a deal but you weights could vary depending on seasonality, buying cycles, business models, etc. Another view could be: This chart is showing we are pacing above where we should be relative to our Q4 target.

I love pacing because it helps make adjustments but gets the team aligned on where you should be. You might be only 2 weeks into a quarter but you want to know where you are compared to where you are supposed to end up. Being 10% to your Quarter target may be acceptable and makes sure the entire team and stakeholders are aligned while understanding the health of particular KPIs.

What is your ultimate report?

Want us to create it in Visible for you?

Want access to the Google Sheet template that powered this post? Drop us a note.

Up & to the right,

-The Visible Team

founders

Reporting

How to Deliver Bad News to Investors

Even the best companies will eventually face one of the unfortunate inevitabilities of startup life—the investor update that’s littered with bad news. But delivering dissatisfactory results doesn’t make you unique. How you handle adversity, on the other hand, can make you stand out and serve as a test that separates the strongest founders from those that crumble under the pressure.

Related Reading: How To Write the Perfect Investor Update (Tips and Templates)

The irony of investor updates

Entrepreneurs on a hot streak tend to be better at keeping investors up-to-date than those struggling to hit KPI goals. Makes sense. We’re happiest to show our work when we’re assured accolades for our hard work. But it’s the entrepreneurs missing their goals that need to be the most transparent with investors—even if the next report resembles an S.O.S. message.

You can’t lose sight of the fact that investors are bought into the company’s future as well and willing to assist. Let them help. Shielding a group of experienced mentors from chipping in with their expertise on issues they’ve likely faced before is a lose-lose scenario for investors and founders. So regardless of company performance, keep investor updated early and often. “Transparency is the foundation of all great companies,” Entrepreneurial coach CJ McClanahan says. “Everyone is going to figure out what’s going on eventually—your team, investors, the marketplace, everyone. So live by this adage: tell the truth fast.”

How to avoid the big blow up

Hit your investors with some unpleasant news after months of radio silence could be seen as a sign of disrespect. Thus, an unnecessary blowup could ensue, taking everyone’s eye of the ball of what’s really important: turning the company around.

Regularly send your investor reports. There’s no reason a bad quarter has to turn into a company crisis, but slumping numbers will shock investors if they haven’t been able to track the company’s progress in months. This approach is also a great strategy for securing future funding. Early stage VCs tell me they are twice as likely to invest again in later rounds with companies that kept them up-to-date on performance.

When it comes to the bad news, don’t be afraid to get specific. If there’s been a plan or decision that you’ve executed that didn’t work, walk your investors through your process. Explain why it didn’t work. And always justify. Even if you’ve made the wrong choice, backup your decision making with what you knew at that time and what you expected as a result. You don’t want your investors thinking you’re acting careless with company strategy. A Columbia study showed people are much more likely to empathize with poor results if they understand the process. By doing this, you’ll also preemptively answer many of the questions your investors will want to know about the company and use the moment as an opportunity to showcase your preparedness.

Plus, the extra level of detail will help investors identify where you may be able to improve or how they may be able to help. After you explain your process for previous decisions, let your investors share how they would’ve done it different. If you allow the room to debate the merits of a decision, investors will feel more confident that their voice will be considered in the future.

Finally, as Joshua Margolis, a professor of business administration at Harvard Business School, explained to HBR.org admitting that you’ve made a strategic mistake can help you maintain credibility as a founder and provide a rallying point for everyone to work harder on making the business a success.

But your message won’t motivate unless it’s delivered well. It’s essential to walk into a meeting ready to deliver bad news without ambiguity. Don’t make investors guess which metrics underperformed or what efforts didn’t work. Outline the problem right away. Make sure you’ve prepared your remarks before you give them and practice, practice, practice. Go over your updates with a co-founder or a friend and double-check that you’re clearly conveying the information you want to get across. Even if you’re not a natural presenter, rehearse enough to allow yourself to stand in front of room full of investors and speak with confidence. You don’t want your body language to say something more negative than your underperforming numbers.

How to turn the ship around

Now it’s time to move on to the future. Like Don Draper said, “If you don’t like what’s being said, change the conversation.” That’s not always easy when you’re looking at hard numbers, but a shifting the conversation to a strategic focus on the future can get all investors onboard. Don’t just beg for help, get into specifics. Assign tasks to individual investors (based on their strengths) and share with the group what you expect in return.

Then show what you and your team are going to do to solve your biggest problems. Much like walking through the process that lead you to poor results, show the specifics of what you plan to do to jumpstart your KPIs. Open the floor to questions and feedback after. Allow your investors to tweak the process. Strong collaboration will create additional buy-in and get everyone excited for what’s coming next.

You’re in a great position to turn this situation into a big win for you and your company. Never forget that adversity is a necessary ingredient in all great startups.

founders

Reporting

5 Ways to Make Investor Communication Better

Yes, bad blood between a startup CEO and one of the company’s financiers may be a plague on both houses, but the responsibility largely falls on the founder to prevent the affliction.

Maybe you’re one of the lucky ones. Maybe you have managed to preserve the sacred union between founder and investor. Good. But your work is not complete! Like all relationships it’s bound to fall apart without strong trust and communication. It’s not good enough to simply declare an open door policy for emails, calls or visits. Set a schedule and stick to it. Provide regular updates that outline vital metrics and allot time for investors to have the opportunity to ask you anything. The cycle of updates and willingness to be transparent mitigates one-off asks and actually helps you stay focused on the most important aspects of the business.

Follow These 5 Steps to Improve Investor Relations

Go one-on-one—Set up individual investor calls. Allowing time for long-form discussions, brainstorming, individual inquiries and just shooting the breeze or sweet talking to help make every investor feel important. This is essential for those unable to attend in-person meetings. Do your best to schedule interactions outside of the office, too. If you and your investors are able to make time for lunch or drinks, you can better understand your investors on a social level as well.

