Blog

Reporting

Resources to help level up your investor reporting.

All

Fundraising Metrics and data Product Updates Operations Hiring & Talent Reporting Customer Stories

founders

Reporting

NextView Ventures Seed Investor Update Template

NextView Ventures is a hands-on seed venture capital firm based in Boston. The team at NextView makes 10-12 investments a year so its fair to say they’ve seen their fair share of investor update email templates. David Beisel, Partner at NextView, recently put together a great seed investor update template for startup founders.

As David Beisel, partner at NextView Ventures, wrote in his investor update post, “First and foremost, investors (whether they say it or not) prefer over communication of what’s happening at the company, both the good and the bad. And a regular update with candor about what is going well and what is not signals an orientation towards transparency, which in turn engenders trust. This trust can yield benefits later on if the company faces a challenging situation in which it requires to raise more capital outside a position of strength.”

By building trust, this will only unlock further benefits down the road. When you stay top of an investor’s mind they will be more inclined to help with networking, hiring, fundraising, decision making, and more. You can check out the NextView seed stage update template below or continue reading for a deeper breakdown of the template.

The Seed Stage Investor Update Template

As David writes in his post, “In terms of form, we recommend an update email that is short and sweet. After all, the goal is to have investors actually read it!” The seed stage investor update template from NextView is similar to the other seed stage templates we have seen in the past. The template is largely broken down into the easily digestible sections below:

TL:DR;

The TL:DR; section is used to give a short and sweet overview of the entire update. This can include a sentence or two overview of the last period with a bullets highlighting key initiatives and specific areas where you need help.

Highlights

The highlights section is exactly what it sounds like; a section to showcase your team’s wins over the last period. Make sure to share goals that you achieved or other company and team initiatives that are moving your company forward.

Core Metrics

Include 3 to 5 key metrics that are related to the success of your business. Your investors should be familiar with your metrics and should know what to expect here. With each metric be sure to include a chart or visualization and a brief recap of the last period’s performance.

Challenges

Arguably the most difficult section to craft, this can also be one of the most important sections for your investors. Mentioned where you missed the mark and what your plans are for improving this moving forward. Investors know that building a startup is hard and are fully expecting challenges and road bumps along the way.

Goals

This section should lay out your major company goals over the next few weeks or months. You will want to be sure to revisit these goals in a future update.

Asks and Thanks

Use this section to call out specific people, investors and teammates, that went above and beyond over the past few weeks or months. This will not only make the person feel good but will also motivate others to help in the future.

Finances

Share the vital metrics to your companies financial health. David encourages founders to share cash in bank, runway, and burn rate. If anything unexpected happened over the past period, be sure to call it out. Bonus points if you include a financial document or link to a spreadsheet.

We hope this template is helpful. To learn more about best practices for sending regular investor updates, check out our template library here.

founders

Fundraising

Reporting

6 Components of a VC Startup Term Sheet (Template Included)

Term sheets can be intimidating as a first-time founder. As it is likely the first time you’ve seen a term sheet, the intricacies of the deal can be difficult to understand. You can spend hours trying to understand a term sheet and what exactly makes up a “good” term sheet. As the team at YC writes, “we’ve noticed a common problem: founders don’t know what “good” looks like in a term sheet.”

If you’re looking for a breakdown of a term sheet specific to Series A, check out our blog post, “Navigating Your Series A Term Sheet.”

In order to help founders best understand their term sheets, many firms and individuals have come up with their own term sheet templates. In fact, many investors and founders now use a 1-page term sheet template. Check out our breakdown of term sheet components with a few templates below.

As a note, this is not legal advice and we suggest consulting with your lawyer while reviewing your term sheet.

Related Resource: How to Choose the Right Law Firm for Your Startup

VC Fundraising Timeline

As we often write about at Visible, we believe a startup fundraise shares a lot of characteristics of a B2B sales funnel. In the most simple breakdown — at the top of the funnel you are bringing in new investors, in the middle you are nurturing them through investor updates and meetings, and at the bottom, you are signing term sheets and building relationships with new investors.

Kicking off a VC Fundraise

Once you have formed your company and launched/are preparing to launch a product you may decide to pursue venture fundraising (to learn more about determining if VC funding is right for you, check out this post). Before kicking off a fundraise, especially at seed stages and later, you likely have some form of product-market fit.

Finding Investors

If you’ve decided VC funding is right for your business. You’ll need to start finding investors to “fill the top of your funnel.” Check out Visible Connect, our free investor database, to filter and find the right investors for your business. If you’re earlier in your company lifecycle and want to find angel investors, check out this post.

Pitching Investors

Once you start reaching out to investors (via cold email or warm intros) you’ll begin a series of meetings and pitches with the hopes of moving them down the funnel. Check out our template and guide for pitch decks here.

Related Reading: How to Write the Perfect Investment Memo

Due Diligence and Final Steps

If an investor is interested in moving forward, you will likely begin due diligence where they will audit your data, get feedback from customers and investors, and confirm their conviction in your company. If they decide to move forward, next comes a term sheet.

Term Sheet

At the end of a fundraise comes the term sheet. Assuming both parties are happy with the terms, you’ll be able to onboard your new investor.

6 Components of A VC Term Sheet

Liquidation Preferences

Liquidation preference is simply the order in which stakeholders are paid out in case of a company liquidation (e.g. company sale). Liquidation preference is important to your investors because it gives some security (well, as much security as there is at the Series A) to the risk of their investment. If you see more than 1x, which means the investor would get back more than they first invested, that should raise a red flag.