Regular conference calls— Follow up on written reports by setting up a call to field questions or any other particulars that pique an investor’s interest. Share a conversation and you and your investors will remember why you fell for each other in the first place.

Write monthly reports: Keep it simple. Investors want updates in five key areas: how much cash is in the bank, how many months until $0, how the team is functioning, how are the KPIs and how they can help you. Having a hard copy provides your investors with a reference sheet when they need quick answers about your company.

In-person meetings— Get everyone in a room and let investors pepper you with questions like you’re facing a firing squad. The physical meeting simply can’t be replaced, even if out-of-town investors can’t make it. Investors will appreciate the chance to meet face-to-face.

Ask what you’re doing wrong –Vulnerability is a great thing if it strengthens relationships. Open yourself up to criticism from your investors. Let them take you to task, you’ll be better off for it. And to improve your communication strategy, ask each investor what else you could do to keep them properly up-to-date on the company’s health.

Investor communication is no less important than communication with your employees. Everyone involved in the business needs to stay on top of what’s going on. And investors will have a much tougher time staying in the loop while managing a portfolio of other companies and spending most days not interacting with your business at all. So don’t let communication gaps form and relationships fizzle. Keep the feedback loop going and let harmony reign. Now say it together: ‘til liquidation do we part.

Related Resource: Liquidation Preference: Types of Liquidation Events & How it Works

Search through thousands of VCs with Visible Connect:

founders

Reporting

Investor Letters: One Ford

Ford was Founded in 1903 and has been a staple of American culture since. No company has created the stories and memories like those of Ford; the Model T, the assembly line, the Mustang, the Pinto, and most recently “their 2008 comeback”.

We are all too familiar with the financial crisis in 2008. The automotive industry was hit particularly hard and faced challenging questions all while on the brink of collapsing. Alan Mulally, Ford’s newly appointed CEO at the time, stuck to his guns and pulled out a historical comeback. Mulally’s plan, ONE Ford, is prevalent while the company fought to stay afloat in one of the most uneasy times in recent history. Although Alan stepped down in 2014, ONE Ford is still largely influential at Ford and crucial to their company history.

All of the charts, images, quotes, and emphasis below were added by us.

If you like what you see and want to share Visible Investor Letters with friends or colleagues, send them here to sign up.

Ford’s 2008 Letter to Shareholders

A Message from the President and CEO,

In 2008 the automotive industry faced a deep recession in the United States and Europe, the worst worldwide financial crisis in decades and a dramatic slowdown in all major global markets. Like all automakers, Ford Motor Company was adversely impacted by these extraordinarily difficult economic conditions.

However, the plan Ford is operating under – what we call ONE Ford – is helping us endure these current conditions and position ourselves for future success. Our plan has been consistent for the past two years:

Aggressively restructure to operate profitability at the current lower demand and changing model mix.

Accelerate the development of safe, fuel-efficient, high-quality new products that customers want and value.

Finance our plan and improve our balance sheet.

Work together as one team, leverage our global assets.

ONE Ford has transformed us into a different auto company: different than others today and from ourselves a few years ago. However, the worldwide economic slowdown – driven by tight credit markets and weak consumer confidence – has shaken the foundation of even the strongest companies, in the automotive sector and in every other industry.

A plan so simple it can fit on a business card – yet so influential it overhauled the culture at Ford. ONE Ford was the first step Alan Mulally took when he took over the reigns as Ford’s CEO in 2006. The plan, simply enough, revolved around creating one vision for everyone on the team – not just executives and managers. The fruits of the plan have paid off greatly as Ford has generated record profits while staying lean and innovative.

Certainly, the severe economic challenges of 2008 had a significant impact on our results for the year, both in terms of our operating losses and cash flow. After earning a profit in the first quarter of 2008, we had an overall net loss of $14.7 billion for the year, with $6 billion of that coming in the fourth quarter. That compares with an overall net loss of $2.7 billion in 2007. Our worldwide Automotive revenue was $129.2 billion in 2008, compared with $154.4 billion in 2007. At yearend 2008, our total Automotive liquidity was $24 billion, including gross cash of $13.4 billion.

Fortunately, we began aggressive restructuring efforts under ONE Ford before the current crisis began. We eliminated excess manufacturing capacity, closing plants and reducing our workforce. We negotiated a new contract with the UAW to improve our competitiveness. We shifted to a balanced product lineup offering high quality, proven safety, excellent fuel economy and good value.

As part of our ONE Ford plan we also secured credit in advance of the financial market meltdown. As a result of all of these actions and based on our current planning assumptions, we have sufficient liquidity to make it through this global downturn while maintaining our product plans, without the need for government bridge loans. However, as we told Congress in our business plan submission in December 2008, in this environment a number of scenarios could put severe pressure on our Automotive liquidity, causing us to require such a loan – including most importantly a significantly deeper economic downturn, or a significant industry event such as the uncontrolled bankruptcy of a major competitor or major suppliers that caused a major disruption to our supply base or dealers.

When Mulally took over as CEO, in 2006, Ford mortgaged all of their assets to finance the loans spoken of above. At the time, Ford was in desperate need to restructure their company as whole and saw the need for “a cushion to protect for a recession or other unexpected event”, as Mulally put it in a separate interview. As an added bonus, staying away from a bailout was solid for marketing and created a positive image of Ford for many consumers.

Staying aligned with their plan, Ford sold off most of their marques in order to stay agile and focus on their most important brand; their own. In the year or so leading up to this annual report Ford sold off their interest in Aston Martin, Jaguar, Land Rover, and Mazda. A few years after the report they would continue the trend and sell off their share in Volvo as well as discontinuing the Mercury line.