To learn more about liquidation preferences check out this article, “Liquidation Preference: Everything You Need to Know.”

Dividends

In the eyes of an early-stage investor, dividends are not a main point of focus. As Brad Feld puts it, “For early-stage investments, dividends generally do not provide “venture returns” – they are simply modest juice in a deal.” Dividends will typically be from 5-15% depending on the investor. Series A investors are looking to generate huge returns so a mere 5-15% on an investment is simply a little added “juice.”

There are 2 types of dividends; cumulative and non-cumulative. YC warns against cumulative dividends; “the investor compounds its liquidation preference every year by X%, which increases the economic hurdle that has to be cleared before founders and employees see any value.”

Conversion to Common Stock

Common practice will automatically convert preferred stock into common stock in the case of an IPO or acquisition. Generally, Series A investors will have the right to convert their preferred stock to common stock at any time. As Brad Feld puts it, “This allows the buyer of preferred stock to convert to common stock should he determine on a liquidation that he is better off getting paid on a pro-rata common basis rather than accepting the liquidation preference and participating amount.”

Voting Rights

On a Series A term sheet, the voting rights simply states the voting rights of the investor. Generally, your Series A investors will likely receive the same number of votes as the number of common shares they could convert to at any given time. In the Y Combinator example, as with most term sheets, this section can include some technical jargon that is not easy to understand.

The most important vetoes that a Series A investor usually receives are the veto of financing and the veto of a sale of the company.

Board Structure

One of the more important sections when navigating your Series A term sheet is the board structure. Ultimately, the board structure designates who has control of the board and the company. How your Series A investors want to structure the board should be a sign of how they perceive you and your company.

The most “founder-friendly” structure is 2-1. A scenario in which 2 seats are given to the common majority (e.g. the founders who control a majority of the common stock) and 1 given to the investors. This allows founders to maintain control of their company.

On the flip side, there is a 2-2-1 structure (2 founders, 2 investors, 1 outside member). In this scenario, it is possible for the founders to lose control of the company. While a common structure, be sure that the board structure is in line with conversations while fundraising. As Jason Kwon of YC puts it, “So when an investor says that they’re committed to partnering with you for the long-term – or that they’re betting everything on you – but then tells you something else with the terms that they insist on, believe the terms.”

Drag Along

As defined by the Morgan Lewis law firm, “Drag along is the right to obligate other stockholders to sell their securities along with securities sold by the investor.” Drag along rights give investors confidence that founders and the common majority will not block the sale of a company. While there is no way around drag-along rights, some people will suggest that founders negotiate for a higher “trigger point” (e.g. ⅔ votes as opposed to 51%).

You can learn more about drag along clauses in this post, Demystifying the VC term sheet: Drag-along provisions.

VC Term Sheet Examples

The Y Combinator Term Sheet Template

With thousands of investments under their belt, Y combinator is always a great place to start when looking for startup best practices. The team at YC put together an awesome 1 page term sheet template (with a focus on Series A) that any founder can use. While your actual term sheet may look different the Y Combinator Term Sheet template is a great place to get familiar with the subject.

YC does a great job of breaking down the different components and laying out terms and language that founders should keep their eye out for. Check out their term sheet template here.

Buffer Series A Term Sheet

The team at Buffer raised a $3.5M Series A back in 2014. Check out the signed term sheet and the terms from their raise here.

VC Term Sheet Templates

As term sheets are a necessary part of any fundraise there are hundreds of templates and examples to choose from by the investors, founders, and lawyers that have been there before. Check out a few popular templates below:

The One Page Term Sheet Template from Ben Milne

Ben Milne, Founder of Dwolla, has spent his fair share of time navigating term sheets. Ben is a Midwest founder and has seen the amount of time midwest founders and investors waste negotiating term sheets. As he put it, “Midwest investors and founders lose a lot of time trying to figure out the term sheet. Sometimes, they lose even more time deciding what the terms should be.”

In order to help bring some guidance to both startups and investors, Ben put together a one-page term sheet template. You can check out the template below:

You can check out the one-page term sheet template from Ben Milne in this blog post.

The NVCA Term Sheet Template

The National Venture Capital Association recently released their latest version of their term sheet template. As the team put at NVCA wrote, “The Enhanced Model Term Sheet allows an investor to draft term sheets while comparing terms against market benchmarks. Version 2.0 is powered by a database that now includes more than 100,000 venture transactions, representing over 40,000 investors with a combined network of over $1 trillion in assets under management.”

Check it out and download the template here.

Let Visible Help

We are here to help with any fundraise. Use our free investor database, Visible Connect, to kick off a raise. From here, use our fundraising CRM as you move investors through your funnel and sign a term sheet. Start your free trial here.

founders

Fundraising

Reporting

Dr. Dan — The Burdensome Investor

Raising capital is hard. Raising capital during a pandemic can feel impossible. As we discussed with Lolita Taub in our webinar last week, more founders are looking for alternatives to venture capital.

Founders are looking to solutions like Pipe, Earnest Capital, ClearBanc, Angels, Friends & Family, among others. Raising from angels and friends/family came into focus during our webinar with Lolita. Note: Check out our “How to Find Angel Investors” guide if you’re searching for angels for your business.

Friends and family often make for an easier fundraising process. Less stringent due diligence combined with less pitching can make friends and family be an attractive option. However, a friend or family member could be less startup savvy than a traditional VC and can become a burden to you and your business.