We continue to take the decisive actions necessary to lower production to match lower worldwide demand and reduce costs. We expect this will contribute to significantly reduced negative Automotive operating-related cash flow in 2009 as compared with 2008, and position Ford for growth when the economy rebounds. Based on our current planning assumptions, we believe we are on track for total Company and North American Automotive pre-tax results and Automotive operating-related cash flow to be at or above breakeven in 2011, excluding special items. Our ultimate goal remains unchanged: to create a viable Ford Motor Company and a lean global enterprise delivering profitable growth for all.

Looking ahead, we anticipate very weak global industry sales volumes during 2009, with a full-year decline in the range of about 15% from 2008 levels. Significant government policy stimulus is being implemented in most markets and is expected to improve the environment for sales later this year. Financial markets remain under significant stress, however, and further government and central bank actions are needed to provide liquidity and stabilize banks.

For Ford, the year ahead will be marked by an unprecedented number of new product introductions. Consistent with our ONE Ford plan, we are introducing more products that customers want and value.

As other automotive companies were solely focused on gathering capital, Ford’s previously mentioned loans allowed them to continue to invest in the introduction of new products and technologies. This has included the innovation of their hybrid/electric vehicles and renewed success of their staple models, such as the Focus.

Ford also is on track with its plan to invest in new, smaller, fuel-efficient vehicles and achieve a more balanced global product portfolio. Within the next five years, all Ford vehicles competing in global segments will be common in North America, Europe and Asia, fulfilling a key element of our ONE Ford plan. This includes Ford Fiesta- and Focus-sized small cars, Fusion- and Mondeo-sized midsize cars and utilities, as well as commercial vans. Importantly, every new product will be the best or among the best in its segment for fuel economy, while providing top quality, safety, smart technologies and value.

In another instance of ONE Ford, Mulally touches on the importance of consolidating their platforms and becoming a global company. In the above graphic, pulled from a 2015 Ford corporate update, you can see the continuance of consolidating their platforms. Currently all of Ford models share just 9 platforms and roughly 80% of the same parts; by doing so Ford has been able to create massive economies of scale.

We also are launching the most aggressive vehicle electrification program in the industry. By 2012, we plan to produce at least four high-mileage vehicles that will use the most advanced forms of battery technology in a family of hybrids, plug-in hybrids and battery-powered vehicles.

In addition to producing these vehicles, we are employing a comprehensive approach to electrification that will tackle commercial issues such as batteries, standards and infrastructure. We are working with Southern California Edison, the Electric Power Research Institute and six additional electric utility companies from New York, Atlanta, Detroit and Raleigh to develop plug-in hybrid vehicles and infrastructure.

Despite an extremely difficult year we continue to see many positive developments. These ongoing improvements make us more confident than ever that we have the right plan and are taking the right actions to survive the downturn and emerge as a lean, globally integrated company poised for long-term profitable growth.

As always, we thank you for your support of our efforts.

Alan R. Mulally

founders

Reporting

Investor Letters: The Etsy Economy

In the world of business, moving first can be difficult and dangerous. Etsy, the Brooklyn-based marketplace connecting sellers and buyers of handmade and vintage goods, who IPO’d in 2015 is finding this out the hard way.

When it went public, Etsy was the largest (and one of the first) B Corporations ever to do so at a market cap of over $3B. Since, Etsy’s value has slipped to under $1B and it is yet to convince investors of its long term viability in light of widening losses and competition from Amazon (“your margin is my opportunity”).

In this week’s Investor Letter, which was included as part of the company’s S-1 filing, CEO Chad Dickerson makes the case for Etsy as a public company and tries to push Wall Street analysts to see past simple profits and also evaluate the company on the community it has built and the economic impact it has had…good luck with that.

The Etsy Economy

Since inception, Etsy has challenged conventional ways of thinking about commerce, business, individuals and communities. I intend to keep our unconventional operating philosophy as we become a public company, and I welcome new investors into our community.

When I joined Etsy almost seven years ago, Etsy was an online marketplace for handmade goods, vintage items and craft supplies that connected sellers and buyers. Even in my early days at Etsy, it was clear to me that the vision for Etsy could extend far beyond the founding idea of the company and have even more potential to impact the world for good.

Vision is just the starting point. I believe Etsy can truly change the world when our vision is met with strong culture, a powerful team and disciplined execution. In my time at Etsy, I’ve put my heart and soul into nurturing a culture and building a team and company that match the ambition of our mission. Today our mission is much more expansive than when Etsy began: to reimagine commerce in ways that build a more fulfilling and lasting world.

The reimagination of commerce means transforming every aspect of how goods are made, bought and sold. We believe that Etsy has the long-term potential to transform the world economy into one that is more people-centered and community-focused—one that values and honors designers and makers and one that creates stronger connections among people who make, sell and buy goods. We see an economy that is more sustainable and transparent—and one that is more joyful. We believe in an economy that transcends price and convenience, one that emphasizes relationships over transactions and optimizes for authorship and provenance. We call this the Etsy Economy.

Building the Etsy Economy matters more than ever. For decades now, the conventional and dominant retail model has relentlessly focused on delivering goods at the lowest price, valuing products and profits over community, short-changing the future with the instant gratification of today. I do not believe that this race to the bottom is a sustainable, successful model. Our growing community has made it clear that they desire thoughtful alternatives to mass commerce and impersonal retail and products that better reflect their personal style and values. Person by person, sale by sale, we are building a new model to replace the old. With GMS of $1.93 billion in 2014, I see the Etsy Economy emerging.

Etsy’s Values

If you want to understand Etsy, you’ll have to understand our values.

We are a mindful, transparent and humane business.

We plan and build for the long term.

We value craftsmanship in all we make.

We believe fun should be part of everything we do.

We keep it real, always.

Fundamentally, we believe that companies can and should use the power of business to create social good, which is reflected in our status as a Certified B Corporation.