Internally we call the burdensome investor, “Dr. Dan.” Maybe a family member or friend invested in your business but calls every week for status updates or to ask questions about a metric, etc. With the investor + founder relationships (8-10 years) lasting longer than the average U.S. marriage it is important that you are taking on investors that you can build a relationship with. So how do you approach a potential “Dr.Dan?”

Set Expectations Early

As we previously mentioned, a friend/family or angel investor may not be as startup sophisticated as your traditional VC. Sometimes an inexperienced investors’ expectations may be wildly different from reality. It is your job as a founder to make sure a potential angel investors expectations and reality are aligned.

Before you cash a check, make sure that these investors are aware of the realities of investing in a startup. Make it clear how and when they will hear from you, what the possible outcomes are, and where their capital will be going. Even though someone is an “accredited investor” they are investing their own money and it could be a considerable chunk of their savings.

Explore Other Options

If you’re talking to a potential “Dr. Dan” you may need to weigh other funding options. As we mentioned at the beginning of the post there are quite a few alternatives for raising capital. While the most ideal is using customer revenue to fuel growth, that is generally not an option for most startups — especially early stage.

There are countless alternatives and more popping up every day. You can check out a few of our favorite alternatives here.

Trust Your Gut

As Lolita Taub put it in our webinar, “You just have to hustle and do what you need to do for your business.” At the end of the day, only you know what the right decision is for your business. If you’re in dire need of capital, it may be worth the burden of bringing on a “Dr. Dan.” If you’re in a good spot financially, it may be time to re-evaluate and take your time to explore other funding options.

There are countless pros of bringing on a new investor — capital, new networks, fresh eyes, etc. On the flipside, an angel or family/friend investor can quickly become burdensome if they are inexperienced or unsure of what to expect from you. Remember bringing on a new investor means bringing on a new business partner for the foreseeable future — only you know what the right decision is for your business.

Already have angel investors? Send them a quick Update to let them know how your business is doing.

founders

Reporting

Mike’s Note — Investor NPS

How likely are you to refer your current lead investor(s) to fellow founders? Let us know through this NPS form. Answers are 100% anonymous.

We keep hearing from founders wanting a “Glassdoor for investors.” There is a lot to unpack there. e.g. How do you:

Keep founders safe through anonymity but validate the information is accurate?

Remove bias if a founder is an upset that an investor says no? (Which they do 99% of time)

Until then, I am curious to see what the response rate is. If you are comfortable just select 1-10.

founders

Reporting

Operations

Operations

Do You Have a Stakeholder Management Strategy?

All eyes are on leaders in a time of uncertainty. How a leader acts, presents themselves, and communicates echoes throughout the organization (and any outside stakeholders).

Having a stakeholder management strategy in place is a surefire way to give a sense of unity and direction to all of your stakeholders; especially in a time of turmoil. A stakeholder management strategy generally relates to individual projects or campaigns. However, a founder can use a stakeholder management plan to oversee their communication.

As the team at MindTools writes, “Stakeholder management is the process of maintaining good relationships with the people who have the most impact on your work. Communicating with each one in the right way can play a vital part in keeping them on board.”

The goal of your startup stakeholder communication plan should be to give everyone the information they need to understand direction, goals, and to feel a sense of cohesiveness. For a startup, we can boil down a stakeholder management strategy into 5 unique groups: team, investors, board of directors, advisors/mentors, and customers.

As a CEO or Founder it is your job to set the tone for communication and delegate or own different stakeholder groups as needed. Here are a couple of things to keep in mind when setting a stakeholder management and communication strategy:

Keep it Predictable

When it comes to setting up a stakeholder management strategy one of the key components is to keep it as predictable as possible. Set a specific cadence with each stakeholder group so they can expect when they’ll be receiving an email update, phone call, report, etc.

Not only will a predictable cadence help your stakeholders, it will help you as a founder as well. We have found that by committing to a schedule it will help hold you accountable and build good habits. If you’re looking for an easy way to get started with a team communication strategy, check out our “Friday Note” template.

Apples to Apples

We often preach that it is vital to keep things consistent from update to update, especially when communicating with your investors. The same can be said when developing your stakeholder management strategy. If you commit to sharing a certain metric or context, be sure to keep it consistent throughout.

If you are sharing a certain metric, lay out how it is calculated in your first correspondence and stick to it. Questions and a lack of trust will start to form if the calculations or metrics you are sharing begin to change on a regular basis.

Set the Tone

As we mentioned earlier, a stakeholder management strategy is intended to help your different stakeholder groups understand direction, goals, and feel a sense of cohesiveness. In turn, this should also increase productivity and allow employees and stakeholders to build trust with their leaders.

When a founder or leader takes an action, it often reverberates throughout the organization. Keep this in mind when setting up a management and communication strategy for different stakeholder groups. If you want to establish a certain value or action in your company, your stakeholder management strategy is a great place to start.

A Note on Remote Work

In the wake of recent turmoil, more companies are transitioning to remote work. When working remote for the first time, having a sound stakeholder management and communication strategy is more important than ever. There is not such thing as too much communication, especially when all of your stakeholders are feeling the stress and anxiety of our current situation. To learn more about remote work, check out our 9 favorite posts here.

If you think you’re ready to implement a stakeholder communication and management strategy, head over to our Update Template Library to see examples for how to best communicate with your investors, team, board members, and more.

founders

Reporting

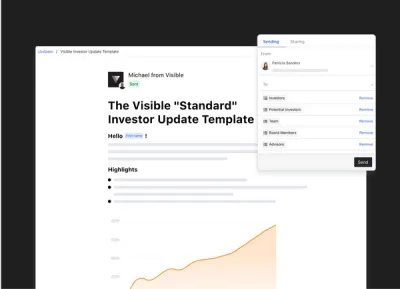

Sending Your First Investor Update Using Visible

Why Send Investor Updates

Investor updates can help in a number of ways. We’ve laid out some of the top reasons for sending investor Updates below. To learn more about why you should send investor updates, head here or visit the Visible Blog.

Communication saves companies

If your investors don’t know what’s going on in your business, they don’t know how to help. Investors provide more than capital. They offer advice, expertise, introductions, and more.

Accountability and trust

Proactive communication builds trust. When investors are kept in the loop they are more likely to help. You’ll always be top of mind for introductions, customer referrals and potential hires.

Follow-on funding

Follow on funding is imperative for success. Current investors provide signal, can lead rounds or can step in to bridge a financing. Make sure your current investors are allocating future capital by demonstrating your commitment to transparent communication and good governance.

Below are the steps for getting successfully set up on Visible to send your first Investor Update. Have a question or need a hand with anything? You can reach out by using the Intercom chat messenger located in the bottom right of you screen.

Starting with Metrics

Sharing metrics allows investors to understand how your business is performing. If a certain metric or KPI is down, don’t be afraid to share this — it happens. In fact, investors can likely offer help to turn things around.

In general, we suggest keeping the metrics you share consistent. You know your business best, so what financials and KPIs to share will vary. If you’re looking for more on what metrics to share check out the Founders Forward Blog here.

To get started with metrics and charts in Visible, click the “Metrics” tab towards the bottom of the left hand side navigation. If you do not use any of our data sources, we suggest getting started with a Google Sheet or User Provided metrics.

For this example, we’ll walk you through getting a Google Sheet connected. The video below will walk you through connecting Google Sheets.

We are using this Google Sheet in our example. Feel free to make a copy (using this link) to follow along at home! We suggest keeping the date + metric format and swapping out metric names where you would like.

You can find a more involved article for getting started with Google Sheets here and articles for connecting other integrations here.

Charting Your Data

Once you have your metrics and data in Visible, it is time to start creating charts. We suggest creating charts in a dashboard to start. You’ll be able to select any of your dashboard charts when you craft your Updates.

From a dashboard, click “+” button followed by “Chart” as shown below:

Screen Recording 2020-03-17 at 02.01 PM.mov

Once you’ve opened the chart builder. Select what metrics you’d like to pull into the chart. You can select as many metrics as you’d like from any data source! For this example, we’ll be creating a chart with Revenue and Total Expenses.

Screen Recording 2020-03-17 at 02.11 PM.mov

A couple of tools/tips when using the chart builder:

Enhance Individual Metrics — If you click on a metric from the chart builder, you’ll be able to enhance your metrics with our business intelligence layer, chart colors, aggregation, and chart the metric on the Y-axis.

Options Tab — From the options tab of the chart editor, you can edit the visualization and settings of the chart. From the top half you can change the chart title and chart type. Moving down you can pick the metric name or date to show on the x-axis, show data labels, show data markers for line charts, and set a y-axis scale.

In the bottom half of the options tab, you can change the display frequency, pick a time period to display the data, and add in goal lines.

Add Annotations — To add text annotations directly to a chart, click on any data point and select “Add Annotation” when you have the chart builder open. You can add up to 100 characters.

Creating Your First Update & Using the Editor

Now that you’ve got a hang for creating charts, it is time to create your first Update! To get started, click the “+” sign next to Updates in the left hand side navigation. You will have the option to use a blank Update or start with one of our Update Templates.

Screen Recording 2020-03-17 at 02.14 PM.mov

For this example, we’ll walk through our basic investor update template.

This a rough guideline of what we have found to be best practices for sharing investor Updates. Feel free to make any changes to the Update Template that you would like.

With Updates you can include and combine any of the following components:

Text with rich formatting

Images

Charts

Side-by-side charts

Tables

Files

Line breaks

Check out the video below for a quick breakdown of our Update Editor:

Rich text — Simply highlight text to expose our editor. Create bulleted and numbered lists, create merge tags, and hyperlink text from here as well.

Build and include charts — Connect data and build charts. To include a chart in an Update, hit enter on your keyboard and you will see an option to add a component to the right side. Select an existing chart or build a new one directly in an Update. You can include as many charts as you’d like as well as tables and side-by-side charts.

Files and Images — To include a file or image, click enter and you will see an option to add a component to the right side (same as a chart). Select the image or file icon to embed either directly in your Updates.

Sharing Your Qualitative Data

You’ll notice in our standard investor Update template it is broken into a few key qualitative sections:

Highlights — Always start with the good news! Briefly recap your company highlights, including things like goals hit or exceeded, new key hires, product updates, etc. Anything that made the previous month great.

Lowlights — Next, include some areas where you struggled or could use some help. Noting the steps you’re taking in response is even better, as investors will see you reacting to tough situations and moving forward. Transparency is key!

Asks — Potentially the most important part of your update! Here is where you can leverage your investors and get the help you need. Make specific asks that investors can easily respond to by drawing on their networks, experience and advice.

Thanks — Giving credit where credit is due is important. This is where you can call out team members who went above and beyond in the previous month. Also, specifically call out any investor who responded to your previous month’s asks, or helped you in another way. Nothing wrong with creating a little peer pressure for your other investors!