As we noted in the intro, Etsy was the largest (and one of the first) B Corporation ever to do so at a market cap of over $3B. Rally Software, out of Denver, was the first of the group to go public (at a market cap of just over $300MM). It has since been acquired by CA Technologies for $480MM. Natura Brazil (Market Cap: $12.4B) is the world’s largest publicly traded B Corp but it received certification after it was already public

Other well known B Corporations include Ben & Jerry’s, Warby Parker, which could overtake Etsy as the largest B Corp IPO should it choose to take that route.

Our commitment to using business as a force of good manifests itself in the way we run our business.

People often ask me how I choose between the success of our community and the success of our business. My answer is that I don’t have to choose; we have built a business that does well when our community is successful. Making money matters to Etsy because our financial success creates long-term sustainability for our community. The more we invest in our platform, the more we enable Etsy sellers to pursue their craft and grow their businesses and the easier we make it for Etsy buyers to find unique goods. We call this Etsy’s Empowerment Loop.

Community

At Etsy, we believe that our strength and business success rest in the interdependence among Etsy sellers, Etsy buyers, responsible manufacturers and our employees—in other words, our community.

Etsy sellers represent a diverse mosaic of needs and aspirations. Some sellers are first-time small business owners and benefit greatly from our seller support and education programs. The vast majority of sellers on Etsy are one-person shops, and we continue to embrace and develop new ways to support them. Other sellers have grown and need help scaling with the assistance of responsible manufacturers, creating opportunity for other participants in the Etsy Economy. In all cases, we empower each Etsy seller to succeed on her own terms.

I have heard concerns that by allowing our sellers to partner with responsible manufacturers, we are diluting our handmade ethos. I share our community’s desire to preserve what is special about Etsy. After all, Etsy has always served as an antidote to mass manufacturing. We still do. With our vision of responsible manufacturing, we are promoting a new, people-centered model in which artisans can preserve the spirit of craftsmanship and grow responsibly by collaborating with people at small-batch manufacturers to make their goods. This brings more hands together to build both products and more diverse local, living economies. These local, living economies band together into a larger Etsy Economy made up of individuals with diverse roles but all sharing a collective vision of an economy based on community.

When individuals share a collective vision, the power and possibility of community manifest in profound ways. Etsy is, by design, a collection of many small things. As we grow, Etsy becomes a larger collection of individuals and communities, with compounding benefits when they connect with each other. Etsy sellers have self-organized into more than 10,000 groups around the world, known as “Etsy Teams.” They provide local support to each other and collaborate with Etsy on initiatives, such as teaching entrepreneurship to economically disadvantaged people in their communities, lobbying the government on issues important to Etsy sellers, running local craft fairs and translating Etsy’s site into other languages.

In 2012, Mayor Larry Morrissey reached out to me on Twitter asking how to build an Etsy Economy in his community of Rockford, Illinois. Rockford is a city that has faced challenges familiar to many cities in America and around the world: loss of manufacturing jobs, high unemployment and a struggling economy. We worked with Mayor Morrissey, members of the local Rockford Etsy Team, the public education system, local arts organizations and the public housing authority to launch the Etsy Craft Entrepreneurship Program. This program teaches people with a craft skill that entrepreneurship and economic opportunity are within reach on our platform. We have extended this program to 10 cities around the world and see it as an inspirational model for even deeper community involvement in the coming years.

Our concept of community includes the cities where we live and work, and we run Etsy in a way that supports our own local economy and ecosystem. At our headquarters in Brooklyn, twice a week we serve a meal that we call “Eatsy.” Our approach is to foster community and productivity through a meal, designed for employees to eat together on picnic-style benches. This meal allows employees to engage with each other, within and across teams, and increases team-building and work relationships throughout the company. Eatsy also serves as an end point for company-wide meetings, so that employees can continue the conversation on important workplace topics.

In 2014, we sourced food from over 40 local businesses with an emphasis on our health and ecological impact. We eat on compostable plates, and employees sign up to deliver our compost by bike to a local farm in Red Hook, Brooklyn, where it is turned back into the soil that produces the food we enjoy together. In this way, Eatsy goes into the very soil we live and work on. Eatsy is a metaphor for how I think about many aspects of our business and our relationship to the world around us: regenerative, mindful, interdependent, community-based and fun.

Why Etsy Should be a Public Company

I believe the principles and resources of being a public company align well with the model of shared success that is fundamental to Etsy’s way of doing business, namely that we make money when our sellers make money. Investing in the growth of our business and increasing Etsy’s visibility will help elevate Etsy sellers and attract more buyers, which creates more opportunities for everyone.

This section is perhaps the most interesting since it attempts to answer a question that, to this day, the public markets feel has not been put to rest.

To date, the public markets have shown an unwillingness to accept a company like Etsy where profit seems to take a back seat to impact — unless, of course, that company is Amazon whose scorched earth brand of market expansion appeals a great deal to Wall Street in spite of minimal profits.

Accountability / transparency

Etsy has a long history of providing data to the community, everything from key financial metrics, to our gross happiness index, to our carbon footprint data, to our workplace diversity stats. As a public company, we will be able to provide a higher level of transparency and accountability to a broader number of people.

Community participation

Being a private company means that most people don’t have an opportunity to invest in Etsy. When Etsy is a public company, anyone will be able to own a piece of Etsy, including our sellers, our buyers and anyone else who shares Etsy’s values and mission. These shareholders will be valued members of our community.

Long-term sustainability

We want to be a company that spans generations. Eighty-six of the original companies in the S&P 500 index are still publicly traded after 58 years. I view going public as an important step towards providing Etsy with the capital and long-term corporate structure to achieve similar longevity.

In light of Amazon’s foray into the handmade goods market and Etsy’s struggles as a public company (likely related), there has been some chatter about a buyout. As we noted above, Amazon has a history of scoffing at traditional Wall Street desires and with its acquisition of Zappos in 2009 proved it is willing to take bets on company whose culture seems to be at odds with their own.

Making the world more like Etsy

I believe that Etsy can be a public company that holistically integrates the concerns of people and the planet, the present and the future, profitability and accountability. If we succeed, then other companies might replicate our model. We think the world will be a better place for it.

As a public company, we will continue to concentrate on the long term. Our mission to reimagine commerce is a big goal and it will take time to achieve it; success will be based on strategies that evolve over years and decades, not just quarters. We are more focused on creating long-term results for us and our community than short-term results that lack that promise. I believe this approach will deliver the most sustainable long-term returns to investors.

When we’re public, we do not plan to give quarterly or annual earnings guidance. I think providing quantitative earnings guidance is misaligned with Etsy’s mission. For example, the pressure to hit a quarterly financial target could incent us too heavily to seek near-term gains, which could diminish our ability to fulfill our larger mission over the long-term.

We will continue to be transparent with our investors. Instead of providing guidance in the traditional sense, I plan to talk frequently with our investors about our progress, challenges and opportunities. I welcome investors who share our long-term, community-oriented philosophy.

What’s Ahead

I am intensely grateful to all of the people who have given so much of themselves to build Etsy, and I am excited to welcome new like-minded shareholders to our community.

We are entering a new era. I believe that successful businesses will be those that combine vision, execution and discipline with values, heart and conviction. That is how I plan to lead Etsy and work with our community to build a more fulfilling and lasting world through commerce. Etsy will be entering its second decade this year, and we look forward to many more in our new form as a public company.

founders

Reporting

Investor Letters: Howard Marks on Liquidity

Like Warren Buffett, Howard Marks is a master craftsman of memos on the state of the market, investment psychology, and investment philosophy. In January of 2016 as capital seemed to be pouring out of public and private equity markets – at the time of his post, the S&P was down almost 9% from where it ended 2015 – and liquidity was on the minds of many investors and operators.

For people building companies (as opposed to investment firms), his notes on liquidity provide ample learning opportunities to help effectively navigate periods of exuberance and tightening that inevitably occur.

Marks framed his thoughts on liquidity well at the beginning of this Bloomberg interview where he states: “The best defense against liquidity is not needing it. It is buying things you can hold for a long period of time.”

We have pulled out our favorite sections and added our thoughts below. The full investor letter (pdf) can be found at the bottom of this post. All of the charts, images, quotes, and emphasis below were added by us.

If you like what you see and want to share Visible Investor Letters with friends or colleagues, send them here to sign up.

Oaktree’s Howard Marks on Liquidity

Liquidity Defined

Sometimes people think of liquidity as the quality of something being readily saleable or marketable. For this, the key question is whether it’s registered, publicly listed and legal for sale to the public.

“Marketable securities” are liquid in this sense; you can buy or sell them in the public markets. “Nonmarketable” securities include things like private placements and interests in private partnerships, whose salability is restricted and can require the qualification of buyers, documentation, and perhaps a time delay.

But the more important definition of liquidity is this one from Investopedia: “The degree to which an asset or security can be bought or sold in the market without affecting the asset’s price.” Thus the key criterion isn’t “can you sell it?” It’s “can you sell it at a price equal or close to the last price?” Most liquid assets are registered and/or listed; that can be a necessary but not sufficient condition. For them to be truly liquid in this latter sense, one has to be able to move them promptly and without the imposition of a material discount.

Much ink has been spilled in recent periods about the lack of liquidity – using the definition Marks’ favors – in the private markets. Companies of all stages are struggling to raise fresh capital without taking a haircut (selling an asset below the last price) and the IPO window is firmly closed.

Liquidity Characterized

I often say many of the important things in investing are counter-intuitive. Liquidity is one of them. In particular, it’s probably more wrong than right to say without qualification that something is or isn’t “liquid.”

If when people ask whether a given asset is liquid they mean “marketable” (in the sense of “listed” or “registered”), then that’s an entirely appropriate question, and answering it is straightforward. Either something can be sold freely to the public or it can’t.

But if what they want to know is how hard it will be to get rid of it if they change their mind or want to take a profit or avoid a possible loss – how long it will take to sell it, or how much of a markdown they’ll have to take from the last price – that’s probably not an entirely legitimate question.

It’s often a mistake to say a particular asset is either liquid or illiquid. Usually an asset isn’t “liquid” or “illiquid” by its nature. Liquidity is ephemeral: it can come and go. An asset’s liquidity can increase or decrease with what’s going on in the market. One day it can be easy to sell, and the next day hard. Or one day it can be easy to sell but hard to buy, and the next day easy to buy but hard to sell.

In other words, the liquidity of an asset often depends on which way you want to go . . . and which way everyone else wants to go. If you want to sell when everyone else wants to buy, you’re likely to find your position is highly liquid: you can sell it quickly, and at a price equal to or above the last transaction. But if you want to sell when everyone else wants to sell, you may find your position is totally illiquid: selling may take a long time, or require accepting a big discount, or both. If that’s the case – and I’m sure it is – then the asset can’t be described as being either liquid or illiquid. It’s entirely situational.

There’s usually plenty of liquidity for those who want to sell things that are rising in price or buy things that are falling. That’s great news, since much of the time those are the right actions to take. But why is the liquidity plentiful? For the simple reason that most investors want to do just the opposite. The crowd takes great pleasure from buying things whose prices are rising, and they often become highly motivated to sell things that are falling . . . notwithstanding that those may be exactly the wrong things to do.

Select Passages

Specific investor actions can have a dramatic impact in illiquid markets For example, the price of an illiquid asset can rise simply because one buyer is buying, in which case selling the asset becomes very easy. When that buyer stops buying, however, the market can quickly reset to much lower levels in terms of both price and the liquidity enjoyed by sellers (and it can overshoot in the other direction if the buyer decides to sell what he bought.