Customer Story — Investors love to see customer reactions to your product or company. Include customer feedback, social media mentions or anything that highlights how you’re impacting your buyers.

Monthly Metrics — Finally, include the key data your investors want to see. This will vary from company to company, but we recommend all companies track Revenue, Burn, Cash in Bank. Include everything you think investors will want to see, but don’t go overboard with unimportant numbers. If you aren’t sure what charts/metrics to include, just ask!

Sending Your Update

Once you’ve got your charts and qualitative sections dialed in it is time to share your Update with your investors.

There are 3 main ways to share an Update; email, link, and Slack. To get started with all 3, click the “Send” button in the top right corner. From here, you’ll be able to share via email in the “Sending” tab and/or setup a link/Slack share in the “Sharing” tab.

Screen Recording 2020-03-17 at 02.26 PM.mov

A couple of things to note when sending Updates:

Create Contact Lists — By clicking “Contacts” in the left side navigation, you’ll be able to create segmented lists. For example, you could create a list of “Investors” that has all of your investors. Instead of adding individual contacts, you can add a list. Learn more here.

Stats — After you send an Update, we’ll display engagement stats. View clicks, opens, and “reactions” to your Updates. Learn more here.

Reactions — Reactions are a simple thumbs up icon at the bottom of your Update that investors can click to acknowledge they’ve read your Update. Think something similar to a like on Facebook or Twitter. Lear more here.

We hope this guide was helpful! If you have any questions or need a hand with anything don’t hesitate to reach out via email or by sending a message using the Intercom chat in the bottom right corner.

If you’re ready to take your reporting to the next level be sure to check out our Founders Forward Blog and Update Template Library.

founders

Fundraising

Reporting

Founders — are you sharing memos?

This won’t be the first or last time we write this: being a startup founder is hard. On top of your day-to-day tasks you have to worry about your customers, employees, and investors. You can often feel like you’re buried when balancing the communication and relationships with all of your stakeholder groups. Concisely sharing strategy with your stakeholder groups is an effective way to set expectations and build relationships.

One tool we’ve seen pop up more frequently in the last few weeks are strategic memos. Memos are a clear and concise document to lay out strategic vision, rationale, and expectations. We’ve shared 3 different “memos” below that can be used for your investors, team, and executives.

Y Combinator Fundraising Memo

In case you missed it, YC recently published a Series A Fundraising Guide. The guide is full of useful information covering every aspect of a fundraise. One of the areas we found to be most interesting was the idea of writing and sharing an investment memo.

YC makes the case that founders should write an investment memo is two-fold. First, it can set up a meeting with a potential investor nicely when sent in advance. Secondly, it helps you as a founder clarify your pitch, thoughts, and rationale. As the team at YC writes, “A memo is particularly effective if you can write well. It stands better on its own as the deck (sent ahead of time) can miss context provided by your voiceover. Founders tell us that memos sent before meetings in place of a deck provided the necessary to set up an engaged conversation from the outset.”

They go on to share a template of a memo that you can find here. We’ve turned it into an Update Template so you can share it out via email or link!

Executive Team Strategic Memo

Andy Johns is a seasoned startup professional and currently a partner at Unusual Ventures. Andy recently published a blog post, A Simple Tool for Managing an Executive Staff as a First-Time CEO, to help first time founders deal with their first executive hires. As Andy points out, managing an executive can be quite different than managing team individuals.

“An executive’s job is to focus primarily on taking strategic risks. Each year, they should identify 2–3 major initiatives, large enough in impact to shape the direction of the company and enforce great execution against those initiatives. This is in contrast to non-executives, who you want to be focused primarily on tactical execution.”

So how does a founder enforce execution against those initiatives? Andy suggests having your executives fill out a quick memo template for your executives to share with you. As Andy puts it, “Ideally, what they come back with is a strategy that has 2–3 major initiatives that they find are important, along with a list of success metrics and resources they need to get it done.”

Once a founder gets a strategic memo from each executive it makes forming strategy and roadmap for the company as a whole easier. These memos can be used to fuel your strategic and financial plan for the year, create performance plans with executives and individuals, and the kickoff discussion points for annual planning.

Check out the strategic memo template from the team at Unusual Ventures here.

The EVERGOODS Product Brief

The last memo is slightly different than the first two. EVERGOODS is a small equipment and apparel company based out of Bozeman, MT. EVERGOODS has a strong focus on building an incredible product and puts a great deal into R&D and perfecting every minor detail of their products (a couple of gear junkies on the Visible team can attest to this).

As the founders, Jack and Kevin, put it, “Our experience lies in product design, development, R/D, and manufacturing for the likes of GORUCK and Patagonia. We believe in product and the processes of doing the work ourselves. Each project is an exploration, and ultimately a discovery, aided by our triumphs and our failures. This evolution inspires us and is at the heart of EVERGOODS.”

Being gear junkies and product focused ourselves, we found their product brief to be interesting and useful to more than equipment and apparel companies. While it may not translate directly to every industry, their brief is a great tool to help product-focused founders understand why and how they are building certain products and features.

Check out the product brief memo from EVERGOODS here.

Each template above serves a different purpose. While each template may be entirely different they all have one thing in common: clear and concise communication. Setting up a system to properly share strategy and rationale in a concise way will not only strengthen relationships but keep all of your key stakeholders aligned.