People have pointed out that the slowdown in VC funding (to whatever extent it has or will happen) has been largely a VC conspiracy and it is tough to write this off entirely — although I am sure that in this imagined world of VC “conspiracies” a yoga studio or vest-shopping excursion replaces the dark, smoke-filled rooms of old-timey conspiracy theories.

The reality is that the venture market is small and quite illiquid, so when a few major firms decide to focus more on their existing portfolios or non-traditional players like mutual funds decide to slow down, liquidity begins to trickle out of the market.

And in an already illiquid market, change can happen fast. In describing current market conditions, Mark Suster of Upfront Ventures noted the following:

If you want to see what was on my mind – I started foreshadowing change publicly in October 2015 with a forecast of what I expected in 2016 VC funding markets at a presentation I gave at the annual Cendana VC/LP conference hosted by Michael Kim. Word travels at light speed amongst this small network of people who all know each other and even though they’re rivals they also sit on boards together and many probably went to business school together.

So when something in changing those at ground zero, in my word, “get the memo.” Of course it’s not literally a memo but that’s a metaphor for knowing that things have dramatically changed. If you’re not in this closed group of VCs you will eventually figure out the new game but the memo arrives more slowly. Many of the industry’s top thinkers were at Cendana’s annual meeting and panel after panel privately debated what they were seeing.

On the other hand, at the right time, investors can make tremendous amounts of money simply by being willing to supply liquidity (are accept illiquidity). When everyone else is selling in panic or sitting frozen on the sideline, refusing to buy, cash can be king. Often when a crash follows a bubble driven run-up, most people are short of cash (and/or the willingness to spend it).

A few paragraphs before this passage, Marks touches on the need to think about liquidity levels carrying over from one asset or market to another. This was the case in 2008 and 2009, when it seemed people in all markets were content to sit on the sidelines and reserve cash. During that time, investors who were unwilling to spend their cash (supplying liquidity) in the early stage private markets would have missed out on investing in generation-defining companies like Uber, Slack, and Airbnb.

The bottom line is unambiguous. Liquidity can be transient and paradoxical. It’s plentiful when you don’t care about it and scarce when you need it most. Given the way it waxes and wanes, it’s dangerous to assume the liquidity that’s available in good times will be there when the tide goes out.

What can an investor do about this unreliability? The best preparation for bouts of illiquidity is:

Buying assets, hopefully at prices below durable intrinsic values, that can be held for a long time – in the case of debt, to its maturity – even if prices fall or price discovery ceases to take place, and

Making sure that investment vehicle structures, leverage arrangements (if any), manager/client relationships and performance expectations will permit a long-term approach to investing.

These are the things we try to do.

In the section above, Marks is talking about the Oaktree approach to building their firm and later notes two benefits to their approach:

We aren’t highly reliant on liquidity for success, and

Rather than be weakened in times of illiquidity, we can profit from crises by investing more – at lower prices – when liquidity is scarce.

Rephrased for someone building a company and not an investment firm, the benefits to this type of strategy would be:

1. We aren’t highly reliant on another round of funding for success

2. Rather than be weakened when the funding market pendulum swings, we can profit from downturns by investing more – at lower prices – in things like talent and customer acquisition

This mirrors the approach of Slack’s Stewart Butterfield who has tried to take advantage of a period of high liquidity to protect his company (financially and psychologically) from a market downturn.

“And really the thing we get out of having the cash in the bank at this point is options. We’re in a really good position where when opportunities arise that we want to take advantage of, we can just do them. Whether that’s acquisitions, international expansion, advertising — whatever it is that comes up that feels like the best move for the business, we will take advantage of. Having the freedom to pursue opportunities without the constraint of capital enables all kinds of things which otherwise wouldn’t have been possible.” – Stewart Butterfield, Business Insider Interview

founders

Reporting

This YouTube Investment Memo Shows You the Path to the Perfect Pitch

Every company going out to try to raise capital from angel investors or VCs seems to have some derivative of the same question – “What should we include in our pitch deck?”

While the outsize clout people give a simple slide deck may seem silly, it speaks the importance of being able to weave a compelling narrative about your business.

Roelof Botha of Sequoia Capital is one of the most successful venture capitalists of all time. He sits on the board of companies like Square and Jawbone and led investments in Youtube and Meebo before they were acquired by Google. Recently, he checked in at #18 on CB Insights list of the top 100 venture capitalists.

Basically, he knows what it takes to build great companies and how those companies should think about raising capital.

Thanks to court records from the 2010 Viacom-YouTube lawsuit, we can take a first hand look at how the Youtube founders pitched Botha (exhibit 1) and how Botha pitched Youtube internally to his Sequoia partners (exhibit 2). From there, we can better understand how companies should think about structuring their own pitches to investors as well as the major hurdles companies need to get over to turn a potential investor into an advocate who makes sure to push their deal forward.

Exhibit 1 – Youtube’s Pitch

Here is the rundown of the order in which the Youtube founders presented their business opportunity and our interpretation of the reasoning. As you will see, the way this is presented does a great job of continually answering questions and pushback that would be brought up in the preceding section.

Purpose – Why should I care?

Problem – What point of friction are you attacking? Money is made at points of friction.

Solution – How are you removing (extracting value from) that friction point?

Market Size – How much value can you conceivably capture from this new offering?

Competition – If the market is so big there must be others after it, right? While some argue that competition is not a good thing, a Blue Ocean approach to entering the market shows you have thoughtfully evaluated where others have failed and understand how to attack those areas.

Product Development – What is the actual product that will serve as the conduit for this better customer experience?

Sales & Distribution – How will you make the market care about this cool product?

Metrics – Have any of your previous predictions been tested and evaluated by your target market? How has it gone?

Team – Are you the people that are going to connect all of these dots?

Exhibit 2 – Botha’s Pitch to His Sequoia Partners

Raising a seed round is like making a sale to a SMB customer — smaller amount of money in play, usually one decision-maker, and a relatively short sales cycle.

Raising institutional money is more like conducting an Enterprise sale. The check size is bigger, the timeline is longer, and you need to find an advocate on the inside that is going to continually work to push the deal forward and get buy-in from other decisionmakers.

This latter process is the one we see at play here in Exhibit 2, where Botha takes us the Youtube cause internally at Sequoia and present the case for investment to his partners. Here, we get a rare glimpse into how an investment decision is made at a VC firm.

As a founder, reading through this section is instructive in that it can help you anticipate some of the questions an investor will face from partners so you can be sure to address those in your own presentation.

Intro – What is the thesis and (like in the previous section) why should we care?

Deal – How do the terms and structure of the deal (valuation, our ownership, etc.) fit in overall with the portfolio we are building?

Competition – How does this company fit into the marketplace of both large and small competitors? An outline of the competition quickly helps investors build a framework for what your go-to-market strategy may look like.

Hiring Plan – Does this company have a plan and the ability to attract talented executives and key employees to bring the business from where it sits today to where the founders have said it will be in the future?

Key Risks – What factors will cause the statements that have been made around market, product, distribution, and team to not come true? What is the likelihood and scale of those risks?

Recommendation – As Thrive’s Miles Grimshaw put it in his blog post on the document, how does management, market, and monetization all tie together?

founders

Reporting

Investor Letters: Overstock’s Super-de-Duper Year

Overstock has long been a bit player in the world of Ecommerce. Founded in Utah in 1999 (at the height of the Dot-Com boom), the company grew rapidly and IPO’d in 2002 (a week after Netflix and almost right at the bottom of the Dot-Com bust) on annual revenue of $40mm and at a market cap of just under $350MM dollars.

Despite being one of the few companies to come out of the Dot-Com crash alive, its long term growth has disappointed and the value of the company today sits just a few million dollars north of where they IPO’d 14 years ago.

Still, the company and its CEO, Patrick Byrne have a way of keeping themselves in the news. There was the battle with naked shortsellers, its rebrand to O.co, and its early adoption of cryptocurrency.

There has also been his ongoing embrace of transparency, which started with the following letter to shareholders recapping the company’s 2003 performance. The general tone and openness of this letter is uncommon for a public company and calls to mind the way Warren Buffett approaches his shareholder communication. So while the performance of the company hasn’t quite kept up with its peers, Byrne’s approach to stakeholder management is as relevant as ever.

All of the charts, images, quotes, and emphasis below were added by us.

If you like what you see and want to share Visible Investor Letters with friends or colleagues, send them here to sign up.

Overstock’s “Super-de-duper” Sales Numbers

The rhythm of the Dao is like the drawing of a bow. – Lao-zi

Dear Owners:

My colleagues executed well this quarter. Were 2003’s four quarters a boxing match, I’d say we were dropped to our knees in the first, cleared our head in the second, got on our toes again in the third, and won the fourth on a decision.

In this letter I will describe how my colleagues accomplished this, and detail some mistakes your chairman made that prevented victory by a knockout.

First, I will explain why I am appending this letter to our earnings release. Simply put, I want owners to understand their business: they entrust capital to me and I owe them no less.

I am warned that a letter such as this has risks. A lawyer told me that my use of this more colloquial style may be misconstrued, saying: everything you write will be Exhibit A in a lawsuit against you, (but lawyers say that about most things). Bill Mann of The Motley Fool says that we live in a time when, if things go passably well, CEOs say, Everything is super-de-duper, and when they go poorly they say, Everything is just super-duper. In such a climate, if I write, X went pretty well, but I could do better on Y and Z, the former is read as an admission of mediocrity, and the latter, calamity.

This fits in with what many founders in the early stage world worry about. Everyone else is “killing it”, why aren’t we? Stakeholders – as Byrne touches on above – deserve to hear from management in an honest and open fashion that lays out what has worked, what hasn’t, and what is coming next.

Lastly, cynics claim that my candor is but an attempt to pump my stock by drawing investors looking for someone who does not pump his stock: I am flattered to have attributed to me such Machiavellian subtlety! (And I suggest they look up Popper’s Falsification Principle.)

Saved you a click…

For six quarters I have struggled to reconcile my desire to report in this fashion to Overstocks owners with the more traditional approach used by most companies. Trying to mold a murky reality into a few lines of happy quotes has always been difficult. I have thus decided (when able and time permitting) to write lengthier and more informative letters to owners, filtering out points that concern individuals, details, or strategies that might bore readers or advantage competitors. Note, then, shareholder, that when I write, X is going pretty well, just because I did not say, X is super-de-duper it does not mean, X is a disaster. Sometimes a cigar is just a cigar. The journalists, lawyers, and cynics will find their own way.

Ed Note – The entirety of the 2003 letter from Overstock is about 10 pages long…we’ve pulled out a few of our favorite passages here. You can read the entire letter here.

Sales

To begin with, sales were super-de-duper. They truly were. We returned almost to the hyper-growth curve (94% year-on-year growth).

Just to give you a sense of the size of the business at the time of this writing, Overstock brought in just under $300mm in revenue during the preceding year and was, as Byrne notes, growing rapidly.

As you would expect, this growth has since slowed significantly due to a number of factors – increased competition and the buyer behavior shift to mobile being a couple. Still, the company has returned to double digit revenue growth in the last three years.

Expense Discipline

I believe I can do much better here. At the risk of giving an excuse I’d note that it is difficult to get expenses precisely right when one starts a quarter with a range of expected GMS from $80 million to $120 million: optionality costs money. Still, in retrospect, I believe I could have saved $1-2 million if I had addressed some issues earlier.