Do you have a memo or strategic doc that you share with your stakeholders? We’d love to check it out. Shoot us a message to marketing at visible dot com.

founders

Reporting

Webinar Recap: Alternatives to Venture Capital with Tyler Tringas of Earnest Capital

We recently hosted a webinar with Tyler Tringas, General Partner at Earnest Capital, covering alternative financing options available to startups. During the webinar Mike, our CEO, and Tyler covered the current state of venture and SaaS markets, all things Earnest Capital, and SEALs. In case you missed it, check out the recording and our favorite takeaways below.

Financial –> Production Capital

One of the driving forces behind the Earnest Capital Investment Memo is the notion that software is entering the deployment age (read more about the deployment age in the investment memo here). In short, Tyler explains the deployment age as a time when products, software in this instance, can and should be distributed to every corner of the economy. This creates a new software category where niche and sustainable business can succeed as opposed to the winner take all software companies we’ve seen in the past.

Generally speaking, venture capital has been the default funding option for software companies but as we enter the deployment age there will be a need for a new form of funding. As a result, the type of capital companies need is shifting from financial capital to production capital (Enter: Earnest Capital).

The Peace Dividend of SaaS Wars

Another key driver to Earnest Capital Investment Memo is the idea of “The Peace Dividend of SaaS Wars.” The idea is that when countries are at war they will throw money to escalate and create new technologies. An example Tyler gives is the development of synthetic rubber during WWII. After the war, synthetic rubber could be applied to consumer goods.

So how does this relate to SaaS? Investors and early leaders are throwing money to create new technologies in the winner take all SaaS markets. As a result, it is less capital intensive than ever before to start a new business. Tyler mentions that software companies can be started on a free Heroku plan where in the past you’d need to buy your own servers and space. In turn, this helps companies attack markets with a smaller total addressable market and may not be a fit for venture capital.

The New American Dream

Entrepreneurship is in decline in the US. Tyler believes that one major component of the decline is because, “the major area for new entrepreneurship, software and software-enabled businesses, has no default form of aligned funding.” In the past (think 1970s or 80s), an entrepreneur may have had experience or been highly qualified in a field, went to the bank for funding, and likely built physical locations. But with no physical collateral for a software company, who is supplying the funding to grow these companies? Another sign of a need for a new form of financing.

Tyler argues that, “building, owning (and possibly someday selling) a profitable remote software business is the new American Dream.” Entrepreneurs can employ 15-20 people, distribute their profits amongst employees, and still create huge economic impacts for themselves and those involved with the business.

Shared Earnings Agreement

Tyler discovered that the traditional financing options for early stage investors (SAFEs, convertible notes) are not aligned with “Earnest” founders so they create a new financial product: Shared Earnings Agreement. Tyler discusses why they created the SEAL in the webinar and dives into a few of the key components. If interested in learning more about SEALs, we suggest checking out this post.

Send Updates to Potential Investors

Tyler briefly touches on the importance of sending investor updates. Tyler mentioned that he has seen investor updates as the best tactic they have seen in use to help companies fundraise. If Earnest speaks with a company they are interested in but are not quite ready to invest, they’ll ask to be sent updates about the business. From here, Earnest can be in the loop and ready to make an investment as soon as possible.

Check out the Founder Summit

Earnest Capital is hosting a summit for founders and startup leaders in Mexico City in March. The summit is intended to allow founders to meet and network as oppose to another conference full of presentations. If you’re a founder and interested in learning more about the summit, check it out here.

Q&A

Mike and Tyler tried their best to answer all of the questions at the end of the webinar. For the questions they did not get to, you can check out Tyler’s answers inline below:

Q: I assume that at least some incumbents/market leaders will try to meet growth expectations by appealing and selling to niche audiences. How much weight does this threat carry in your investment decisions? If it’s not a threat, why not?

A: Competition from large incumbents is definitely not something we outright ignore, it’s just that we try to dramatically lessen the risk by backing founders tackling markets that just wouldn’t move the needle for a $10B or 100B+ firm even they came in and took 100% of the market. That said it certainly can still happen. I don’t think we have a special sauce for that scenario other than to encourage founders to lean in to their startup competitive advantages. One thing we do is encourage founders to not try to make themselves seem bigger than they are (don’t use the “Royal We” if it’s actually just You). It’s surprising how much some customers really want to support an independent small brand. The Basecamp folks are putting on a masterclass on how to counterpunch on BigCos like Google with this

Q: How does Earnest protect itself from a business defaulting on quarterly shared earnings payments?

A: Pretty much the only “investor right” we ask for in our investment docs are the right to inspect the books. Many founders just go ahead and give us access to their Quickbooks. Which is how we would address some kind of fraud or misrepresentation of Founder Earnings. At another level it’s quite hard to accidentally “default” in the sense of being unable to make a payment, since the Shared Earnings are always a % of Founder Earnings, the business should have generated the cash to make the payment (in contrast to debt where a payment is due whether you have the profits to pay for it or not). Lastly if a company has the Founder Earnings but just refuses to pay, we are somewhat protected by the fact that a) the company is obviously doing well and therefore is valuable and b) not making Shared Earnings payments keeps our implied % of a sale higher, so the founder is kinda shooting themselves in the foot if they ever intend to sell the business, we’ll likely get more money from the higher % of the sale than they would have paid out in Shared Earnings along the way. All about aligning incentives!

Q: The required “hit rate” for a SEAL portfolio to work is really high (given the capped return + long time horizon): How do you think about this question? Do you have a target % of startups that must “survive” to get a return?

A: It is higher than you would see in a traditional seed VC portfolio, but our theory is that the failure rate is not a law of startup physics but rather the whole venture strategy ratchets up both a) the chance of being a unicorn and b) the chance of failure. We don’t know what the typical failure rate is for a basket of highly filtered and selected, post-revenue bootstrapped businesses, but our basic bet is it’s much much higher than is typical in venture. I go into this in some detail here.

Q: For your portfolio companies, to what extent do they also have other investors beyond the founding bootstrappers? What is your range of size of investment and also the range of time horizon to large-scale recurring revenue?

A: We have done a mix of being the first/only investor in a company, leading a round where several angel investors co-invest with us, and a few deals where we co-invested with other investors (least likely for us, but does happen). We’re open to anything but have a slight preference to be the first/only just because it’s so much easier to close (can be as fast as 2 weeks). As of this moment, we invest $50k-$250k which may increase over time. As a fund, ideally we would love to see business mature and get to real profitability in 7-10 years but we are early-stage, long-term investors and understand that timeline is out of our control.

Q: Tyler mentioned a mix of outside capital and sweat equity, however Earnest and other micro-VCs only seem to want to invest in products that are built and have traction. How do I get help building an MVP? I’m a technical founder so I can write code, but trying to do everything myself is taking forever.

A: Yea, I have to concede that one of the main advantages the venture model has over ours (similar funding for bootstrappers ideas) is that pre-seed VCs have a model where they can invest at the “idea stage”… because we are not unicorn hunting, we also can’t take the very high risk of investing pre-product pre-launch. One of the main effects of the Peace Dividend that I talk about is that it’s now pretty reasonable to bootstrap, as a side project, a real product to real revenue from real customers. So as an investor, I (and many others) now really have to wait until that stage because so many entrepreneurs are getting there without funding. Some good resources would be some of my Micro-SaaS blog posts (microsaas.co), Indiehackers.com, and Makerpad (makerpad.co) for tips on building an MVP for business ideas without writing a ton of code.

founders

Reporting

Community Templates: Malomo’s Weekly Investor Update

Our Community Templates are a collection of Update Templates created by our customers, partners, and friends. If you’d interested in showcasing your Update Template send a message to marketing@visible.vc

Community Spotlight

Company Name — Malomo

Description —Malomo is a seed-stage, SaaS company based in Indianapolis, IN providing shipment tracking software for ecommerce brands

Stage — Seed

Capital Raised — $600k

Market/Business Model — SaaS, E-Commerce

The Investor Update Template

If you’re a seed stage, SaaS founder this is a great template to get you started. Yaw, the CEO and Founder, of Malomo shares the Update below on a weekly basis followed by a longer form Update on a monthly basis. For a seed or earlier stage company a weekly investor Update can be a valuable resource for your company.

A weekly Update gives you an added opportunity to leverage your investors and use their experience, network, and knowledge to help with early company decisions. Talk to your investors and see if they’d be interested in a more frequent Update. You may not need to send a weekly investor update to your entire investor list. If you have investors that are not as hands on or close to the business it may be best to only share a monthly or quarterly Update with them.

You can view and use the Template below:

Thanks to Yaw for taking the time to share his template. If you’re a founder, investor, or company operator and would like to share your Update Templates send us a message to marketing@visible.vc

founders

Fundraising

Reporting

Upside.fm Podcast: Powering Communication for Founders and Investors

Upside is a podcast about startup investing outside of silicon valley. Our founder, Mike Preuss, was able to sit down with the hosts at Upside and discuss all things founder and investor relationships.

If you’re interesting in learning more about Visible, investor communication, and portfolio management give the episode a listen. From the Upside blog, you can find the recap of the episode below:

AD: Finding experienced employees for your new business with Integrity Power Search (5:23)

Mike’s background and entrepreneurship experience (7:56)

Orr Fellowship (11:17)

Managing a remote culture, different time zones, and off-sites (12:44)

Initial problem and genesis of Visible (18:38)

Changing the product from investors to founders (21:53)

Finding clients (26:07)

Tracking metrics and data (or lack thereof (30:05)

Visible using Visible (32:38)

Money model (36:13)

Investors’ and founders’ access to information (43:13)

Visible’s potential in a downturn or recession (46:31)

founders

Reporting

Webinar Recap: How to Run a Board Meeting on Demand

A board meeting can be an intimidating endeavor for first time founders. However, when a founder is well prepared a board meeting can be an integral part of a company’s success. In case you missed it, we hosted a webinar with Russell Benaroya covering the ins and outs of running a board meeting on demand.

Russell spent the last twenty years investing in private equity and as a healthcare entrepreneur, building and exiting two start-ups. Currently, Russell is a Partner at Stride Services where they help high growth organizations with back-office support. Between his time as a founder and helping companies at Stride, Russell has become an expert in preparing and executing a board meeting.

During the webinar, Russell shared how founders can always be prepared for a board meeting. You can find our favorite takeaways from the “Board Meeting on Demand” webinar below:

Lead with Facts

It is normal to feel anxiety and excitement before a board meeting. However, it is important to manage your emotions and stick with the facts. If you lead with data and facts then you can take the time to talk about strategy and the future of your company. Russell warns founders not to approach board meetings with a narrative or a story to tell as it can be exhausting and can understates the facts.