Something that teams at any high growth company can likely relate to.

Capital Needs

Funds call me regularly offering to do PIPE’s (private investment in public equity) at X% discounts with Y% warrant coverage struck up Z%, etc. etc. I am a bear of little brain, and my reaction to such invitations is roughly the same as being asked to join a game of Three Card Monte in Times Square. Yet their enquiries do keep me thinking about the issue of capital.

Build a model of our business at break-even and growing 100%. Do we need capital? If we were a brick factory the answer would be, “yes”, but for the float reason given above the answer is, hard as it may be to imagine, maybe not. Yet my answer would continue, That is, if we are comfortable skimming along at times with a weeks worth of cash in the bank, as we did at one point this Q4 when we bulked up for Christmas.

Are we at break-even? Not yet: our GAAP loss in Q4 2003 was 2.6% of revenue. Should we strive to be at break-even? What if, by continuing to lose two-and-a-half pennies on every dollar of sales, we could grow at our current rate for three more years (and thus turn into a >$2 billion GAAP revenue business): should we? What if we could lose four pennies but grow at 200%: should we? It depends, I suppose, on what our net margin would be when we throttled back growth.

In sum, then: it is not clear that Overstock needs more capital; if we do, it is not clear we need it now; if we do need it now we are not going to raise it through a warrant-warted PIPE. That said, we will continue to look at our capital needs and try to position ourselves so that we will be able to raise capital conveniently if the right time arrives. For example, we are in the process of obtaining an inventory line of credit. Please know that I have the benefit of an excellent board, well-versed in capital and which views advising me on this issue as one of its main duties.

In the early stage market, it is common to see founders plan or go through fundraising processes at a certain pace and targeting a certain amount of money just because they think it is what they are supposed to do or because it is available.

While there is almost never anything wrong with opportunistically raising capital to increase optionality, the decision to raise capital of any type should always be well thought out else you risk wasting your time chasing opportunities that are not a good fit.

Operations

We had a few sleepless nights here. At this point I suppose I should mention that, as Team Overstock’s player/coach, it is my occasional and regrettable duty to reposition, bench, trade, and sometimes cut teammates, alas. “Benching” takes the form of sending people home on paid leave to recoup and to allow us to rearrange. For example, two summers ago I benched someone by sending him and his family to Hawaii while I took his job myself: when he returned I gave him a different job (in fact, things like this happen often enough that “getting sent to Hawaii” is synonymous around here with “getting a last chance.”)

This Christmas season an executive moved to the bench: I did not put out a press release about it, partially out of respect for him, but also because his future role in the game was unclear. As I have noted recently, he is no longer with the company. While I acknowledge that losing one’s COO during the Christmas rush is discomforting (as I know better than anyone), I hope that this clarifies my thinking satisfactorily.

Rare insight into how the CEO of a public company thinks about what is likely the most important responsibility he has, attracting and retaining good people. Image below via First Round’s “State of Startups”.

Conclusion

A man crosses a desert by shooting an arrow from his bow and retrieving it as he walks. He must cross the desert with the fewest shots possible. At times he strains the bow with all his strength and lets his arrow fly, but sacrifices accuracy, at times shooting the arrow wildly off course. Other times he aims carefully and draws timidly, attempting little but guaranteeing himself small, solid progress. In time he finds the balance of draw and aim that covers the most ground in the fewest shots.

I have not yet found such balance. Yet in 2003 Q4 we drew the bow deeply, and our shot went far and fairly straight. On such a deep draw I could have blundered the shot (as I have before), and only the excellent work of my colleagues prevented mishap. I do not enjoy chancing so much on each shot. Yet I saw an opportunity to let one fly, and we still have much ground to cover.

Your humble servant,

Patrick M. Byrne

President

P.S. As much as I like hearing from owners and potential owners, I am now deluged by the volume of contacts from those saying they want to invest but must get to know me better before they do. I am flattered; I am humbled (believe me, you’d be disappointed if we met); I am torn between wanting to help answer their questions and Reg FD; but mostly, I am out of time. Though I enjoy hearing and learning from owners I must, regrettably, propose two alternatives. First, in the investor relations section of our site I intend to include material that will elucidate our business philosophy. Second, for any who actually visit us in Utah I will always make time to meet with you.

Sounds like Patrick needs a “one-to-many” tool to manage the communication with his investors a bit more efficiently…we know where he can find one 😉

founders

Reporting

Investor Letters: Starbucks in the Dot-Com Bust

Starbucks was founded in 1971, was purchased in 1987 Howard Schultz (the man globally associated with the brand), went public in 1992, and opened its first international location in Japan in 1996. By the late 1990’s when the dot-com boom was in full swing, Starbucks was onboard, investing in eventual blow-ups like Kozmo, Talk City, and Living.com.

In 2000 – just as the company was taking writedowns on the investments listed above – Howard Schultz and Orin Smith penned the following letter to shareholders which laid out core focus areas and set the table for the massively important technology company Starbucks has become today.

All of the charts, images, quotes, and emphasis below were added by us.

If you like what you see and want to share Visible Investor Letters with friends or colleagues, send them here to sign up.

Starbucks’ 2000 Letter to Shareholders

To our Shareholders,

We entered the new Millennium with a great sense of accomplishment and excitement, knowing that we were poised to share the Starbucks Experience with even more people around the world. Today, the anticipation we experienced as we began fiscal year 2000 has been more than fulfilled, thanks to the passion and dedication of our partners (employees), our unwavering commitment to the highest quality coffee, and the connection that we are fortunate to enjoy with our customers. We believe that the possibilities for our future achievements are virtually limitless, and we are even more inspired to climb to greater heights. These are still the early days of building our company and the Starbucks brand.

Starbucks experienced tremendous success and growth in fiscal year 2000. We had record revenues of $2.2 billion for the year.