A Board Member Will Never Know Your Business as Well as You Do

If you’re looking for a board member to give you tactical operational advice remember that their view will be slanted. No matter how involved a board member is with your business they will not have the same information and understanding of your business as you do. In reality, a board member should be able to determine if you’re properly capitalized to execute on your strategy, how you are executing to the strategy, and do you have the right people in the right roles.

Turn the Executive Session on Your Board

Rather than using the executive session as a chance to air your frustrations and “seek counseling,” use it as a time to allow your board to bring up their own discussion items. Ask your board to come prepared to discuss their topics, their observations, and their agenda items they want to cover.

What to Send Before the Meeting

Russell suggests sending your metrics vs. plan, financial and operating metrics, actions since last meeting, key customer learnings, your pipeline, and your functional roles chart. You can take it a step further by saying founders should not send a simple org chart but rather a functional role chart that will showcase what positions you need to fill to deliver on your strategy. Russell recommends sending your materials 3 days in advance so your board has a chance to review the facts and form an opinion in advance of the meeting.

No Surprises

A board meeting should not be full of surprises for you as a founder or any of your board members. You should go into a board meeting with a deep understanding of where every board member stands. Russell recommends scheduling 1 on 1 meetings with each board member to pick their brain on different issues. There tends to be a herd mentality when sharing to a group (your board) so it is important to discuss on an individual basis to understand where they truly stand.

Come with Your Best Thinking

As a founder “you should be coming to your board meeting to share your best thinking.” This can be boiled down to a simple process. You come to the meeting and share how you are thinking about an issue, how you analyzed it, your recommendations, then ask the board for their thoughts on your recommendations. This way you stick to the data and use your knowledge to make the best decision for your business. From here, you can have a spirited discussion with your board.

All in all, remember that running a board meeting comes down to the preparation you put in beforehand. With the right preparation and mentality heading into a board meeting, it can truly be a valuable asset for your business.

founders

Reporting

How Your Board Can be a Secret Weapon With Matt Blumberg

A great board of directors can be a “secret weapon” for a company. At the same time, a bad board can kill a company. Matt Blumberg, CEO of Bolster, joined us to break down how early-stage founders can build a great board — we covered everything from recruiting board members to running a successful board meeting.

What we covered:

How a great board can be a secret weapon

The purpose of a board of directors

Determining the makeup of your board

Scaling your board as you grow

How to best run a board meeting

founders

Reporting

How to Build Trust Through Investor Feedback

A guest post for the Founders Forward blog by Florent Merian.

Visible is on a mission to move founders forward. We’ve built an automation tool that lets you, founders and startup leaders, instantly create and send updates to your team and your investors.

We often preach treating fundraising and investor communication as a process. It should be no different from any sales, marketing, or product process that you would implement at your business.

In this blog post, we explore how you can apply your support process to your investor communication and why getting feedback from your investors is so important to build trust, engagement, and a successful long-lasting relationship.

Know your investors, enhance your relationship

To get feedback from your customers is vital to increase your business. So is feedback from your investors to build transparency and trust in your relationship.

As Fred Wilson, partner at Union Square Ventures, reported, “founders and their teams spend a lot of time preparing for a meeting, and then they give the meeting their all, and often the Board leaves, and nothing is really said about it.” As he stated, “one of the most frustrating things about board meetings is that it is difficult for founders and CEOs to get feedback on them.”

By engaging with your investors to know how they feel after a meeting and how you can improve, you better know them, their expectations and you get valuable insights to improve your performances as a startup leader.

Related Resource: Navigating Investor Feedback: A Guide to Constructive Responses

Build a personalized online survey to get insights

There are several ways to ask for feedback. For instance, you can build an online review with a simple web tool, and share it with your investors when done.

You can ask them the following questions:

What are the three things we’re doing well?

What are the three things we need to do better?

What would you like to see followed-up on from this board meeting? Are there any topics you’d like to explore in-depth at the next board meeting?

As your investors might be overwhelmed by emails and might not have the time to reply, personalize your survey with their first name to make more engaging and make sure it has a responsive design, so it’s accessible from any where and from any device.

Then, you can collect data as part of your process to review your performances, to improve your management, and ultimately to foster your business development. This way, you can get valuable feedback from your investors and you can rely on it to improve your next meetings and updates.

Get continuous investor feedback

The same way you would do with your customers, regularly request feedback from your investors. Send them surveys after your Board meetings and keep them informed of your activity with regular updates to build and maintain a trustworthy relationship.

Remember founders who regularly engage with their investors are 200% more likely to receive follow-on funding. To engage with your investors by getting feedback and sending updates regularly helps you maintain a trustworthy relationship, and it also enables you to build a better company.

Thank you for your read! How about you, how do you engage with your investors?

founders

Reporting

The Founder's Guide to Investor Communication With Elizabeth Yin

Investor communication is a key skill that all startup founders should hone. Whether you're pitching new investors, updating existing ones, or trying to raise your next round, your ability to engage investors can mean the difference between failure and success.

In this webinar you’ll learn:

How to reach out to investors and get a meeting

How to pitch effectively

How to stay top-of-mind with prospective investors

How sending consistent investor updates can make getting your next round easy

How to leverage your investors’ experience and networks to get the help you need

founders

Reporting

Webinar Recording: The Ultimate Guide to Investor Communication

Investor communication is a key skill that all startup founders should hone. Whether you’re pitching new investors, updating existing ones or trying to raise your next round, your ability to engage investors can mean the difference between failure and success.

Unlock Your Investor Relationships. Try Visible for Free for 14 Days.

Start Your Free Trial